Next crypto to explode is a major topic of discussion in the current market, after established tokens, including Bitcoin and Ethereum, saw a speedy recovery. Bitcoin has successfully sustained the $90,000 breakout, while Ethereum has surged nearly 20% from recent lows.

Macro conditions are favouring bullish sentiment in the market, with the chances of another rate cut at the upcoming Fed meeting having risen. However, crypto ETF products are experiencing high volatility with alternating inflows and outflows.

According to experts, figuring out which crypto could do well in the upcoming months will require more than hype and established names. The fresh crypto narrative is now shifting towards innovation, which could lead to delivering higher ROI.

Every bull cycle has seen some names outperforming the rest, but early indicators often appear months before, when they show momentum even in the weak market conditions. Bitcoin Hyper is showing strong momentum, having raised $29 million in its presale and emerging as a top candidate for the next crypto to explode.

Macro Conditions and Institutional Inflows Show Mixed Signals

Speculative assets showed weak momentum on Wednesday, pushing US five-year Treasury prices higher and lifting gold close to $4,260. Gold alone has climbed about 3% in the last two weeks. The US job market lost some steam in November, with private employers cutting 32,000 positions.

This slowdown has reignited the debate on interest rates. One side argues that the Federal Reserve needs to cut rates soon to prevent a deeper weakness in the labor market. The other side cautions that cutting too fast could worsen inflation, which is still far above the Fed’s 2% goal.

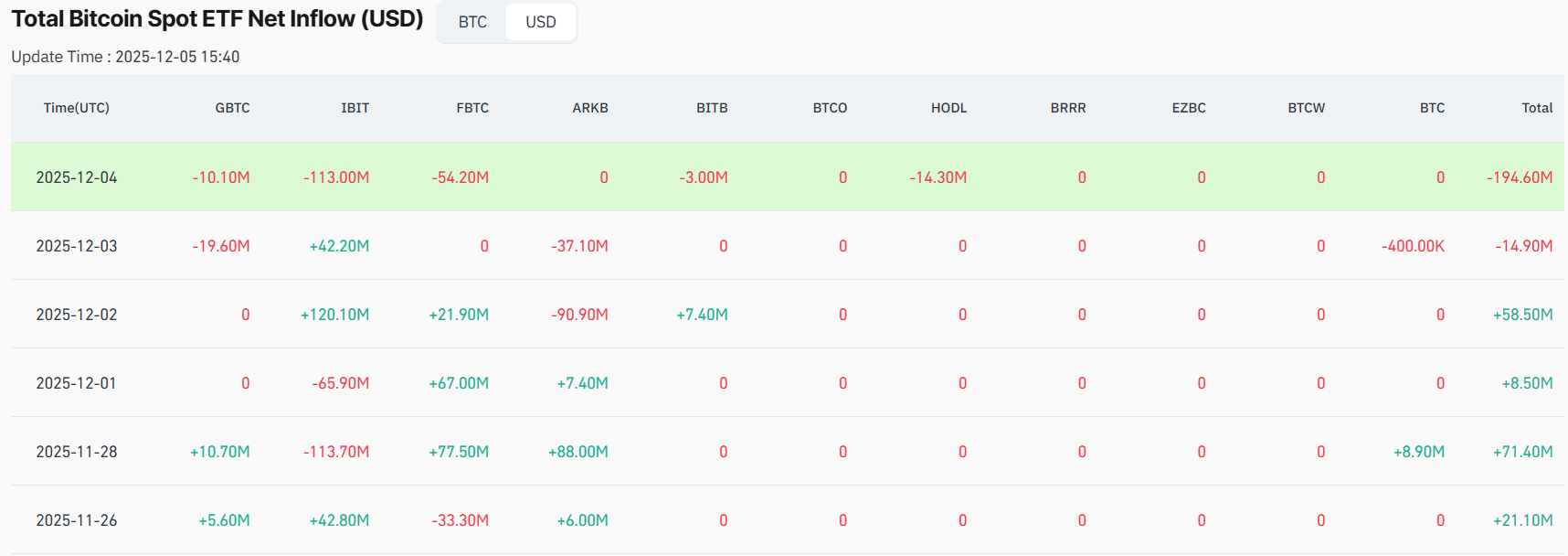

Source: Coinglass

In the crypto market, spot ETFs continued to shape institutional sentiment. Data from December 4 showed a sharp shift as Bitcoin spot ETFs recorded $194.64 million in net outflows, ending a period of steady inflows. Ethereum ETFs followed the same trend with $41.57 million leaving the market on Thursday.

Despite the negative flow for the two largest cryptos, some altcoins held up better. XRP recorded $12.84 million in inflows, while Solana recorded $4.59 million, indicating stronger investor confidence. Even so, broader market weakness and profit-booking have dragged ETF performance lower across the board.

Bitcoin Hyper Presale Surpasses $29 Million Milestone

Despite volatile and weak market conditions, the new utility infrastructure project Bitcoin Hyper (HYPER) has surpassed the $29 million mark in its ongoing presale.

The project is introducing a Bitcoin layer-2 blockchain built directly upon the Bitcoin network. The protocol improves the network’s speed and functionality. It is similar to how ERC-20 functions on Ethereum.

$HYPER is Unstoppable. ?⚡️

29M Raised! ?https://t.co/VNG0P4GuDo pic.twitter.com/51TU5mrGJK

— Bitcoin Hyper (@BTC_Hyper2) December 5, 2025

Bitcoin Hyper is powered by the advanced Solana Virtual Machine (SVM), leveraging Solana’s speed and programmability while benefiting from Bitcoin’s security and liquidity.

The aim is to turn Bitcoin’s $2 trillion dormant capital into active utility. With the help of canonical bridge and zk roll-ups, the platform lets users bridge Bitcoin into a high-speed layer-2 environment. This can then be used across meme-coin trading, NFTs, gaming, and dApps, all while anchoring security to Bitcoin.

$HYPER Presale: Less than 10 Hours For Next Price Increase

With record-breaking $29 million raised, Bitcoin Hyper has topped the list of the next crypto to explode. HYPER tokens are currently priced at $0.013375. However, the system’s dynamic structure raises prices at each new stage, and the next price increase is scheduled within 8 hours.

Investors seeking real utility and growth in the crypto market have an opportunity to explore Bitcoin Hyper at lower prices.

Currently, the project is offering presale investors a passive income opportunity with 40% per annum in staking rewards. Third-party auditors such as Coinsult and Spywolf have already conducted rigorous security checks, increasing transparency and investor confidence.