Analysts note weakening momentum and a long-term downtrend capped by the $0.22 resistance.

Sei is hovering near its crucial $0.13 weekly support, an area that sparked two major rebounds in the past. Recent intraday action indicates cautious buying, but there is limited follow-through. The market now awaits confirmation as the coin attempts to defend its most critical price floor.

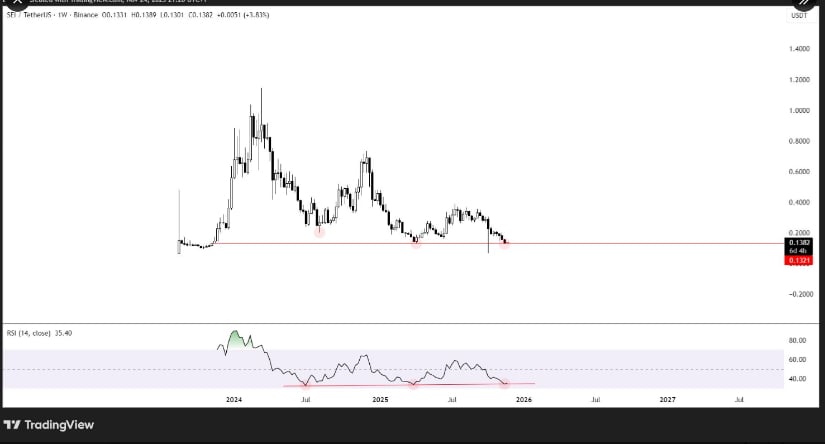

Price Returns to Long-Term Support Zone

The altcoin is once again testing the long-standing weekly support near $0.13, a level that previously provided two recoveries over the past year. The coin has gradually drifted toward this area through steady weekly declines, putting renewed focus on whether buyers will defend this floor. Historical reactions at this point have produced rebounds that carried through multiple sessions, making it one of the clearest price zones watched by market participants.

SEIUSDT Chart | Source:x

The weekly RSI currently sits near its historical base, matching earlier points where momentum flattened before prior rebounds. This alignment has drawn attention because both price and momentum have reached levels that preceded earlier stabilizations.

Despite this positioning, the asset continues to trade within a broad downward structure, and traders are monitoring for a clear confirmation before assuming another recovery phase.

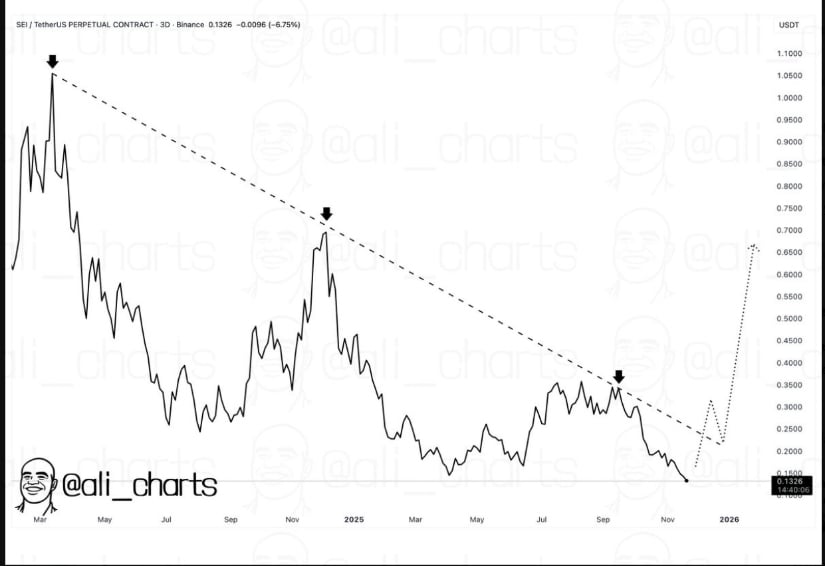

Descending Trendline Still Controls Broader Direction

Analyst observations show the asset remains under its long-term descending resistance, with the key trendline positioned near $0.22. This level has rejected every major rally since early 2024, consistently preventing the market from forming a sustained uptrend. Each test of the trendline resulted in sharp retracements, reinforcing its role as a barrier for medium-term movements.

The chart shared by analysts shows that volatility has compressed beneath this trendline over recent months. Price action has narrowed, suggesting that market conditions are tightening as the asset approaches the lower boundary of its range. Traders are watching whether the asset can eventually force a breakout above $0.22, a move seen as necessary to shift the trend into a constructive phase. Until such a break occurs, the coin remains within a broad downward pattern.

Potential Upside Opens Only After Trendline Break

Analyst projections outline a possible path if it successfully reclaims the $0.22 level, pointing to thin volume between $0.35 and $0.65. This range has historically offered limited congestion, which would allow smoother price movement if the trendline is converted from resistance to support. Such a scenario, according to the chart structure, would represent the first higher-timeframe shift in nearly two years.

SEIUSDT Chart | Source:x

That projection remains conditional. The trendline has limited every attempt at recovery, and traders are waiting for a strong close above it before considering any extended upside. Without that confirmation, the coin continues to trade inside the same descending channel that has shaped its performance since 2024. Market participants are therefore assessing both the support at $0.13 and the overhead trendline as the two primary reference points.

Short-Term Trading Shows Controlled Movement

The asset is trading around $0.14 after a mild gain, following an intraday dip toward $0.131–$0.132 on November 24. The coin rebounded to an intraday high of $0.138, suggesting that buyers defended the lower range. Later trading on November 25 showed a gradual retreat from the high, indicating that sellers remain active above the mid-$0.13 region.

SEIUSD 24-Hr Chart | Source: BraveNewCoin

Volume stayed steady through the session, with a slight rise during the midday push toward $0.138. This suggests participation increased during the upward movement, though momentum faded as price stabilized.

The asset remains above the $0.13 support, but traders are waiting for a firm move above $0.136–$0.138 to establish short-term strength. Until that occurs, the altcoin continues to trade within a controlled, range-bound structure while the market watches the key weekly support for direction.