Bitcoin price prediction is once again in the spotlight after it regained $91,000 support on Wednesday, ahead of Thanksgiving. After two weeks of brutal selling, the largest crypto offered some relief to investors, surging 15% from the November low.

BTC currently trades at $91,010, posting an increase of 4.07% in the past 24 hours. Despite putting on a strong show in the second and third quarters and hitting an all-time high recently, it is still trading 28% below that level. Other altcoins, including Ethereum, have also faced strong bearish pressure over the past few weeks; however, external pressure seems to be easing now.

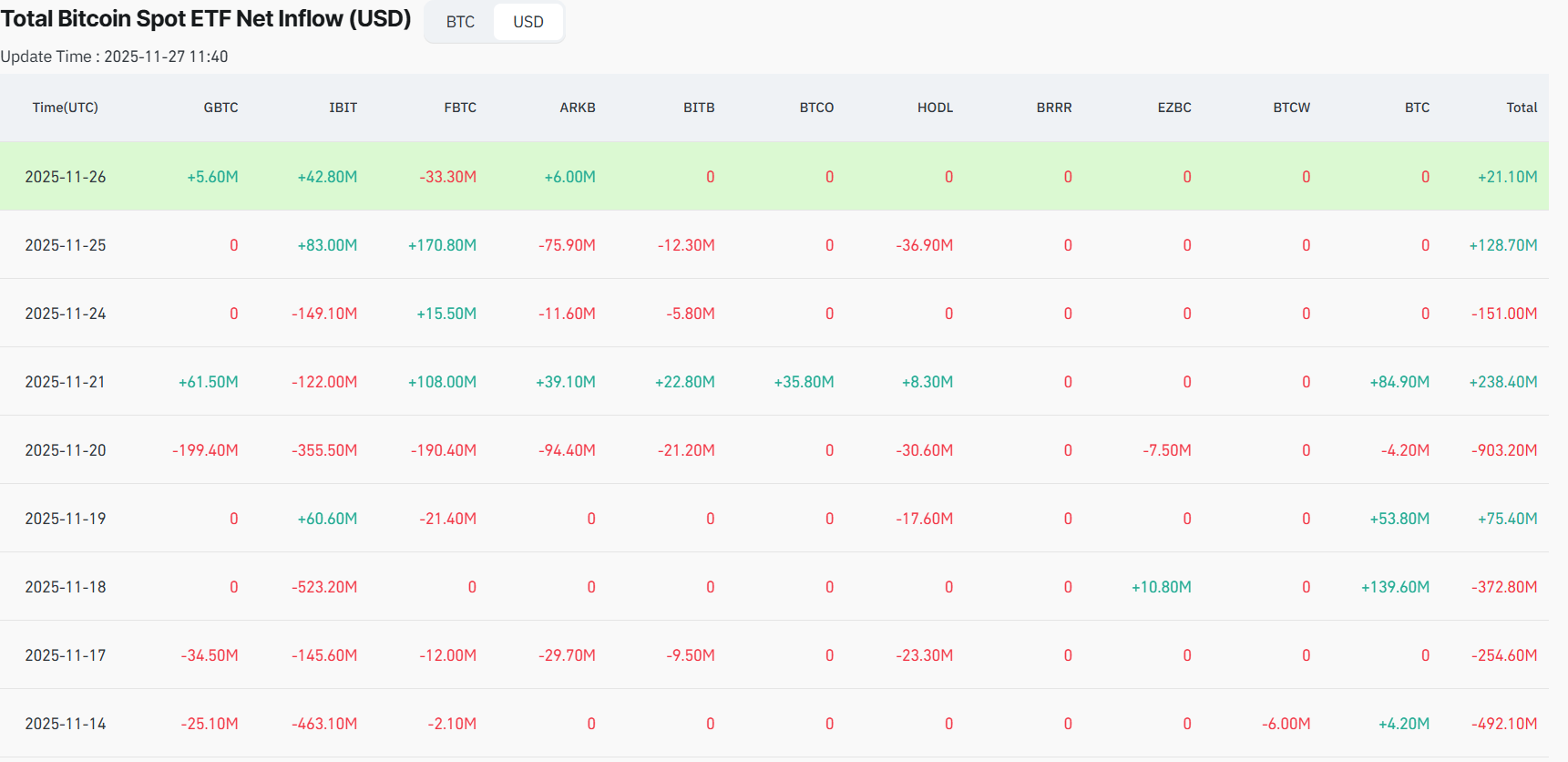

Fueling the bullish momentum, Bitcoin exchange-traded funds (ETFs) saw strong inflows on Tuesday and Wednesday, demonstrating returning confidence and coordinated inflows across its ETF products.

If the bull returns, experts believe Bitcoin-backed projects could explode. The debutant Bitcoin Hyper, a layer-2 project on Bitcoin, is shaking up the presale scene. The presale momentum has broken several records, raising over $28.5 million in a short period. With real utility and strong fundamentals, the project is offering stronger opportunities than a bullish Bitcoin price prediction.

Bitcoin ETFs Rebound With Inflow Streak

After hard days of sustained outflows, Bitcoin ETFs are now gaining attention amid a two-day inflow streak. On November 25, BTC spot ETFs recorded a total net inflow of $128.70 million, and on November 26, a net inflow of $21.12 million, although Fidelity’s FBTC fund experienced a small outflow.

Source: Coinglass

Source: Coinglass

Fidelity’s FBTC sparked the rebound with $170.8 million in fresh inflows, while BlackRock’s IBIT followed with another $83 and $42 million. Total inflows into all spot Bitcoin ETFs have now reached $58 billion, supported by strong daily trading volume of $4.89 billion.

Tuesday delivered the strongest combined inflows for Bitcoin, Ethereum, and Solana ETFs in more than a week, signaling that investor confidence is finally returning to the crypto ETF market.

Bitcoin Price Prediction: Can it Regain $100k Psychological Mark in November?

In the recent advance, Bitcoin’s price has posted a 15% upswing. It has surged from $80,524 to a new weekly high of $91,880. However, $100,000 still presents tough barriers, with $93,500 and $95,000 resistance zones in place.

Bitcoin Price Chart. Image Courtesy: TradingView

Bitcoin Price Chart. Image Courtesy: TradingView

Desk strategist Jasper De Maere recently noted that “Bitcoin volatility is rolling over since hitting the highest level since April this year as the market is trading on lower volumes during the week of Thanksgiving.” He also noted, “Thin markets can soften sharp swings,” emphasizing that Bitcoin could see sharp price swings and reach the difficult $100k in November.

However, if BTC fails to sustain above the $92,000 resistance zone, it could start another decline. The current support level is near $90,000 zone, with the major support level near $85,500.

Bitcoin Hyper: The Real-World Infrastructure Token Changing the Game

While Bitcoin price prediction has started the northward trajectory, Bitcoin Hyper has emerged as the best crypto presale of 2025, raising over $28.5 million and selling over 620 million tokens. The platform is introducing the first-ever layer-2 protocol built directly on the Bitcoin network, aiming to revolutionize its utility.

Performance defines what’s possible. ⚡️

Bitcoin Hyper is benchmarking how to deliver Solana-grade throughput on a Bitcoin-anchored SVM rollup—balancing speed, cost, and security with real data, not hype.

Read more: https://t.co/dq0itEGBR8 pic.twitter.com/n26s7C28N5

— Bitcoin Hyper (@BTC_Hyper2) November 27, 2025

Bitcoin Hyper uses the Solana Virtual Machine (SVM) to run transactions at high speed while staying connected to Bitcoin’s base chain. What normally takes around 10 minutes on Bitcoin settles in seconds here, and fees drop to just a few cents. This speed unlocks new use cases inside the Bitcoin world—from quick lending and yield opportunities to fast-paced meme-coin trading.

It works through Bitcoin Hyper’s native bridge, which locks BTC on the main chain and issues a wrapped version within the Hyper network. Once wrapped, BTC can move across SVM-powered apps without Bitcoin’s usual delays, making the entire system feel lighter and far more flexible.

Core strengths behind Bitcoin Hyper’s momentum

Big market opportunity: $2 trillion utility of Bitcoin

Passive income opportunity: 41% APY staking rewards for presale investors

Strict security audit: Fully audited by Coinsult and Spywolf

Strong investor interest: Over $28.5 million raised

Low token price: $0.013335 per token

For investors seeking the next strong contender in the crypto market, Bitcoin Hyper represents a new phase of innovation. Bitcoin will move beyond being just an investment asset and will also support seamless smart-contract functionality. The project’s traction reflects growing demand for crypto with real utility, low gas fees, and clear revenue potential.