Bitcoin faces a pivotal week as three delayed US economic reports are set for release before Thanksgiving, potentially reshaping expectations for Federal Reserve policy and influencing crypto markets.

These economic indicators arrive at a crucial time for risk assets, with December rate cut probabilities near 70%. Bitcoin continues to show heightened sensitivity to macroeconomic shifts, making this week especially important for investors.

Delayed US Economic Data Intensifies Market Focus

The 43-day US government shutdown created a backlog of economic indicators, compressing multiple high-impact releases.

US Economic Reports Before Thanksgiving. source: MarketWatch

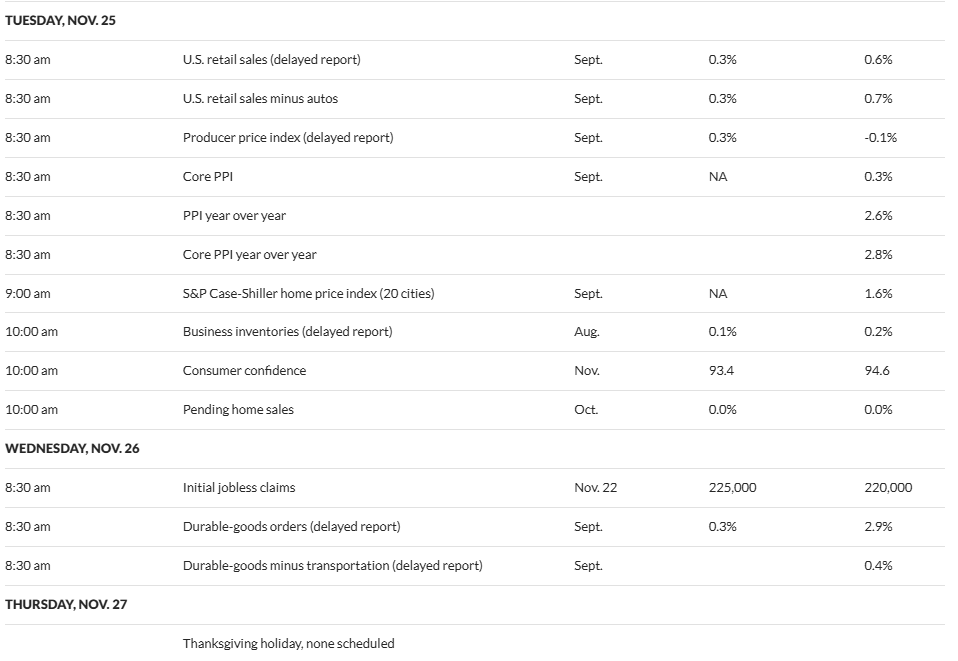

According to MarketWatch’s economic calendar, Tuesday, November 25 at 8:30 a.m. ET brings both September retail sales and the Producer Price Index (PPI), while Wednesday delivers initial jobless claims data.

This convergence matters because markets currently lack up-to-date consumer spending and inflation metrics. The prior retail sales report revealed a strong 0.6% monthly gain, while the Producer Price Index (PPI) fell 0.1% in August. Year over year, core PPI stood at 2.8%, offering a baseline for wholesale inflation trends.

Retail Sales

For September, retail sales consensus predicts a 0.3% month-over-month increase. Any miss below that mark could signal economic cooling, potentially spurring a dovish sentiment among the Federal Reserve policymakers.

For Bitcoin, weaker spending often aligns with rising speculation about rate cuts, which typically weakens the dollar and may support crypto prices.

Recent action highlights this pattern. Bitcoin hit seven-month lows after strong US jobs data reduced rate cut optimism, causing spot Bitcoin ETFs to see nearly $1 billion in outflows, the second largest on record. This episode shows how labor market strength can shape crypto positioning.

PPI Data Sets the Stage for December

The Producer Price Index release is crucial as it serves as the last significant inflation data before October’s Personal Consumption Expenditures report.

Markets have priced in about a 67.3% chance of a December Federal Reserve rate cut, but that outlook will shift with new data.

December Rate Cut Probabilities. SOurce: CME FedWatch SourceTool

A higher-than-expected PPI, particularly in core measures excluding food and energy, could quickly shift expectations.

If core wholesale inflation accelerates, traders may reduce December cut odds below 60%, strengthening the dollar and putting pressure on crypto.

September’s consensus calls for a 0.3% monthly PPI increase. Any number notably above that would challenge the view of moderating price pressures. On the other hand, a softer print would support expectations for continued monetary easing.

Initial Jobless Claims to Bring Holiday Volatility

Wednesday’s initial jobless claims will give the latest labor market update before the Thanksgiving holiday. Analysts expect 225,000 new claims for the week ending November 22, a slight rise from 220,000 previously.

Any figure above 225,000 may suggest labor market weakness, one of the fastest triggers for Bitcoin rebounds as hopes for easing rise.

Employment statistics remain a focus for the Federal Reserve, with Chair Jerome Powell emphasizing the need to maintain labor market health as the Fed controls inflation.

The reporting schedule also matters. Markets close Thursday for Thanksgiving and operate shortened hours Friday, which could amplify volatility if Wednesday’s data surprises.

Since Bitcoin trades around the clock, crypto markets could move strongly even as traditional markets close.

Other indicators add to the outlook. The US Empire State Manufacturing Survey surged to 18.7 this month, the highest in a year and well above the 6.0 forecast. This could hint at economic resilience, potentially complicating the narrative surrounding the rate cut.

The collision of these data points makes this period crucial for crypto markets. Bitcoin’s correlation with Federal Reserve policy expectations has tightened in 2025, turning every major economic release into a potential trigger for price swings.

As markets absorb postponed September data and new November labor figures, the changing outlook is likely to drive crypto price action through the end of the year.