Identifying Bitcoin’s bottom is always a difficult task for even the most seasoned analysts. However, based on on-chain indicators and trading data, several signs suggest that Bitcoin may have successfully formed a bottom this month.

The bigger challenge is determining whether this bottom is temporary or signals a long-term trend reversal.

Whale Activity and Market Liquidity Indicate a November Bottom

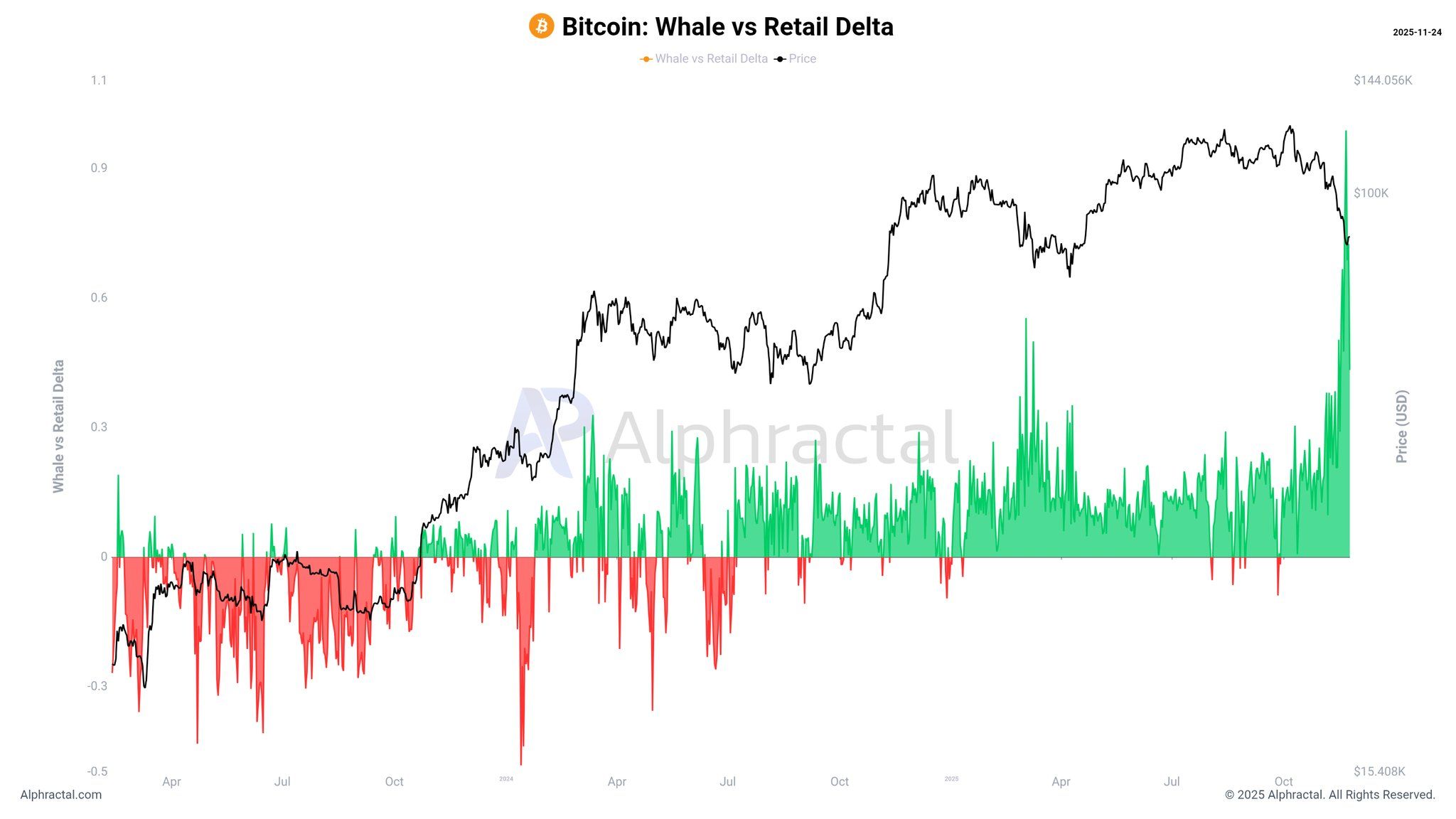

First, the Whale vs. Retail Delta indicator is showing a historically unprecedented bullish signal for Bitcoin.

The Whale vs. Retail Delta measures the difference between the long positions of whales and retail traders. It reflects whale expectations for Bitcoin’s upcoming volatility in the derivatives market.

According to Joao Wedson, founder and CEO of Alphractal, whales — large investors holding massive amounts of Bitcoin — are now holding dominant long positions for the first time in history, far surpassing retail traders.

Bitcoin Whale vs. Retail Delta. Source: Alphractal.

In February and March, this indicator also experienced a sharp spike. That surge marked Bitcoin’s bottom near the $75,000 level.

“Whenever these levels got this high in the past, local bottoms formed — but large positions also got liquidated,” Joao Wedson said.

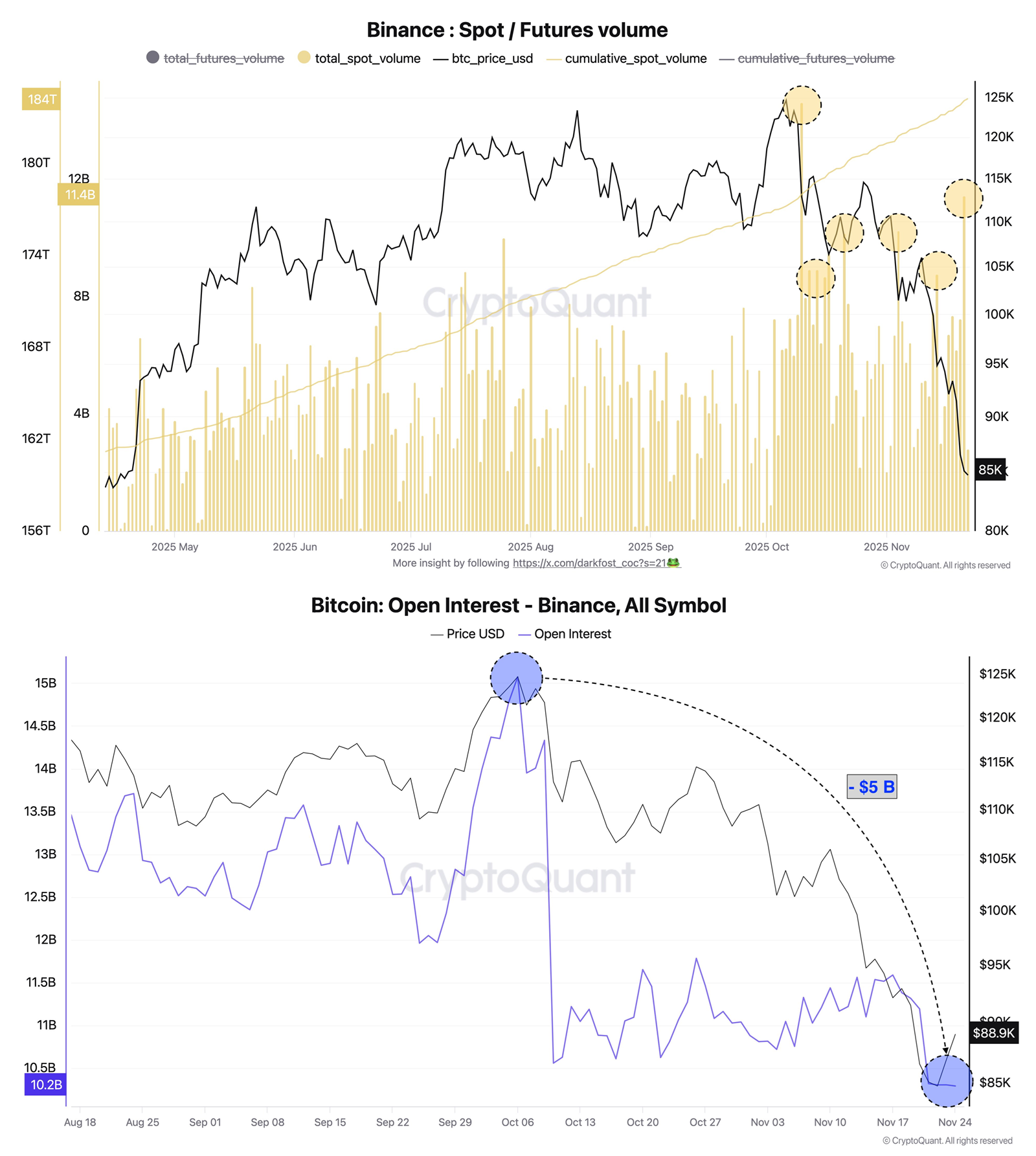

Next, Bitcoin’s spot trading volume is rising while open interest in the derivatives market is declining. This shift indicates a healthier market with less dependence on speculation.

CryptoQuant data shows that Bitcoin’s daily spot volume on Binance consistently exceeded $10 billion throughout November. This level is significantly higher than the average of previous months. Meanwhile, Binance’s daily open interest declined by $5 billion compared to last month.

Binance Spot/Future Volume. Source: CryptoQuant.

This trend suggests that speculative positions are being flushed out. Capital is shifting back into the spot market, where investors purchase actual Bitcoin rather than using high leverage. This transition gives Bitcoin stronger and more sustainable upward momentum.

“When this kind of flush-out happens, analysts often say it resets the market and prepares it for a healthier phase. That’s true, but only if the spot market steps in. And that’s exactly what is happening on Binance right now,” analyst Darkfost commented.

These signs suggest that Bitcoin may have formed a successful bottom in November.

However, not all analysts are optimistic. Many warn that the current rebound could be a “dead cat bounce.” This term refers to a temporary price recovery that occurs after a sharp decline, before the downtrend resumes.

This risk may encourage traders to reduce leverage and trim positions in case the market suddenly turns negative.