Takeaways:

Texas’s $10M Bitcoin purchase via a spot ETF makes it the first US state to treat $BTC as a strategic treasury reserve asset.

State-level adoption strengthens Bitcoin’s macro narrative but doesn’t solve its limitations: low throughput, high fees in congestion, and lack of native smart contracts or rich dApp ecosystems.

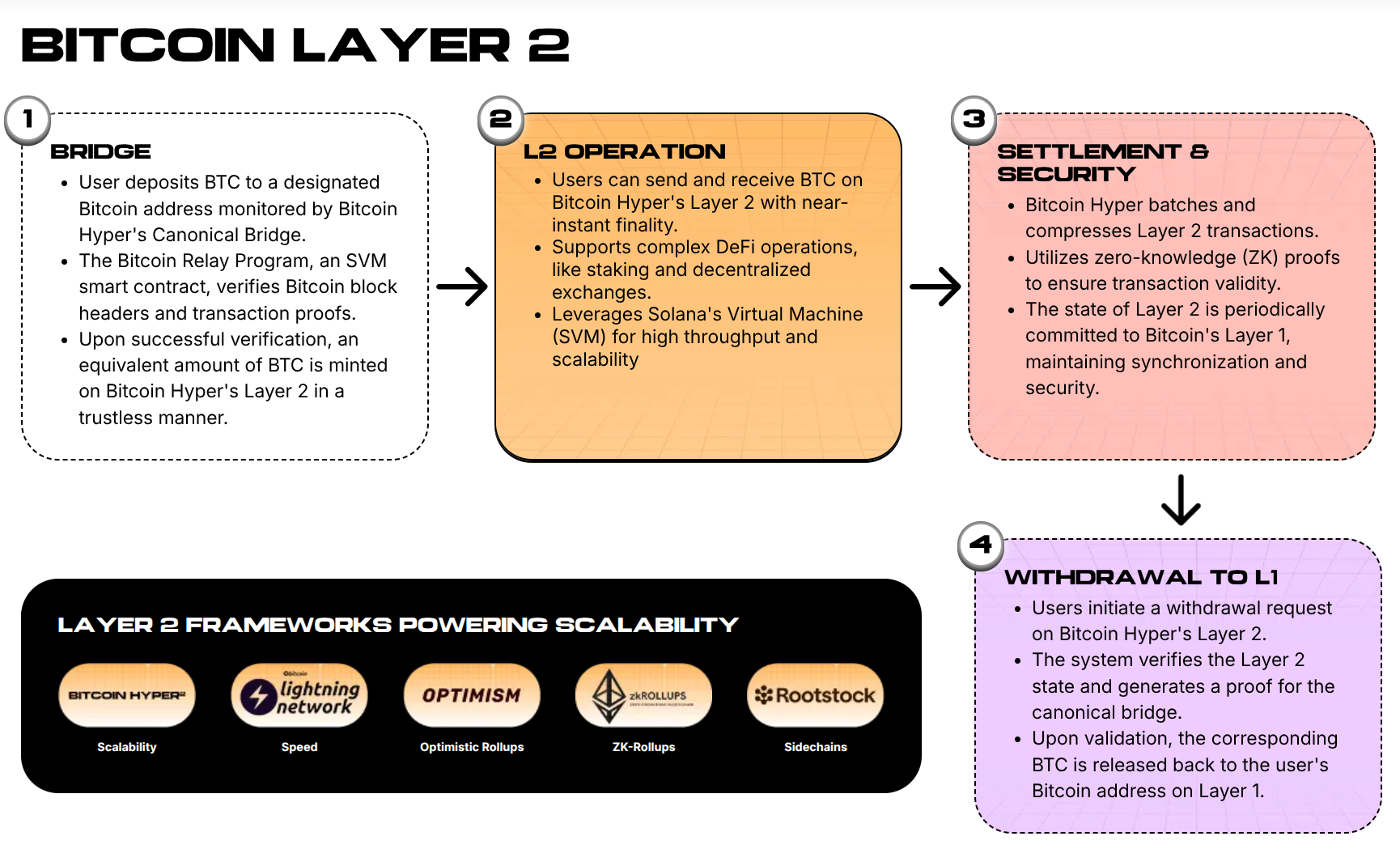

Competition among Bitcoin Layer 2s is accelerating, with approaches ranging from EVM sidechains to rollups and SVM-based execution layers anchored to Bitcoin settlement and security.

Bitcoin Hyper proposes a Bitcoin Layer 2 with Solana Virtual Machine integration, targeting sub-second, low-fee smart contracts to unlock DeFi and dApps around BTC’s store-of-value base.

Texas just did what many politicians have only talked about: it bought Bitcoin for the state treasury.

Under its new Strategic Bitcoin Reserve, officials deployed $10M into $BTC via BlackRock’s IBIT ETF on November 20, 2025, making Texas the first US state to hold Bitcoin as a reserve asset.

This is a clear signal that Bitcoin is shifting from a speculative play to a strategic macro asset held by institutions, governments, and now state treasuries. That narrative shift tends to pull fresh capital into the broader Bitcoin ecosystem every cycle.

As capital flows toward $BTC, the next big question is where the leveraged opportunities sit. Bitcoin’s base layer is secure and battle-tested, but it remains limited to approximately seven transactions per second. And its confirmation times are measured in minutes, still with no native smart contracts on the horizon.

That creates a gap between institutional demand for $BTC and the kind of high-throughput, programmable infrastructure modern DeFi and consumer apps need.

That’s where projects like Bitcoin Hyper ($HYPER) are starting to attract attention.

By positioning itself as a Bitcoin Layer 2 that integrates the Solana Virtual Machine (SVM), Bitcoin Hyper aims to give $BTC the kind of ultra-fast, low-fee, smart contract environment you’d normally associate with Solana.

For investors watching Texas’s move and wondering what’s next beyond simply holding $BTC, this emerging L2 narrative is becoming hard to ignore.

Bitcoin Hyper: SVM Speed On A Bitcoin Security Backbone

Texas’s purchase doesn’t change Bitcoin, but it does change expectations: if states can hold $BTC as a macro reserve, markets will demand a more usable Bitcoin stack on top.

Bitcoin Hyper ($HYPER) is pitching itself as the solution. It leans into the SVM paradigm, high throughput, parallel execution, and sub-second finality, while settling to Bitcoin L1, giving you the security of the OG digital asset.

And how exactly does this magic happen? It’s all thanks to the Canonical Bridge.

This serves as the essential gateway for the Bitcoin Hyper ecosystem, operating on a secure lock-and-mint model that allows users to deposit mainnet Bitcoin in exchange for a 1:1 wrapped asset on the Layer-2 network.

To maintain decentralization, the bridge leverages Zero-Knowledge (ZK) proofs to verify state transitions against on-chain data, effectively removing the need for third-party custodians.

This architecture ultimately unlocks the ability to use Bitcoin within a high-velocity, SVM-powered DeFi environment without compromising the fundamental security of the Bitcoin base layer.

Delivering fast performance, extremely low latency execution, and fees targeting the sub-cent range opens the door for high-speed use cases like swaps, lending, NFT mints, and gaming loops.

These simply don’t fit on Bitcoin L1 today, especially when base fees spike during meme coin or inscription waves.

Already sold? Here’s ‘How to Buy Bitcoin Hyper.’

$HYPER Whales, Massive Money and Social Success

Momentum-wise, the Bitcoin Hyper presale has already raised over $28,5M, and smart money appears to be watching.

On-chain data shows multiple whale wallets accumulating hefty amounts. We’re talking $500K, $379.9K and $274K in recent larger transactions. This only serves to demonstrate that the big players see the value of $HYPER’s proposition and want in at an early stage.

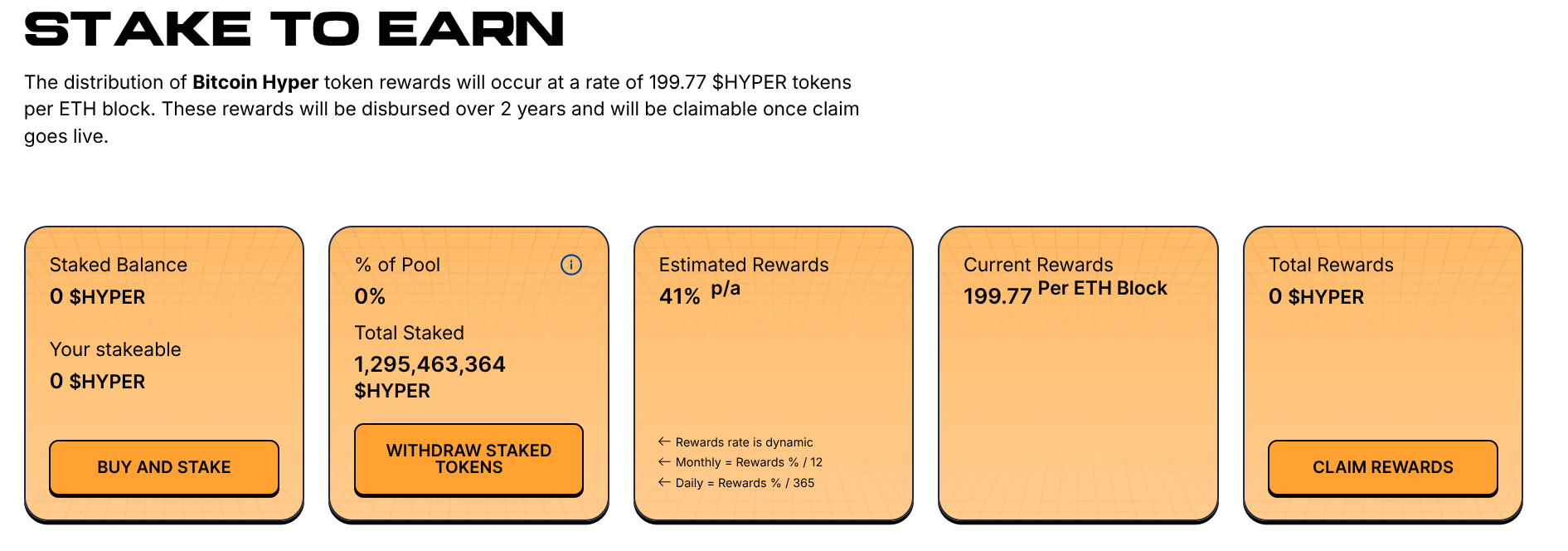

However, you could still see bigger returns with the dynamic staking rewards on offer. Investing today sees you net 41% APY, but get in early, as this amount varies.

$HYPER’s building a path to success. In addition to undeniable utility, future value, and an impressive presale raise so far, it also boasts a strong social media presence.

With over 16K followers on X and over 7K subscribers on Telegram, Bitcoin Hyper has a dedicated and active fan base who believe in the project.

With smart contract audits from Coinsult and Spywolf as well, you know it’s legit.

Don’t miss your chance to jump aboard the $HYPER expressway.

Get your $HYPER today for $0.013335.