Idle wallets linked to the failed LIBRA meme tokens have started buying the dip on SOL. The funds moved after months of inactivity.

Two wallets linked to the failed LIBRA meme token have started buying SOL. The wallets supplied $61.5M in USDC to buy SOL, just as the asset started recovering from a dip below $130.

Some of the funds came from two wallets making their first moves after months of no activity. One of the wallets now holds 328,619 SOL, while the other accumulated 127,871 SOL. The wallets accumulated SOL at an average price of $135.

LIBRA team wallet withdraws liquidity

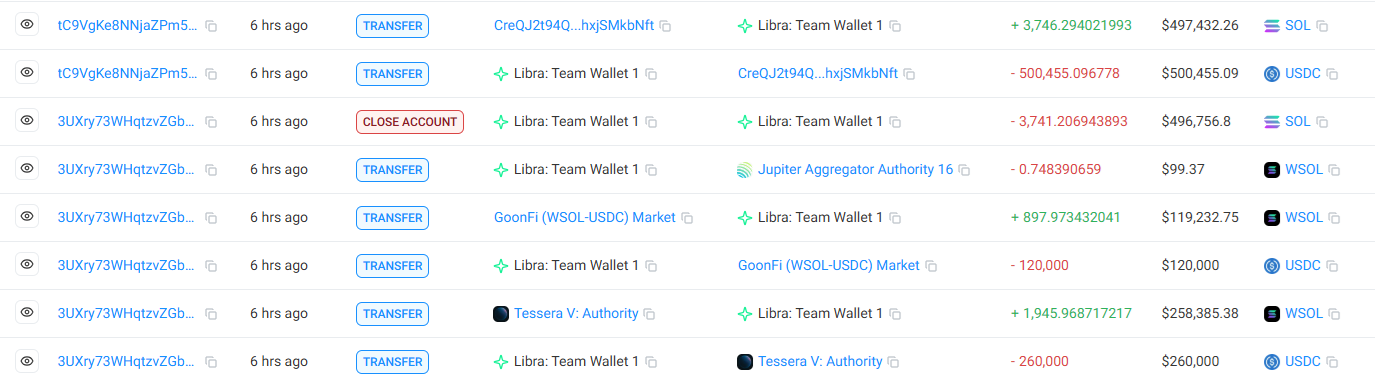

Some of the USDC to purchase more SOL came from a wallet labeled as LIBRA Team 1. The wallet withdrew USDC liquidity from Solana DEX protocols and moved the USDC to buy WSOL and SOL.

The wallet is one of the most closely watched in connection with the LIBRA token pump and crash. The wallet has been moving a significant part of the funds surrounding the LIBRA launch, and was used to lock in profits from the initial aggressive rug pull of the meme token.

The wallet also performed smaller purchases for a selection of Solana-based meme tokens. No restrictions have been imposed on the wallets despite the ongoing class action lawsuit against Libra and related market makers and traders.

The team and other wallets coordinated to swap out a significant amount of their stablecoin reserves for SOL. The buying came at a time when the crypto market is at a crossroads, expecting a further price drop. Yet the actions of LIBRA also signaled confidence and an eventual long-term recovery.

As of November 18, the wallets of Kelsier Ventures linked to Hayden Davis have also been idle for more than two months.

However, none of the wallets linked to the team or to Davis have had their USDC frozen. Despite Circle’s ability to freeze funds, wallets linked to early LIBRA trading have not suffered any sanctions.

Whales increase SOL turnover

The recent price bets on SOL have seen both large-scale buying and selling.

One high-profile whale bought over $17M in SOL during the latest dip, holding through an $8M unrealized loss.

Another wallet withdrew $16.2M in SOL from Binance and stored it in a self-custodied wallet.

SOL open interest is back above $3B in the past day after the latest dip. Long positions are dominating at over 86%, as short positions were closed or liquidated. SOL remains volatile, with potential new long liquidations under $130, or a short squeeze to $145.

Get seen where it counts. Advertise in Cryptopolitan Research and reach crypto’s sharpest investors and builders.