Hedera (HBAR) has been trading sideways for several days, with the altcoin struggling to gather enough momentum to stage a meaningful recovery. After a steep drop this month, HBAR is waiting for a decisive catalyst to break its stagnation.

However, the support needed to drive that recovery appears limited, and the broader market’s uncertainty is not helping its case.

Hedera Traders Are Placing Shorts

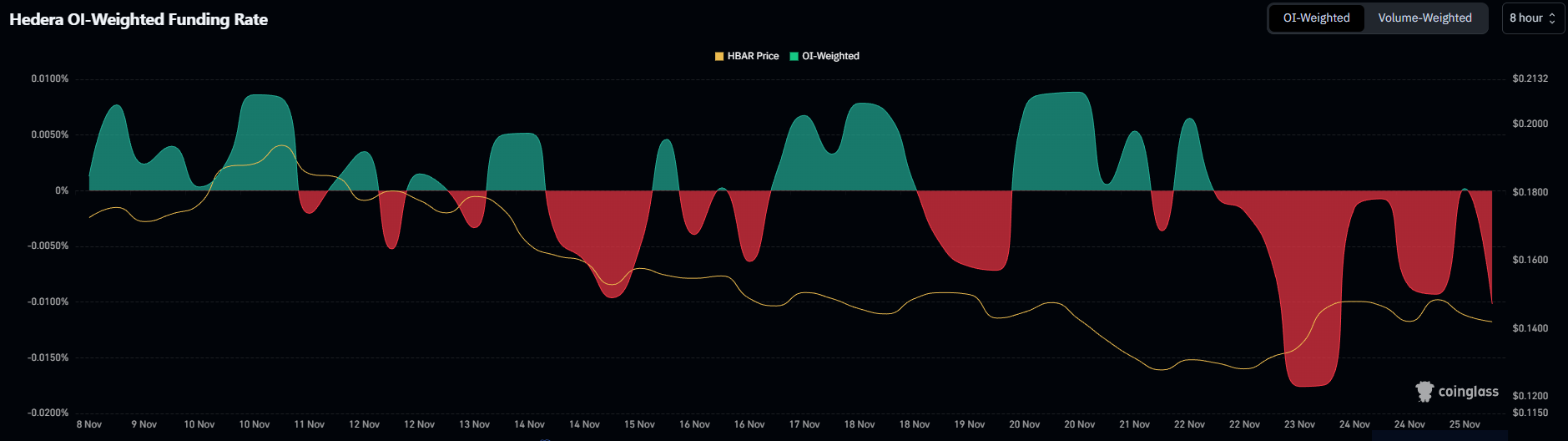

Funding rates across major exchanges indicate that traders remain hesitant. The current negative funding rate suggests that market participants expect more downside and are opening short positions to profit from a potential decline. This type of sentiment often emerges during extended consolidation phases, where traders lose confidence in the asset’s ability to rebound.

However, funding rates are highly reactive and can shift quickly. Their frequent fluctuations signal volatility and uncertainty rather than a firmly bearish trend. If sentiment flips and traders begin to unwind shorts, HBAR could benefit from a sudden surge in buying pressure, helping it regain lost ground.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HBAR Funding Rate. Source: Coinglass

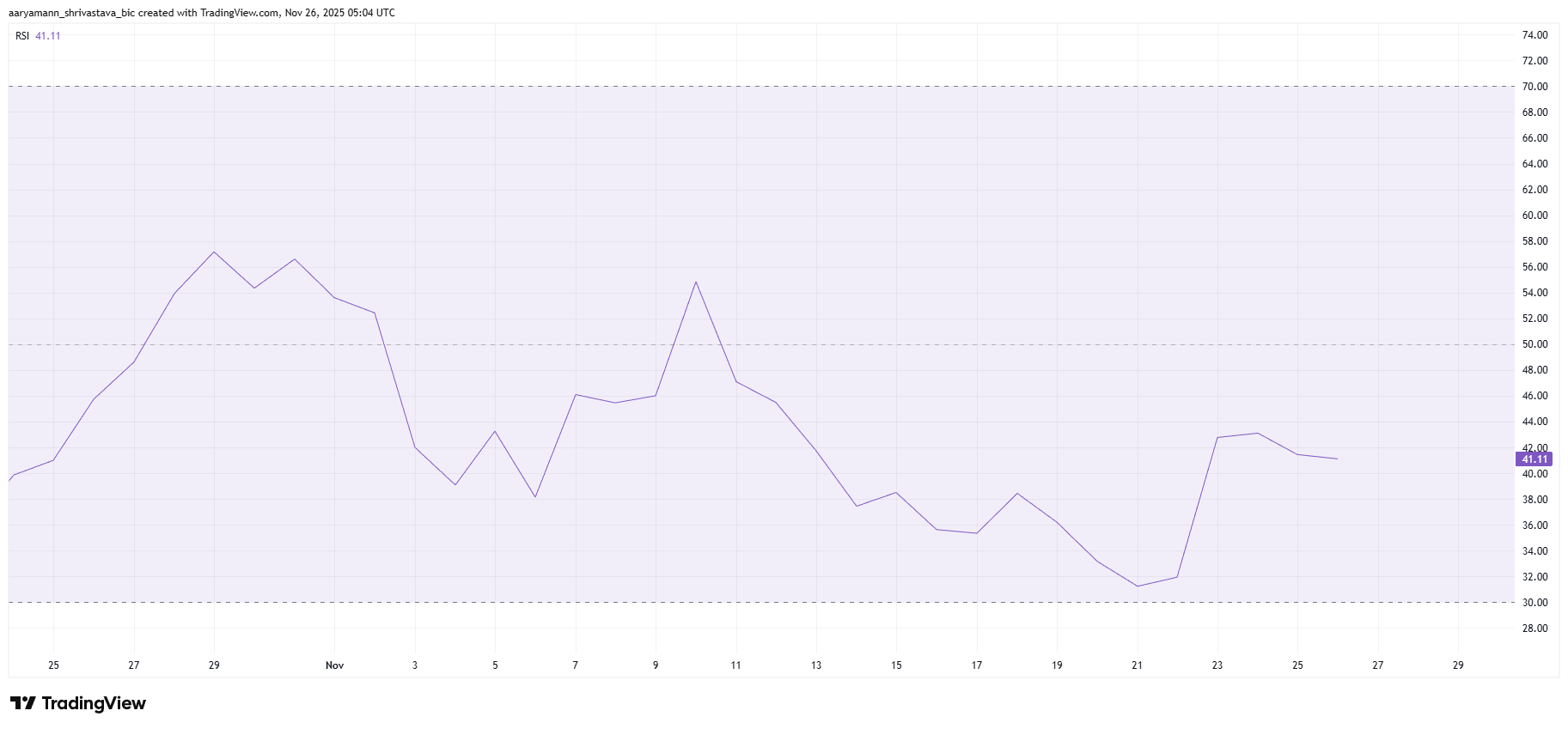

The broader momentum picture remains weak. Hedera’s relative strength index is sitting below the neutral 50.0 level, firmly in bearish territory. This positioning reflects ongoing market pressure and a lack of strong bullish conviction. When the RSI holds in the negative zone, price action often struggles to form higher highs or generate sustainable rallies.

The persistent market-wide caution also weighs on HBAR’s ability to mount a recovery. Unless momentum indicators shift upward, the altcoin could remain stuck in its current range.

HBAR RSI. Source: TradingView

HBAR Price Has A Long Way To Go

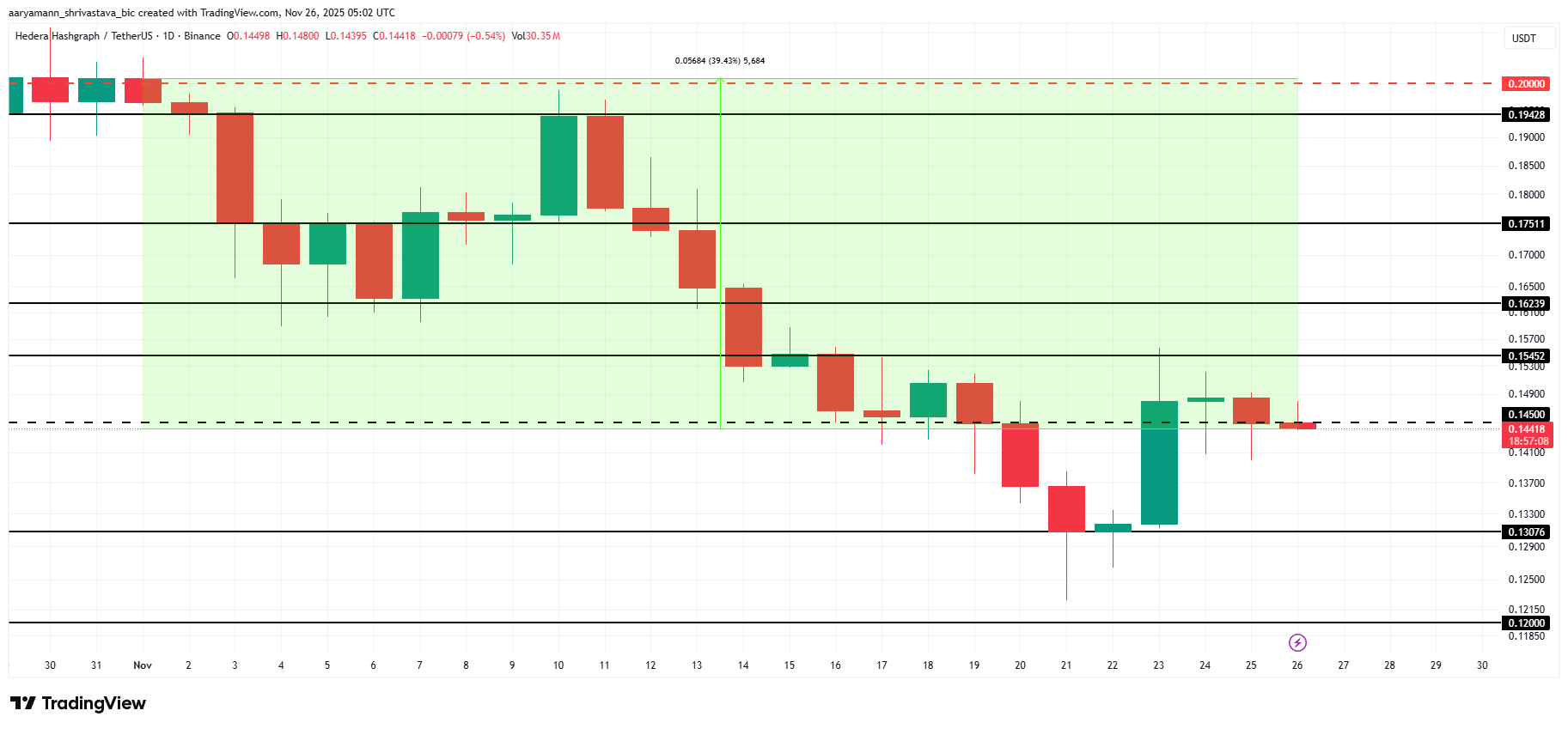

HBAR is trading at $0.144, sitting just under the important $0.145 resistance level. To begin a meaningful climb, the altcoin must flip this resistance into support. This would allow it to move toward $0.154 — a level that has previously acted as a ceiling.

Based on current indicators, HBAR may continue consolidating between $0.154 and $0.130. Bearish sentiment and weak macro signals suggest the altcoin could remain trapped in this zone unless a strong catalyst emerges.

HBAR Price Analysis. Source: TradingView

To recover its November losses, HBAR needs roughly a 40% rally, pushing it toward the $0.200 region. This requires breaking through several resistance levels, starting with $0.154. If HBAR can reclaim that barrier, a move to $0.162 and higher becomes possible, giving the altcoin a chance to invalidate the bearish thesis.