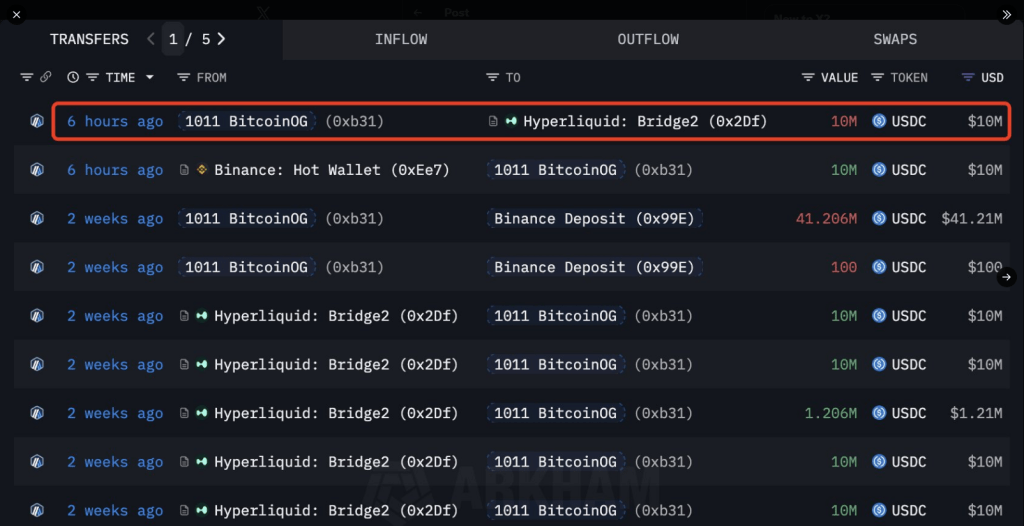

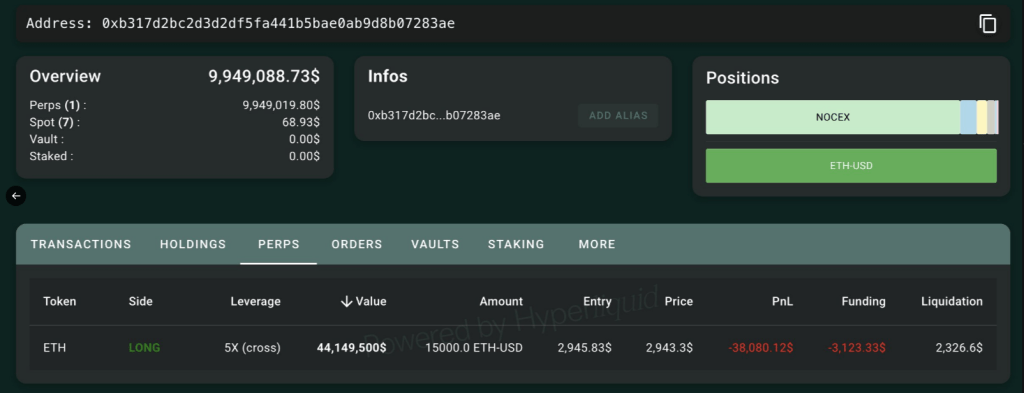

A prominent crypto trader has made a bold move back into Ethereum, stirring attention across digital markets. Reports have disclosed that the account known as “1011short” converted 10 million USDC into Hyperliquid before opening a long position with a five-fold leverage, controlling around $44.15 million in ETH.

Whale Opens A Massive Ethereum Bet

The trade uses 15,000 ETH at an entry price of $2,945, while current market levels sit near $2,896. That puts the position about $38,000 in the red for now.

Based on reports, the liquidation point is $2,326, giving the trader a sizable margin to withstand market swings. With leverage in play, profits and losses are both magnified, making the move high-risk but potentially high-reward.

Market Momentum Shows Mixed Signals

Bitcoin has bounced back to $89,000, gaining 1.37% in the last 24 hours, though it still remains over 20% below last month’s highs.

Some altcoins followed the trend upward. These gains helped trigger a wave of liquidations, catching many traders off guard.

Liquidations Surge As Prices Bounce

In the last day, leveraged positions worth $337 million were liquidated, reports show. About 112,021 accounts were wiped out in total.

The majority of liquidations came from short trades ($233 million), while the total for long trades was ($104 million). One of the largest orders liquidated was on Hyperliquid at $8.61 million BTC-USD.

At the end of the day, Bitcoin and Ethereum made up the majority of the liquidations: about $119 million in BTC and about $73.34 million in ETH.

This indicates the continued high levels of leverage employed in trades on both of the two largest digital currencies by market capitalization, despite large price fluctuations that have been observed recently.

The larger the move in either direction, the more uncertain the trader will be with respect to the timing and extent of their exposure, and thus the potential for loss exists for both bears and bulls.

Meanwhle, Nasdaq-listed BitMine Immersion Technologies expanded its ETH holdings last week by 69,822 coins, bringing its total to 3.63 million ETH — about 3% of circulating supply.

The company also reported 192 BTC, $38 million in Worldcoin, and $800 million in cash. CryptoQuant data indicate unrealized losses of roughly $3.4 billion on its ETH treasury, reflecting market dips.

A Clear Picture Of Caution And Opportunity

Large wallets and corporate treasuries buying ETH suggest cautious optimism among big players. Recent rebounds did not go well for many short positions, showing that volatility can strike quickly.

Traders will likely watch key levels closely, as moves near large whales’ entry and liquidation points can spark fresh swings.

Featured image from Gemini, chart from TradingView