According to Versan Aljarrah, founder of Black Swan Capitalist, fear has crept back into the XRP market as the token trades under pressure. Prices slipped below the $2 mark and recently hit about $1.83 before a small rebound. Volatility has been sharp, and many traders are being pushed into quick exits.

Volatility Tests Investors

Based on reports, XRP’s slide accelerated after a broad market crash in early October tied to tariff tensions between the US and China.

That turmoil forced billions of dollars of liquidations across exchanges. Different platforms briefly showed very different lows — Kraken recorded $1.40 while Binance charts on TradingView showed a flash low at $0.76.

Those swings left behind gaps in liquidity, including a zone around $1.98 to $1.99 that traders are watching closely.

Price action has been messy but not one-directional. XRP was trading around $2.22, up about 1.8% in the last 24 hours, and in another snapshot it was reported changing hands close to $2.24 amid a rebound. Over the most recent 72 hours, the token posted a rally of more than 18%, showing how fast sentiment can flip.

According to Aljarrah, fear has returned, and “it always hits those who don’t understand what it means to hold XRP.” The analyst pointed out that a good number of people will fall before they could even make it and “survive the engineered volatility ahead.” The system, he said, “shakes out the weak” long before actual market valuation takes its course.

History And Psychology At Work

Analysts and market observers point to XRP’s stop-and-go history as part of the problem. In 2017, the coin lingered for months before surging roughly 70,000% and then dropping by as much as 95% at certain stretches.

In 2024, it traded quietly for much of the year before jumping over 600% near year end. That pattern makes holding the token psychologically hard for many. People sell too soon, often right before big moves.

Support levels are being watched closely. Reports list key buffers at $1.95, $1.75, and $1.60. On the upside, some analysts are projecting a rebound to $4 by 2026, with longer-range targets of $13 and $27. Those are forecasts, not promises, and they assume steady market conditions and continued interest.

Whales Take Profit Amid Rally And ETF Flows

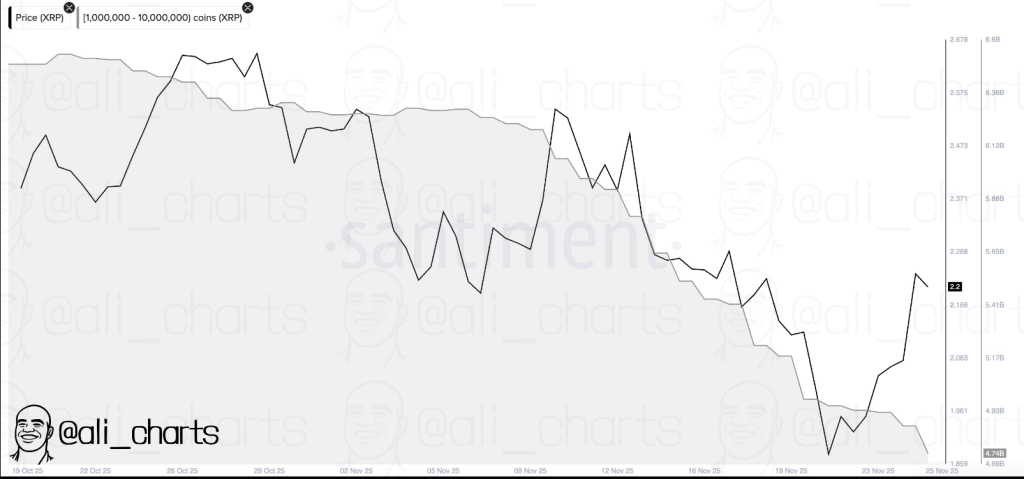

Meanwhile, analyst Ali Martinez said larger holders have been taking profits during the rebound. Whales holding between 1 million and 10 million XRP reportedly sold over 180 million tokens, trimming their balances to about 4.74 billion XRP. That kind of selling can add pressure even while the price is trying to recover.

Institutional flows appear to be a counterweight. Based on reports, the Franklin Templeton and Grayscale XRP ETFs launched in the US yesterday and drew combined positive flows of $130 million on their first day.

Net inflows into US XRP ETFs on Monday were placed at $164 million, a figure that helped absorb some of the selling and supported a more than 7% gain over 24 hours in some trading windows.

Featured image from Pexels, chart from TradingView