MEXC is a global cryptocurrency exchange founded in 2018, and it is best known for its massive range of supported assets and fast trading infrastructure. The best features of the MEXC crypto exchange are spot trading, futures trading, staking, copy trading, demo trading, Launchpad events, high leverage up to 500×, low trading fees, no mandatory KYC, and support for over 3,000 cryptocurrencies.

Well, the MEXC Global is not officially available in the US, as the platform blocks US-based IPs, but it is considered legit and secure, and operates in 170 countries with over 40 million users.

In this MEXC review, we will cover everything from fees, features, supported coins to KYC limits, US restrictions, deposit methods, and user feedback. You’ll find comparisons with Binance, KuCoin, Bybit, and BingX to help you decide if MEXC is the right crypto exchange for you.

MEXC Crypto Exchange Review: What Is It?

MEXC is a centralized cryptocurrency exchange launched in 2018. It is registered in Seychelles and reports more than 40 million users worldwide. The platform supports over 3,000 cryptocurrencies and 3,500+ trading pairs, and actually, that makes it one of the biggest exchanges by number of listed coins.

It has a daily trading volume of $4+ billion and even ranks among the world’s top 10 crypto exchanges, as listed by CMC data. Also, because it doesn’t require mandatory identity verification from you to start trading, many people generally use it as an anonymous exchange, although certain features and higher withdrawal limits still remain locked until you verify your account.

The MEXC crypto exchange was originally launched as MXC Exchange with a focus on Asia only, but it rebranded to MEXC Global in 2021 to signal global ambitions. Well, the exchange gained popularity mainly by listing new tokens faster than competitors and offering high-leverage trading products. Over the years, it added futures markets with leverage up to 500x, introduced copy trading, and even created DEX+. It also offers a hybrid on‑chain/off‑chain platform that aggregates liquidity from decentralized exchanges while keeping the centralized exchange feel.

Now, the MEXC Global exchange claims to operate in more than 170 jurisdictions; of course, restrictions apply in several regions. The exchange offers spot trading, margin trading, perpetual futures, options, leveraged ETFs, staking, loans, copy trading, and demo trading.

| Year Founded | 2018 |

| Headquarters | Seychelles |

| Supported Cryptocurrencies / Trading Pairs | 3,000+ cryptos and 1,000+ futures contracts |

| Spot Maker / Taker Fees | Maker: 0%, Taker: 0.05% |

| Futures Fees (Maker / Taker) | Maker: 0.01%, Taker: 0.04% |

| Withdrawal Fees | Varies by asset (gas fees only) |

| Deposit Fees (Crypto) | Free |

| Withdrawal Limits Without KYC | Up to 10 BTC per day |

| 24-Hour Withdrawal Limit (KYC Level) | Up to 80 BTC (basic KYC), 200 BTC (advanced KYC) |

| KYC Requirement | Optional for trading; required for high limits |

| US / Restricted Jurisdictions | Not available in the US and certain regions |

| Trading Features & Tools | Spot, futures, margin, staking, copy trading, demo, Launchpad |

| Leverage Support | Up to 500× on futures |

| Interface / Usability | Clean layout, dark/light modes, TradingView charts |

Is MEXC Legit, Safe, and Reliable?

Yes, MEXC is a legit, safe, and reliable crypto exchange, but the answer is a bit complicated and requires you to look at a few different things. Look, when we talk about safety, it’s also important to know that MEXC has been operating since 2018 and has not had any major, publicly reported hacks that resulted in large-scale user fund losses, which is obviously a good sign in the crypto world.

They also use all the standard security practices like two-factor authentication, anti-phishing codes, and they even store most of your funds in cold wallets. You should know that in 2025, MEXC also created a $100 million Guardian Fund. Well, this one is basically an insurance pool set aside to protect users in case of technical issues or system failures.

However, the real question of whether MEXC is “legit” goes beyond just avoiding hacks; it also comes to regulation or licensing, and this is where you need to be really careful. Basically, MEXC is not regulated by any of those top-tier financial bodies in places like the US or the UK, which is something you should eventually consider a risk.

Plus, you will also find that regulators in several countries, like Germany’s BaFin and Hong Kong’s SFC, have even issued public warnings about MEXC offering services without the proper local licenses.

Also, some sources list that MEXC is licensed in Australia and Switzerland, but we did not find any official public records, and we think that it is completely unregulated. Hence, on balance, MEXC appears to be a technically secure exchange, but again, it lacks comprehensive regulatory oversight in key jurisdictions. So, is MEXC legit? Well, the platform can be best viewed as semi‑legit at best.

Is MEXC Available in the US?

No, MEXC is not available in the US, at least not officially. On paper, the exchange clearly states that it restricts users from the United States and even blocks US-based IP addresses to comply with regional laws. Also, the company’s terms mention that American residents are not allowed to register or trade on the platform.

That said, since MEXC is actually a no-KYC exchange, it doesn’t always require ID verification for basic futures trading. Technically, this means some users from the US manage to access it using VPNs to mask their location, and today, you’ll find many traders online admitting they trade this way, but obviously, it’s not something we recommend.

Hence, using MEXC from the US may violate local laws, and your account can be frozen or restricted at any time. So, if you’re based in America, we say it’s safer to stick with those fully regulated exchanges like Coinbase, Kraken, or Gemini, which are 100% licensed to operate in the US.

MEXC Restricted Countries

MEXC fully restricts users from the United States, Canada, Iran, Cuba, North Korea, and Sudan. It also restricts users from Mainland China, Hong Kong, and Singapore due to national regulations. Now, looking over at Europe, the United Kingdom is another major market where MEXC is not allowed to offer services.

The MEXC exchange will usually detect your location using your IP address during the sign-up process, but again, due to its no-KYC trading option, many users bypass this restriction using VPNs.

MEXC Fees

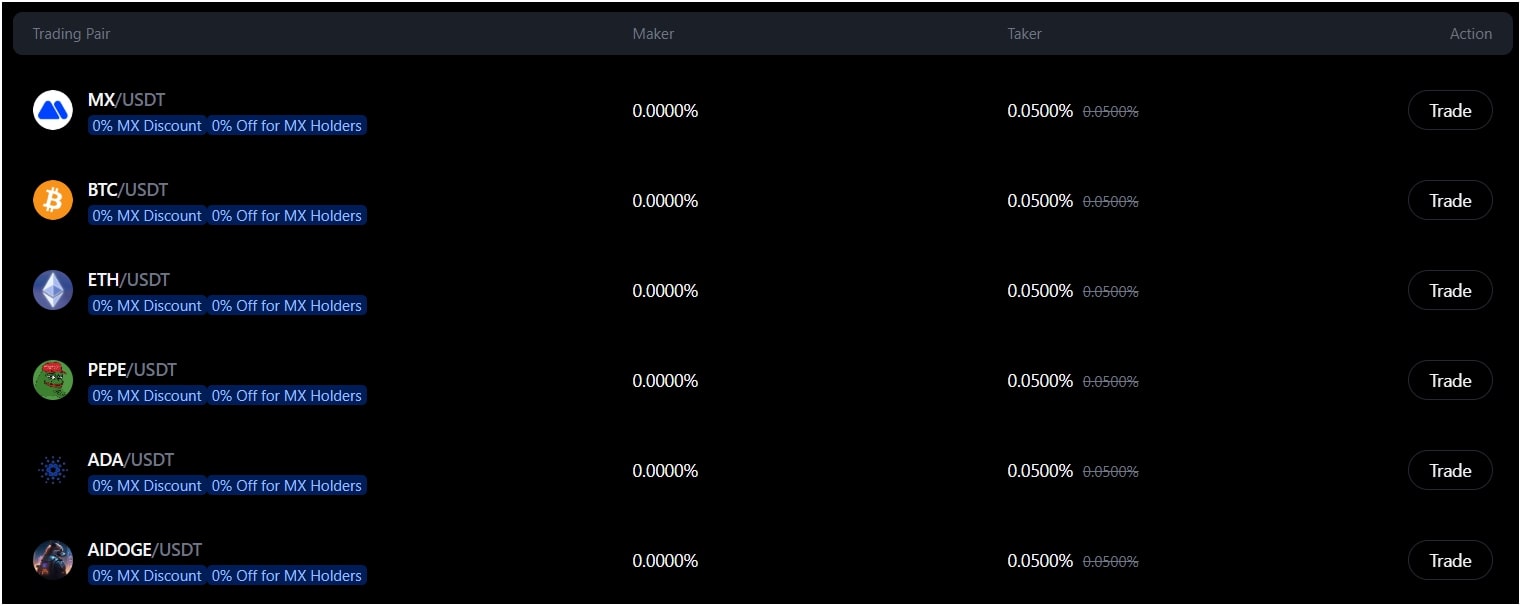

The MEXC trading fees are basically the lowest in the industry, offering a 0% maker fee for spot, and taker fees are set at a very low 0.05% for spot and 0.04% for futures.

MEXC Withdrawal Fees

MEXC withdrawal fees are not fixed and actually vary a lot depending on which cryptocurrency you are withdrawing and, most importantly, which blockchain network you choose to use for that transfer. Also, unlike a trading fee, this fee is mainly there to cover the network’s transaction cost, which is called the gas fee.

For example, withdrawing Bitcoin typically costs around 0.00005 BTC, Ethereum withdrawals are about 0.0005 ETH, and USDT on ERC‑20 costs around 3 USDT. Mainly, these fees cover network costs, and they are subject to change based on network congestion. When withdrawing ETH, you can even save money easily by choosing a cheaper network like BNB Chain or Arbitrum.

MEXC Withdrawal Limit Without KYC

For this basic and unverified MEXC account, your daily withdrawal limit is set at a generous 10 BTC, or the equivalent amount in other cryptocurrencies. Now, if you are a whale or an institutional trader, or if you simply want higher security, you can choose to increase these limits by completing the verification levels.

You can go up to the Primary KYC level, and here, you need to submit basic personal details and an ID, which then raises your daily limit to 80 BTC. Also, if you go for the Advanced KYC, which needs facial recognition, your limit goes up even higher to a massive 200 BTC per day.

MEXC Deposit Fees

MEXC crypto deposits are always free of charge, and this is a standard practice across most major exchanges; MEXC is no exception. You can easily send any of the supported cryptocurrencies from an external wallet or another exchange to your MEXC wallet address, and the platform itself will not going to charge you a dime to receive those funds.

But, you need to remember that even though MEXC does not charge you a fee, the original wallet or exchange you are sending the funds from will charge a network fee. So, that means you are still paying the blockchain’s transaction cost, but MEXC simply does not add any extra fees on top of that.

MEXC Trading Fees

MEXC offers ultra‑low trading fees to attract active traders. For Spot Trading, MEXC currently operates on a fantastic 0% maker fee model, and the taker fee is set at a very low 0.05%.

A “maker” is a trader who places a limit order that does not get filled immediately, which adds liquidity to the exchange.

The “taker” is a trader who places a market order that gets filled right away, taking liquidity out.

Now, for Futures Trading, the fees are even better, especially if you are using the popular USDT-M or Coin-M futures products. MEXC has a 0.01% maker fee on futures, and the taker fee for futures is also super competitive, generally sitting around 0.04%. You should know that they also offer discounts, so if you hold their native MX token, you can get a further reduction on your trading fees.

MEXC Features Overview: Trading Tools & More

MEXC is a very feature-rich, one-stop platform for every crypto trader, giving you access to over 3,000 cryptocurrencies, along with trading tools such as spot trading, perpetual futures contracts, copy trading, demo trading, DEX+, and an easy-to-use mobile app.

MEXC Trading Tools

The main trading tools you can use on MEXC are the spot trading interface, the copy trading feature for following pros, the risk-free demo trading environment, and the innovative DEX+ hybrid product.

MEXC Spot Trading

Spot trading is basically the most common and easiest type of trading you will do, where you buy or sell cryptocurrencies instantly at the current market price or even at a set limit price. You will find that MEXC’s spot trading interface is really straightforward and easy to navigate. It gives you a clean order book, a full-featured TradingView chart for analysis, and all the order types you need, like market, limit, and stop-limit orders.

Also, with over 3,500 spot trading pairs, you can easily find almost any coin you want, including many new tokens that might not be listed on larger, older exchanges yet, like Coinbase or Binance. The fast order matching engine on MEXC can handle 1.4 million transactions per second, which is really fast and means your orders get filled very quickly.

According to CMC data, MEXC has over $4B+ daily trading volume with the most popular spot trading pairs like BTC/USDT, ETH/USDT, and SOL/USDT.

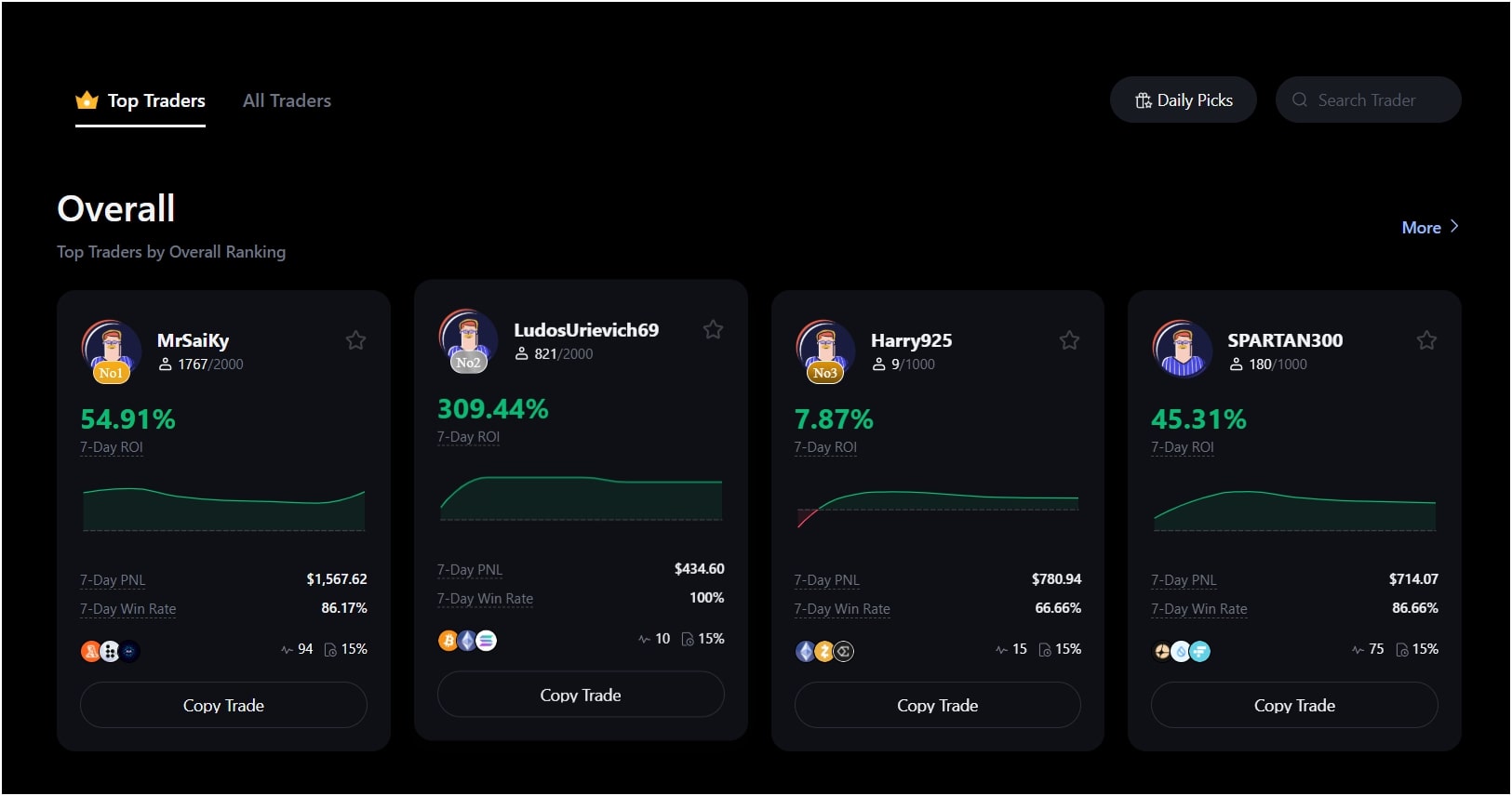

MEXC Copy Trading

Copy trading is an awesome feature that basically lets you automatically copy the exact trades of professional traders on the platform. Honestly, this is a perfect tool if you are new to futures trading or if you just do not have the time to sit and watch charts all day. You can go to the Copy Trading page, browse through a list of expert futures traders, look at their past performance (like their profit and loss history), and then choose to follow one.

The MEXC system automatically allocates a portion of your funds to mimic their moves, and the pro trader earns up to a 15% share of any profits you make. Also, you need to remember that this is for futures trading, so leverage is involved, and you can definitely lose money, so choose the traders you follow very carefully.

MEXC Demo Trading

Demo trading lets you practice futures without risking real money. So, when you open a demo account, you will generally receive virtual USDT, BTC, and ETH to test strategies in the same markets as live accounts. Your Demo funds will reset daily, so you can experiment freely, and there is no demo for spot trading, so you’ll need to start small when trading real coins.

MEXC DEX+

DEX+ is MEXC’s attempt to blend centralized and decentralized trading. Here, instead of sending you to an external DEX, DEX+ aggregates liquidity from exchanges like Raydium, Pumpfun, and Pancakeswap to offer on‑chain swaps for more than 10,000 tokens.

You can easily swap tokens across blockchains such as Solana, BNB Chain, and Ethereum without needing a separate Web3 wallet. Also, if you prefer non‑custodial control, you can connect MetaMask, Trust Wallet, Phantom, or TronLink. DEX+ accounts are actually separate from your regular MEXC account, so trades in one environment don’t affect balances in the other.

MEXC Best Features

You will find that the other best features of MEXC are really the huge variety of over 3,000 tokens, the amazing 0% maker fee model on spot trading, the unique DEX+ integration for decentralized access, the popular Kickstarter and Launchpad events, and the generous 10 BTC daily withdrawal limit without KYC. The MEXC mobile app is also user-friendly and has a secure trading wallet for all your accounts.

MEXC Wallet

Your MEXC wallet is basically the place where you store, receive, and send all your cryptocurrencies once they are on the exchange. MEXC uses both hot wallets (online for quick access) and cold wallets (offline for secure storage). Mainly, the exchange keeps the vast majority of client assets in those cold wallets. You know, this is the industry standard for keeping funds safe from online attacks.

You can easily manage your assets by going to the “Wallet” section of the website or the mobile app, where you can see separate balances for your Spot account, Futures account, and even your DEX+ account.

MEXC Mobile App

The MEXC mobile app is really well-designed and basically offers you full access to everything the desktop website offers. You can easily download the app for both iOS and Android devices, and you are going to get real-time price charts, the full order book depth, and the ability to place all the different types of spot and futures orders, just like on the desktop.

The app is known for being fast and responsive, as this is really important when you are trying to execute trades quickly. Also, all the best features are right there on your phone, including copy trading, the demo environment, and the DEX+ portal. You can also handle your account security settings, check your asset balances, and initiate deposits and withdrawals all from the app.

How to Sign Up and Buy Crypto on MEXC Global Exchange?

To sign up and buy crypto on the MEXC global exchange, you need to create a new account with your email, set up 2FA, deposit funds, and start spot or futures trading.

Step 1: Register Your Account

First, you need to go to the official MEXC website and then click on the “Sign Up” button. You can choose to register using either your email address or your phone number. Now, you will need to enter your preferred method, create a strong password, and then you will be sent a verification code to confirm that it is really you. Enter the code, and basically, you have created your account.

Well, this basic registration gives you that high 10 BTC daily withdrawal limit we talked about, and you can start trading immediately.

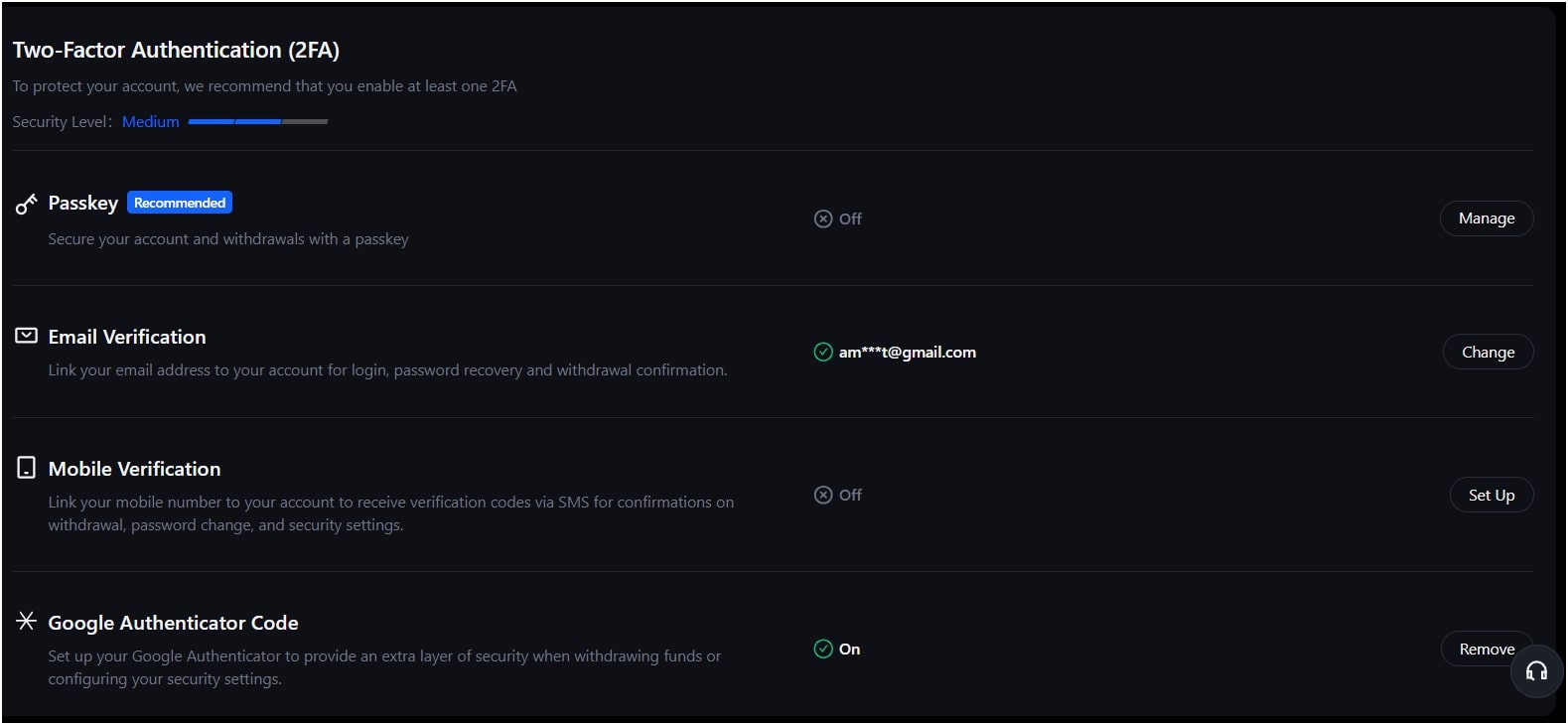

Step 2: Account Security (2FA)

Honestly, you should activate 2FA immediately as well. You can find this option in the “Security” settings section of your profile. Here, you can use an app like Google Authenticator or Authy to scan the QR code that MEXC provides. So, every time you log in, withdraw funds, or change key settings, you will need the code from that app, which makes your account much safer.

Step 3: Depositing Funds

To buy or trade, you need money in your account. You have two main options here. You can deposit existing cryptocurrency from another wallet or exchange, which is free of charge from MEXC’s side. Or, if you are starting with regular money (fiat), you can buy crypto directly using a credit card or bank transfer through one of MEXC’s third-party partners. Just click “Buy Crypto”, select your currency and the amount, and follow the partner’s instructions.

Step 4: Buying Crypto (Spot Trading)

Finally, once the funds are in your account, you can start trading. You can start by going to the “Spot” section and searching for the crypto pair you want, like BTC/USDT.

Now, on the trading screen, you can either choose a Market Order if you want to buy instantly at the current best price, or a Limit Order if you want to set a specific, lower price to buy at a later time. Next, enter the amount you want to spend and click the “Buy” button. That’s it. Your new crypto will appear in your Spot wallet right away.

Customer Support and User Feedback on MEXC

You will generally find that the MEXC has a fast and intuitive interface. The 24/7 live chat is quick for simple questions, but the customer support often turns slow and generic when you run into complicated account problems. We found that the biggest negative is the strict “risk control” system that can sometimes freeze accounts and hold up withdrawals for days or weeks.

User Experience & Interface

The user interface of MEXC is generally quite well-regarded, especially by experienced traders, because it is intuitive and fast. You will find that both the website and the mobile app are very organized, and it’s very easy to switch between spot trading, futures, and other services like the Earn program. Plus, the platform is really responsive, and the TradingView charting integration is exactly what most traders expect for their technical analysis part.

Well, we can say that new users might find the large amount of tokens and features a bit overwhelming at first, because there are so many options. So yes, the learning curve is a bit steep just because there is so much packed into the platform. But eventually, most users find it easy to use once they get familiar with the layout.

Customer Service

MEXC does offer 24/7 live chat support directly on the website and app, and they also use a ticket-based email system for more complicated issues. Look, for simple questions like “How do I deposit?” or “Where is my coin?”, the live chat is usually fast and efficient.

Well, when you run into more serious, complex account issues, like if your account gets frozen for a “risk control” review, which obviously happens sometimes, many users report that the support can become slow and generic. So, here, people have to wait a long time to get their accounts unlocked, and they often complain about getting canned, non-helpful responses that do not solve the problem right away. Also, you should know that while they offer multilingual support, the quality can sometimes vary a lot depending on the complexity of your issue.

Community Feedback

Well, community feedback on MEXC is really polarized, as mainly people either love it or they hate it, and you rarely see people in the middle. Now, traders who love it usually point to the huge selection of low-cap coins, no-KYC trading part, and the amazing 0% maker fees, saying they can make profits they cannot make anywhere else. Most of them totally agree that MEXC is best for “altcoin trading”.

But the negative feedback is almost always focused on two main things. The first one is that the regulatory warnings from major financial bodies make some users feel uneasy about the platform’s long-term safety. Second, the issue of accounts being frozen for an unexplained “risk analysis” part is a serious concern. You can generally read many online complaints about users having their withdrawals held up for days or weeks until they complete further verification.