HYPE is sitting at a decisive moment, breaking key support while strong on-chain activity fuels speculation about whether a deeper drop or sharp rebound comes next.

HYPE has slipped into a tense moment after breaking its neckline, and the market is reacting with a mix of concern and opportunity. Price has clearly weakened, yet on-chain participation, inflows, and volume are holding far stronger than expected. Hyperliquid has created one of those rare phases where technical pressure is pointing downward, but on-chain activity is pointing in a different direction.

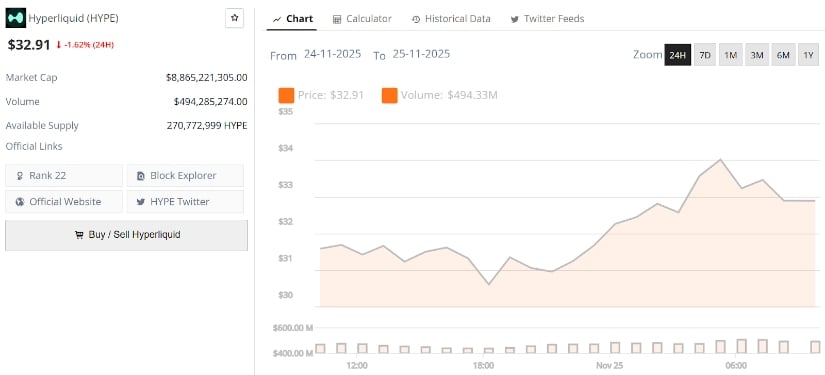

Hyperliquid’s current price is $32.90, down -1.62% in the last 24 hours. Source: Brave New Coin

HYPE Under Pressure After Neckline Break

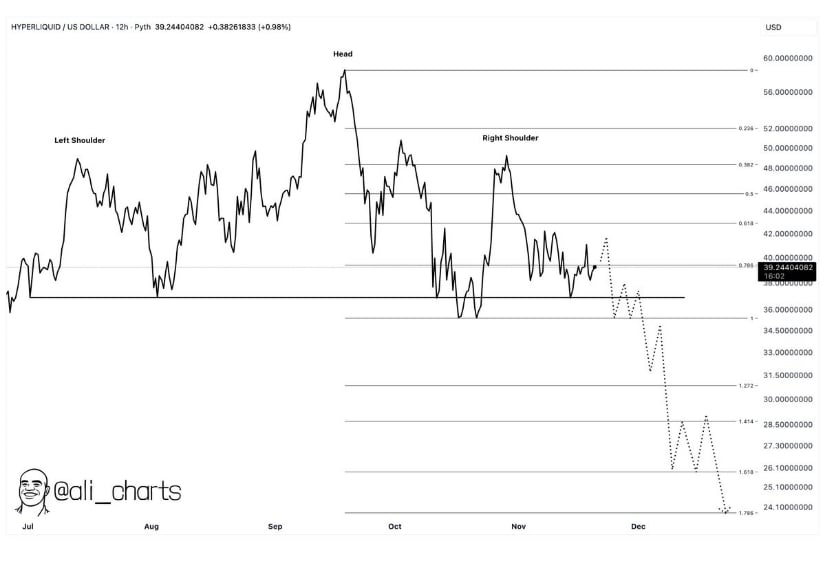

HYPE chart shows the head-and-shoulders pattern has now officially broken down, with price slipping below the neckline around $37–$38. This breach signals that sellers are in control, and the reaction so far has been weak, with no strong attempt to reclaim lost ground. The structure suggests a potential continuation move lower unless buyers step in quickly.

HYPE slips below its neckline as the head-and-shoulders breakdown accelerates downside momentum toward key support levels. Source: Ali Martinez via X

With the neckline gone, famous crypto analyst Ali Martinez believes that the measured move maps out potential downside areas at $33, $30, $28, and $26. The dotted projection on the Hyperliquid chart reflects how fast momentum can accelerate once a major support breaks. For now, the HYPE is following that trajectory closely.

On-Chain Holding Strength Despite Price Weakness

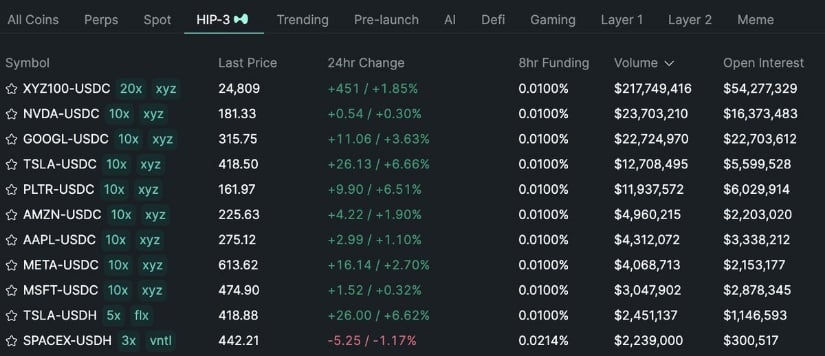

HYPE’s HIP-3 ecosystem is pushing $309M in daily volume, a standout figure during a period when price is losing structure. High transaction flow in a corrective phase often signals that the project still maintains strong participation and liquidity.

HYPE’s on-chain activity remains unusually strong. Source: McKenna via X

Funding remains flat, OI is steady, and the distribution across pairs shows consistent flow. These metrics suggest that while price is correcting, market engagement hasn’t faded. It gives HYPE a stronger base compared to most assets in similar technical conditions.

Trendline Breakout Could be a Sign of Strength

Lucky’s chart lays out Hyperliquid’s larger picture: despite volatility, HYPE is still trading inside its major range, with support near $33–$34. Even after losing the neckline, the broader range hasn’t broken. The descending trendline from the highs continues to cap upside attempts, but the compression is tightening and usually leads to a decisive breakout.

HYPE continues to compress within its broader range, with the descending trendline acting as the next major trigger level to watch. Source: Lucky via X

If HYPE reclaims the trendline, upside levels re-open towards $42, $48, and prior highs near $55. Until then, this remains a range-play environment. The demand zone at $30–$32 is the final line that must hold to keep this narrative alive.

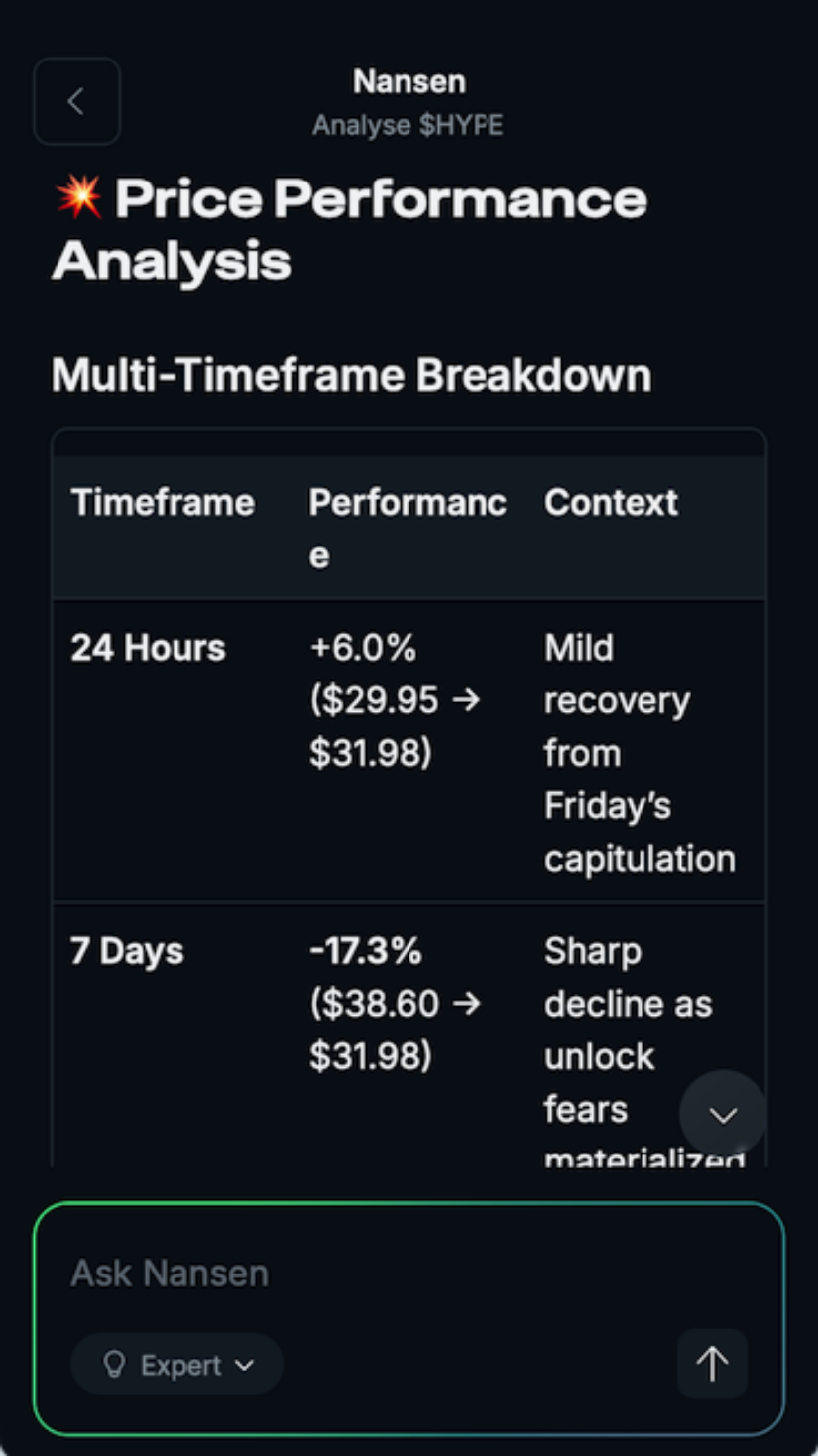

Contrary Signals Emerging Despite Fears

The recent data shared by Nansen shows a surprisingly bullish side to the current narrative. While many fear the unlock, larger players aren’t showing the same concern. Pantera Capital reportedly added +51.7K, fresh wallets poured in $3.9M, and buybacks continue absorbing around $5M per day. These are not the behaviors you see during a distribution phase.

Fresh inflows, wallet growth, and daily buybacks show quiet accumulation despite bearish price action. Source: Nansen via X

If this were a distribution, inflows wouldn’t be rising, instead, it looks like supply is being absorbed quietly. This sets up a strong contradiction: while price action leans bearish, on-chain flow points towards accumulation. If momentum picks up, this could quickly shift sentiment.

Fractal Hinting at a Potential Bottom

HYPE is retesting a major support block that acted as a springboard earlier in the year. The current chart shared by Kasper is closely mirroring that previous fractal: a drop into support, a rounded bottom, and a sharp recovery. The highlighted zones align almost perfectly with past behavior, suggesting this could be another accumulation phase.

HYPE’s current pullback mirrors an earlier-year fractal, hinting at another potential springboard from support. Source: Kasper via X

If the fractal continues to play out, the next step would be a reclaim of the mid-range at $40, followed by expansion into the upper supply at $48–$50. The setup isn’t confirmed yet, but the similarities are strong enough to keep an eye on.

Final Thoughts

HYPE is in a mixed but very important spot. The neckline breakdown adds real downside risk, and sellers are still dictating short-term movement. But strong on-chain volume, steady inflows, stable funding, and accumulation signals keep the medium-term outlook more balanced than the chart alone suggests.

As long as the $30–$32 zone holds, HYPE can still form a recovery base. A reclaim of the descending trendline would be the first major shift in momentum.