Crypto security threats intensify as private key theft becomes big business. DeepSnitch hype causes a stir as the platform has begun shipping tools.

Cloudflare’s outage knocked major crypto sites offline Tuesday, exposing centralized infrastructure risks, while private key theft has evolved into industrialized operations using automated malware tools sold on darknet forums.

Meanwhile, ARK Invest scooped $10 million in Bullish shares as crypto stocks hit record lows, and security vulnerabilities and market volatility are converging, as traders need better intelligence systems.

And one such system is DeepSnitch AI, which has swiftly raised $555K at $0.02381, at 58% gains from its $0.01510 launch. This AI surveillance platform is now operational with a deployed network. It’s the security layer crypto desperately needs, with 100x potential as demand for trader protection is destined to grow.

Crypto infrastructure shows critical vulnerabilities

Cloudflare’s disruption affected Coinbase, Blockchain.com, Ledger, BitMEX, Toncoin, Arbiscan, DefiLlama, and platforms including X. The outage stemmed from an automatically generated configuration file that grew beyond the expected size and crashed traffic management systems.

Despite crypto’s decentralization ethos, most platforms still rely on centralized servers. An Amazon Web Services incident in October similarly halted Coinbase, Robinhood, and MetaMask for hours. When single points of failure cascade, traders get locked out during critical market moves.

Private key theft adds another layer of risk, and GK8’s report has revealed how hackers use malware infostealers to harvest data from infected devices, then feed stolen information into automated tools that rebuild seed phrases and private keys. Even macOS users aren’t immune, with infostealer activity peaking in 2025.

Meanwhile, ARK Invest bought $10.2 million in Bullish shares as the stock hit fresh lows. Crypto-linked equities have faced brutal pullbacks. Yet, analysts Tom Lee and Matt Hougan believe Bitcoin may be approaching a bottom, calling current prices a “generational opportunity.”

Exploring the DeepSnitch hype: DSNT price prediction

DeepSnitch hype is here to stay, as the platform addresses security failures that cost traders billions each year. When centralized infrastructure collapses or private keys get stolen, individual investors have no early warning system. DeepSnitch AI’s five AI agents are here to change that dynamic by creating a distributed intelligence layer that monitors threats across multiple vectors.

AuditSnitch analyzes smart contract risk instantly, pulling token data and applying risk filters to deliver plain-language verdicts on contract safety. Most rug pulls happen when traders skip due diligence on contract code. AuditSnitch automates that process, flagging red flags before users commit capital.

SnitchScan, already deployed, uses on-chain metrics, developer activity, contract age, and liquidity locks to identify safe projects with upside potential. It filters out scams using multi-layered detection logic. Combined with SnitchFeed’s social sentiment tracking, this is the platform’s real-time safety net.

November kicks off the market’s historically strongest six-month period, when crypto tends to run hardest, and DeepSnitch AI is positioned perfectly. The project is fully audited with staking live and over 12.8 million tokens already locked. It has a low entry price, sharp execution, and actual utility, all of which make DeepSnitch AI the standout pick for traders looking to turn early positioning into serious returns. Plus, tools are shipping, even as the presale continues.

The presale has pulled over $555K, and staking went live with 10.9 million tokens locked. With strong months ahead and the Santa rally approaching, there’s clear DeepSnitch AI 100x potential, which comes from solving urgent problems that are only aggravated by a growing market.

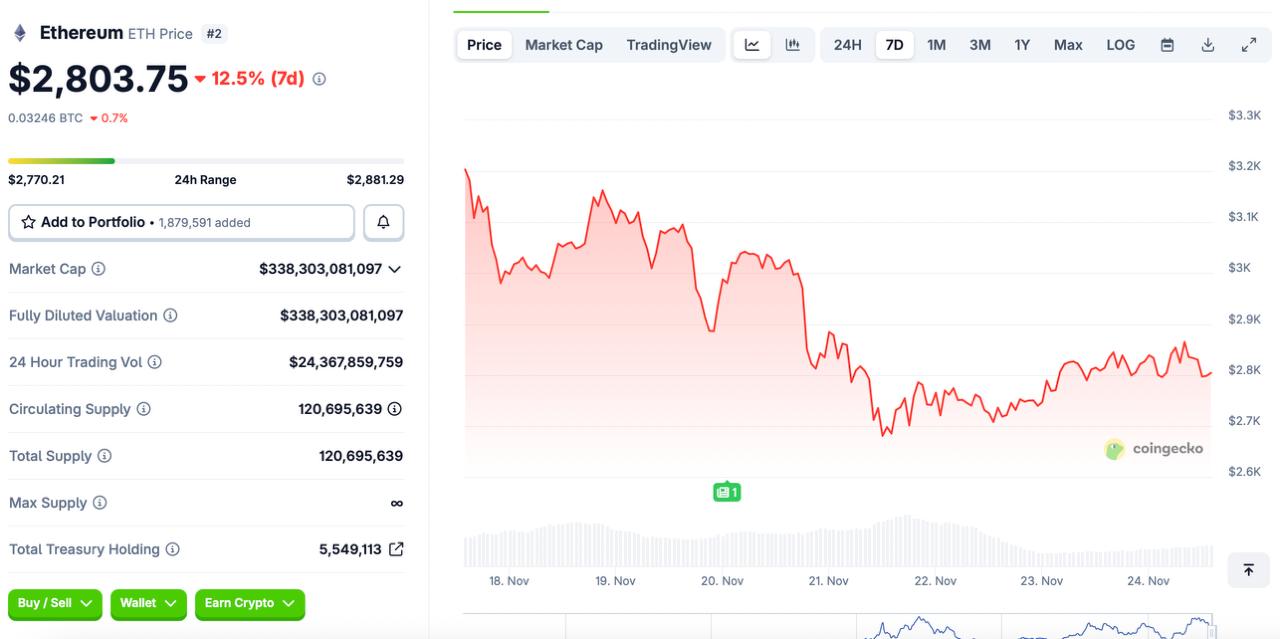

Ethereum: Testing critical support after dip below $3K

Ethereum briefly dipped below $3,000 on November 17, hitting a four-month low before recovering on November 18. Current price sits around $2.800, down roughly 12.5% over seven days.

The drop reflects broader risk-off sentiment as traders question whether the bull market ended after ETH corrected 40% from its $4,956 August peak. Network activity has weakened, with Total Value Locked falling to $74 billion, down 13% from 30 days earlier.

However, layer-2 growth continues to strengthen Ethereum’s position in RWA tokenization. If global uncertainty eases and central banks add liquidity, ETH could retest $3,900.

XRP: ETF launches fuel recovery hopes

Four spot XRP ETFs launched this week. Canary Capital’s XRPC debuted on November 13 with a record $58 million in day-one volume and $245 million in inflows, outperforming all 900 ETF launches of 2025.

As of November 24, XRP trades at $2.02 after finding support above $2.20. Price predictions forecast a slight drop or a steady hold come December 18, though sentiment shows bearish and the Fear & Greed Index is at 11.

JPMorgan projects XRP ETFs could unlock $4 billion to $8 billion in first-year inflows. XRP must hold $2.20 as support to push toward $2.60.

Closing thoughts

Infrastructure failures and private key theft are intensifying as crypto scales, while Ethereum and XRP face their own challenges, testing critical support levels. DeepSnitch AI has raised over $550K, having deployed operational security agents. Priced at an accessible $0.02381 with clear 100x potential, DeepSnitch hype is a fierce response to real security gaps that cost traders billions annually.