Ethereum (ETH) is showing tentative signs of recovery, with technical structures known as vector candles or imbalance zones influencing short-term price dynamics.

Analysts indicate that Ethereum could revisit levels between $3,400 and $4,000 if current support holds, although momentum remains mixed and broader market conditions are uncertain.

Major Sell-Off Creates High-Probability Imbalance Targets to the Upside

Ethereum has recently experienced a notable drawdown, leaving behind unfilled imbalance zones across multiple timeframes—from intraday charts (15-minute) to weekly structures. These zones are regions where trading volume was historically high, but price did not fully retrace, creating structural inefficiencies that often attract liquidity during recovery phases.

Ethereum (ETH) is recovering from a recent sell-off, with unfilled vector candle imbalances across multiple timeframes suggesting potential upside toward $3,328–$4,075. Source: n3uspeed on TradingView

“Historically, ETH gravitates back to areas of high volume that were left unfilled,” says Lucas Meier, a crypto market strategist at Glassnode. “Similar weekly imbalance structures in August 2022 and January 2024 led to 6–12% recoveries as liquidity filled overhead inefficiencies.”

Key short-term recovery targets identified include:

$3,328–$3,398 (15-minute vector candles)

$3,411 (30-minute imbalance)

$3,447 (45-minute inefficiency)

$3,658 (1-week imbalance)

$3,866–$3,891 (3–5 minute clusters)

$4,075 (higher-timeframe inefficiency)

These ranges are monitored by traders using Ethereum technical analysis, including RSI, MACD, and stochastic indicators, to identify potential rebounds.

Market Sentiment: Analysts Debate Bearish vs. Bullish Outlook

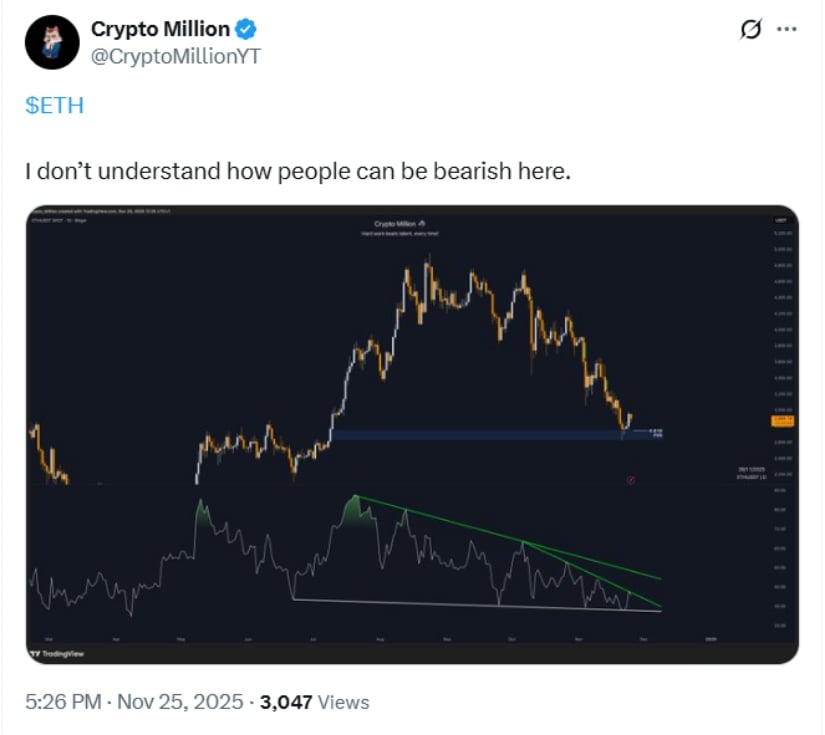

Market opinions remain divided. CryptoMillionYT, a Swiss-based analyst and founder of IMO Invest, recently shared a TradingView chart showing ETH breaking above a descending trendline dating back to March 2025, with the price near $2,900.

CryptoMillionYT noted ETH’s breakout above a March 2025 trendline with bullish RSI, highlighting mixed community sentiment. Source: Crypto Million via X

Despite this, many traders remain cautious due to repeated rejections below the $3,000 psychological barrier, while others focus on upside potential if resistance zones are cleared. This mixed sentiment reflects ongoing uncertainty in Ethereum news and price expectations.

ETH Price Rebounds From Key Support

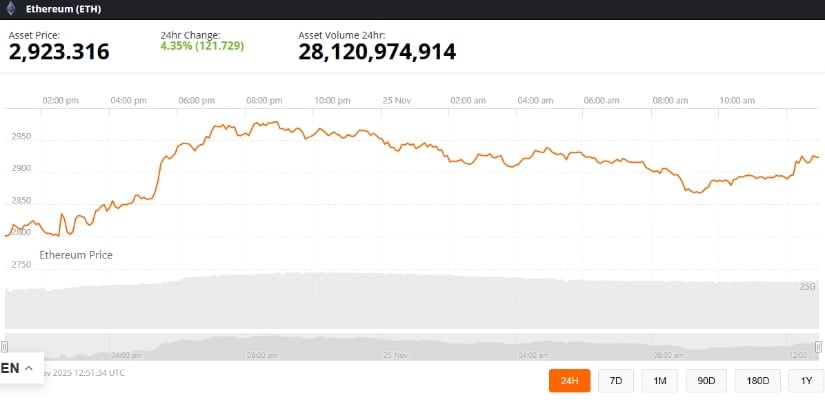

Data from Binance News indicates that Ethereum rebounded approximately 4%, trading near $2,910 after bouncing from the $2,850 support level. The recovery coincided with institutional accumulation, notably from BitMine Immersion Technologies, which added 69,822 ETH to its treasury.

ETHUSD is retracing within a descending correction, poised between key resistance and support, with potential for either a bullish rebound or a breakdown. Source: Hamza Gold on TradingView

According to CoinGecko data, BitMine’s total holdings now amount to 3.63 million ETH, or roughly 3% of the circulating supply, making it the largest corporate Ethereum treasury globally. This accumulation, combined with inflows into ETH-linked ETFs, suggests continued institutional interest even amid short-term market pullbacks.

However, buying pressure remains constrained near $3,000. Observers note that while Ethereum has outperformed the broader digital-asset index with a 4.36% gain this week, momentum is limited, highlighting the need for caution in short-term trading.

Technical Indicators: Oscillators Show Weak Momentum

Short-term Ethereum price analysis points to neutral-to-cautious conditions:

RSI near 36 suggests subdued buying strength.

MACD remains in negative territory, indicating weak trend support.

Stochastic %K sits in lower ranges, reflecting softened demand.

Momentum indicators collectively show lingering downside pressure. Traders are advised to wait for confirmation of a shift in oscillator readings before assuming a sustained reversal is underway.

Moving Averages Signal Continued Headwinds

All major moving averages remain above Ethereum’s current price, highlighting persistent corrective forces. The gap between spot price and trend levels emphasizes the extended selling pressure ETH faces.

This setup explains why ETH has struggled to surpass the $3,000–$3,100 resistance zone, reinforced by the 20-day EMA at approximately $3,133. This area serves as a critical barrier for short-term recovery attempts.

ETH Outlook: Key Levels and Risk Factors

Ethereum’s immediate resistance levels are

$3,000, with short-term friction

$3,100, a stronger ceiling reinforced by moving averages

A sustained move above these zones could signal strengthening bullish momentum and align with vector candle recovery targets between $3,400 and $4,000.

Ethereum was trading at around 2,923.31, up 4.35% in the last 24 hours at press time. Source: Ethereum price via Brave New Coin

Conversely, failure to defend the $2,850 support level may push ETH toward deeper liquidity pockets near $2,300, consistent with broader market softness.

Long-term projections, including Ethereum price predictions for 2025 and beyond, depend on factors such as network upgrades, institutional flows, and macroeconomic conditions. While the market remains cautious, imbalance zones and structural support provide a framework for assessing short-term price dynamics.