Italy is preparing to overhaul how digital-asset companies operate within its borders, setting a firm deadline that will push crypto platforms to either adopt the European Union’s MiCA regime or shut down their services entirely.

The country’s securities regulator has now made clear that the transitional window that allowed firms to operate under lighter national rules is closing, meaning the industry is entering a supervised phase that mirrors wider EU policy.

Key Takeaways

Italy set a December 30 cutoff for crypto platforms under old registration rules.

Firms applying for MiCA licensing can keep operating until approval or June 2026.

Providers avoiding MiCA must shut down, inform users, and return funds.

Crypto providers in Italy have so far functioned through a domestic registration system under the Organismo Agenti e Mediatori. That arrangement will now end. Firms that want to stay in business must file for authorization as crypto asset service providers under MiCA or use the passporting mechanism to enter via a license obtained elsewhere in the European Union. Those who file before the deadline can continue servicing Italian clients, but only temporarily. Italy has allowed a maximum extension until June 30, 2026, while applications are reviewed, although approval or rejection automatically ends that grace period earlier.

Platforms Choosing Not to Comply Face a Mandatory Wind-Down

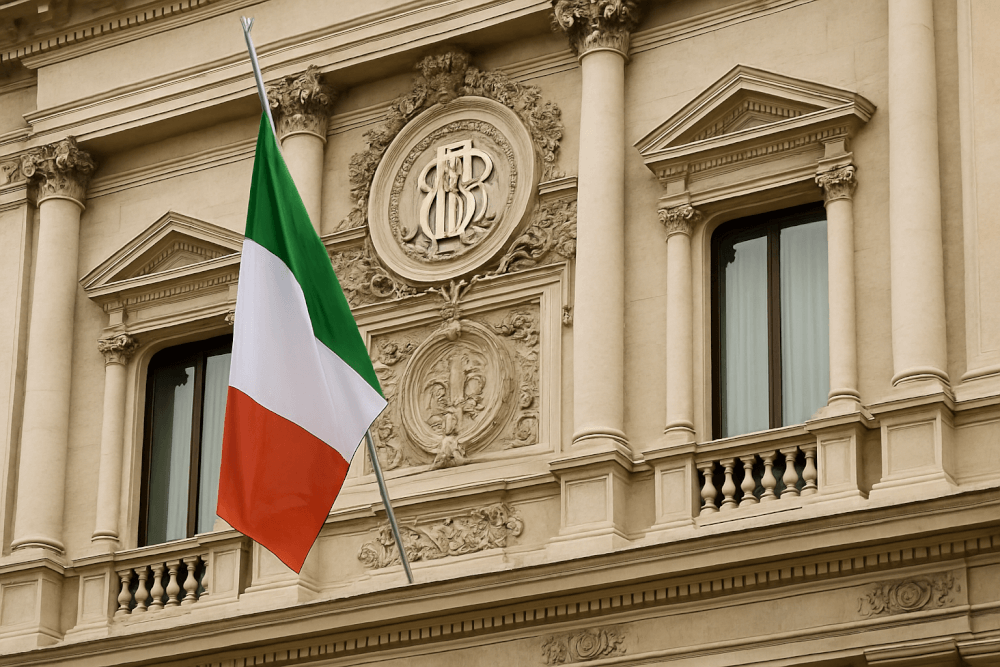

Companies that decide against seeking MiCA authorization are required to exit the market in an orderly way. The Italian regulator, CONSOB, instructed such operators to stop offering services by December 30, alert customers about their withdrawal, close accounts and return held funds and assets on request. Providers must also publicly disclose whether they plan to pursue authorization or step away, meaning users should be able to identify which platforms intend to remain in the market.

Alongside its directive to companies, CONSOB issued a separate warning for retail users. The regulator noted that some operators currently servicing Italian clients may not be authorized to continue doing so next year. Investors are advised to check whether their platform has communicated its plans. If that information is missing or unclear, CONSOB suggests users request clarification or withdraw their balances. The notice is one of the strongest investor-protection messages the regulator has issued since MiCA legislation began moving through Europe.

Italy Pushes Ahead as Europe Signals End of Transitional Periods

Italy’s stance aligns with commentary from the European Securities and Markets Authority, which recently reminded national regulators that transitional allowances under MiCA cannot be indefinite. ESMA urged member states to require wind-down plans from firms unable or unwilling to meet authorization standards. Italy appears to be among the first major jurisdictions to formalize those instructions, using the flexibility granted under MiCA to impose clear deadlines while embedding the legislation into national law.

The shift is expected to temporarily reduce the number of firms operating in Italy, particularly smaller platforms or those reluctant to comply with reporting requirements. However, regulators believe that the market will emerge with stronger consumer protections and clearer operational standards. For investors and companies alike, the transition marks the beginning of a regulated era — one that forces crypto businesses to prove they can meet the same expectations now applied across Europe.