The Bitcoin price prediction has held the positive zone above $85,000 after a four-week run of red candles. Dip buyers remained active below the $80,000 support level, pushing the price higher.

After a string of selling from ETF investors, long-term holders, and technical traders, the largest crypto reached a new seven-month low of $80,524. But the current rebound suggests Bitcoin could regain $90,000 if momentum is sustained.

However, another piece of bad news has struck the crypto market: JPMorgan reported that MSCI, an index provider, is considering delisting Strategy and other DAT companies because they could be treated as funds rather than operational companies. However, it has faced strong backlash, with Bitcoin supporters calling for a boycott of JP Morgan.

While Bitcoin battles bear pressure, Bitcoin Hyper, a layer-2 project, is building investor momentum with its revolutionary infrastructure and robust presale. The project has already raised $28.3 million in its ongoing presale, demonstrating strong investor confidence.

BTC Treasury Strategy Faces MSCI Index Heat

Concerns are growing that Strategy, the biggest Bitcoin treasury, could be dropped from MSCI indexes after JPMorgan flagged higher risks tied to its recent share underperformance. The bank noted that Strategy’s fading premium and increasing balance-sheet pressure make it more vulnerable to index removal, including from the MSCI USA Index.

Tension in the Bitcoin community rose after the report came out, as they may also exclude other crypto-treasury firms from its benchmarks starting January 2026.

Response to MSCI Index Matter

Strategy is not a fund, not a trust, and not a holding company. We’re a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin as productive capital.

This year alone, we’ve completed…

— Michael Saylor (@saylor) November 21, 2025

Strategy founder Michael Saylor entered the conversation, responding to on MSCI policy change, saying, “Strategy is not a fund, not a trust, and not a holding company.” Saylor said, adding that Strategy is a “Bitcoin-backed structured finance company.”

If the exclusion holds, funds that must hold only eligible index stocks would be forced to sell those companies. That automatic sell-off could put extra pressure on their share prices and spill over into the broader crypto market.

Bitcoin Price Prediction: Will BTC Finally Log Its First Green Week of November?

Bitcoin is trading above $87,000, up 1.15% over the past 24 hours. Bulls are attempting another recovery. However, the price could face resistance near the $88,000 and $90,000 levels.

Bitcoin price chart. Image Courtesy: TradingView

If the crypto sustains this momentum, it could mark the first positive week of November, as the first three weeks of November have formed red candles.

However, if Bitcoin fails to rise above the $90,000 resistance zone, it could signal the start of another bear leg. Immediate support is near the $85,000 level. The first major support level is near $80,000.

Bitcoin Hyper: Transforming Bitcoin Into an Interoperable Financial Hub

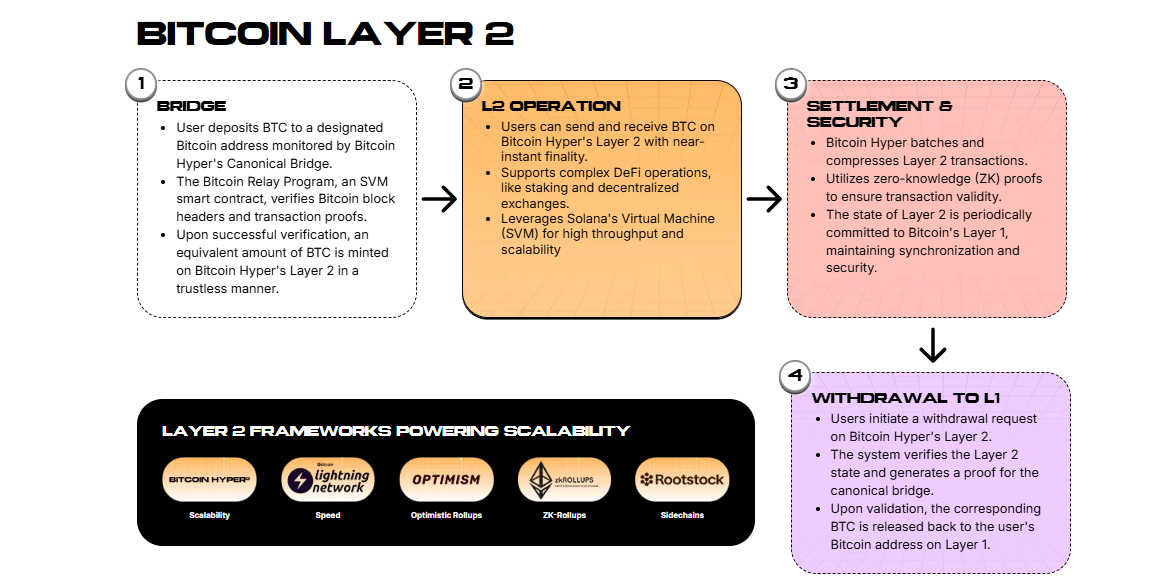

Bitcoin has dominated the crypto market, but at the same time has sacrificed scalability for decentralization and security. That’s why Bitcoin can process just 7 transactions per second (TPS), making it an inefficient choice for expansion in meme coin trading, NFTs, and other dApps. This is precisely what Bitcoin Hyper is solving.

Instead of making Bitcoin handle heavy computation, it lets users lock their $BTC on the main chain and then creates the same amount on its own high-speed network. The Solana Virtual Machine (SVM)-based system checks each deposit, issues the wrapped tokens, and allows them to move through a chain that settles almost instantly with very low fees.

All activity happens off-chain in large batches, and Bitcoin Hyper regularly sends zero-knowledge proofs back to Bitcoin to confirm everything. This keeps Bitcoin’s security intact while giving users a much faster place to transact.

HYPER Presale Demand Explodes

As Bitcoin price prediction points to a recovery, Bitcoin Hyper is being heavily mentioned as the next big bet on Bitcoin-backed projects amid investors’ search for 100x cryptos. The platform is attracting significant attention for its innovative infrastructure and incentives. But most discussion centers on its layer-2 platform, built directly on the Bitcoin ecosystem.

Here are key points that are drawing investors to Bitcoin Hyper:

Transforming Bitcoin’s $2 trillion dormant capital into active utility

41% APY staking rewards for presale investors

Audited by Coinsult and Spywolf, built with trust and transparency

Officially ranked #1 ICO with over $28.3 million raised

Tokens available at just $0.013325

Compared with established tokens, Bitcoin Hyper has shown strong demand even in a weak market. The project has emerged as the best crypto presale of 2025, selling more than 620 million tokens. For investors seeking the next big opportunity in the crypto market, Bitcoin Hyper may present real opportunities.