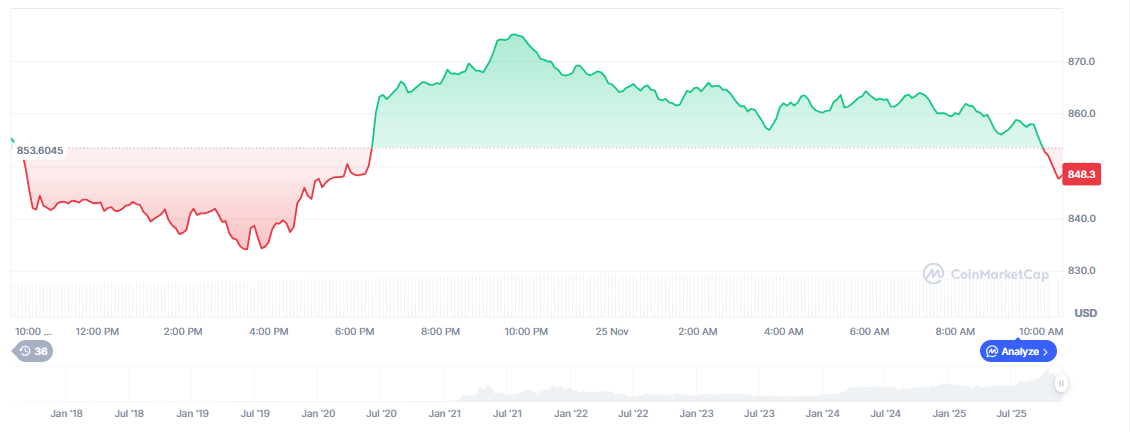

BNB price prediction discussions are heating up again as Binance Coin trades at $848.39, showing a modest 24-hour uptick of 0.32%. With a market cap of $116.85B and volume surging 16.1% to $2.24B, the asset appears stable, but not convincingly bullish. Technical indicators offer a mixed picture, leaving traders split on whether this is a base for another leg up – or the start of a stall.

What’s clear is that the current setup doesn’t excite fast-moving capital. Momentum is cooling, RSI is stuck at 44.74, and despite a fully circulating supply of 137.73M BNB, no strong catalyst has emerged to push it past the key $1,000 psychological barrier. That hesitation is creating a vacuum – one that newer altcoins are quickly filling.

Investors looking for velocity are now seeking early-stage alternatives, and few are making as much noise as Bitcoin Hyper, a high-stakes presale play with traction, real-time whale inflows, and a fixed-supply mechanism that mimics early BNB.

Technical Indicators Are Still Cautious, But Momentum Is There

From a charting perspective, BNB’s price is holding just below the resistance level seen around $849–$852, which has capped short-term rallies before. A decisive break above $1,120 is what most analysts are watching, with several pointing out that the 200-day EMA near $1,090 has historically acted as a springboard.

Current trend analysis shows SMA 3 and SMA 5 signaling Buy, while SMA 10 and 21 remain in Sell territory. Meanwhile, exponential readings (EMA 5 through EMA 50) lean bullish, hinting at mid-term strength – but with visible friction.

Weekly sentiment still leans cautiously optimistic. Traders are aware that a small push could trigger a technical breakout, but they’re not betting on it just yet. Instead, many are waiting for either a confirmed $1,120 close or a sharp increase in RSI above 50 to signal strong accumulation.

BNB Forecast Into December: Slight Uptick, No Fireworks Yet

Short-term projections suggest only modest growth by year-end. Analysts forecast a move toward $852.08 by December 25, with no expectation of sharp surges unless macro or regulatory catalysts emerge.

The predicted average for December sits at $1,165.62, with the optimistic case targeting $1,237.04. That would be a 13.22% increase from current levels, but with little sign of major volume breakout, these numbers are likely to stay on the upper end of speculative.

This type of slow, steady climb favors long-term holders, not short-term traders looking for asymmetric upside. And that’s where the rotation narrative becomes important.

Bitcoin Hyper Grabs Attention as $28M Flows In

While BNB consolidates, Bitcoin Hyper is quickly becoming the destination for traders chasing earlier-stage upside.

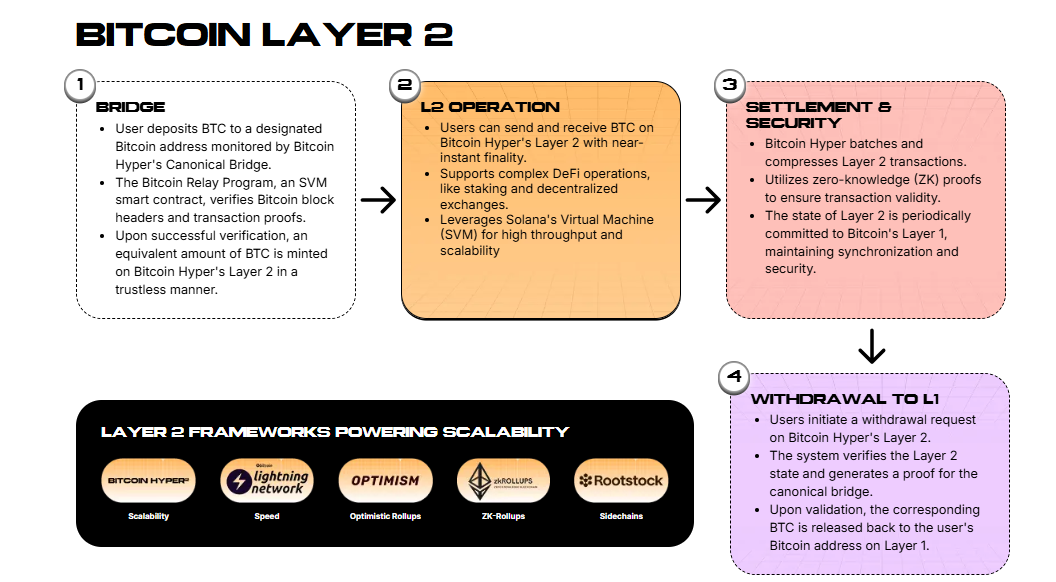

Built as a Bitcoin Layer 2 chain, $HYPER combines scalability, meme appeal, and DeFi utility into one aggressive presale. In just days, the project has crossed $28.45M in total raise, with its token priced at $0.013325 and a price jump due at any moment.

The presale dashboard shows over 313 buyers joined in the last 24 hours, and investor behavior mirrors early BNB adoption curves. A whale just dropped $28,191 into $HYPER, clearly signaling conviction before the next price hike.

What’s pushing momentum isn’t just marketing. The project offers:

41% staking rewards

A fixed supply presale model

Wallet, explorer, bridge, and dApp integrations already outlined

A working ecosystem positioned as the fastest Bitcoin L2 chain

Traders Are Rotating to Momentum, Not Stability

BNB is already a mature asset. Its chart requires a breakout confirmation above $1,120 just to reach previously tested levels. By contrast, $HYPER is still in its exponential phase, where small inflows can dramatically move price due to capped supply and fixed sale rounds.

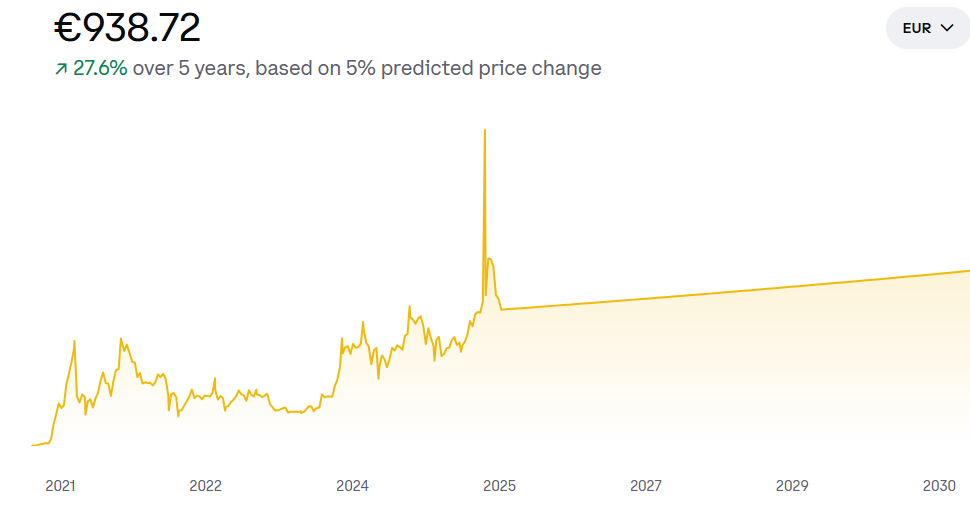

Traders are comparing this moment to 2018–2019, when BNB’s low liquidity and exchange-driven incentives sparked a parabolic rise. Today, Bitcoin Hyper offers a similar structure but paired with DeFi mechanics, staking, and real-time user onboarding that’s visible on-chain.

For short-term movers and long-term believers alike, the rotation has one goal: position before lift-off.