Key Notes

Coinbase sees December as the start of a crypto recovery.

The exchange highlighted that liquidity is improving as Fed cut odds reach 92%.

Bitcoin may be undervalued, according to analysts, following the November crash.

Leading crypto exchange Coinbase released a research report earlier today, noting that December opened with a major lift in global liquidity. The firm said that odds for a Federal Reserve rate cut rose to 92% by December 4, a development that could provide backing to a bounce in risk assets.

Its custom global M2 money supply index showed a clear recovery trend into late 2025, which is building on the expectation that a softer dollar environment would aid broader market momentum.

Coinbase previously talked about a likely positioning reset in October, with November being a weak month. However, the exchange maintains that a reversal is coming in December.

It’s beginning to look a lot like a recovery.

We think crypto could be poised for a December recovery as liquidity improves, Fed cut odds jump to 92% (as of Dec 4), and macro tailwinds build.

Here’s why:

• Liquidity is recovering

• The supposed “AI bubble” hasn’t burst… pic.twitter.com/CpbfijdKWQ— Coinbase Institutional ?️ (@CoinbaseInsto) December 5, 2025

Federal Reserve Policy and Bitcoin’s Undervaluation

Coinbase Institutional’s latest monthly outlook discussed the role of monetary policy as the Federal Reserve returned to the bond market. The final stretch of quantitative tightening may be near.

That shift often reduces liquidity pressure, which supports assets such as Bitcoin. The report stated that Bitcoin fell more than three standard deviations below its 90‑day trend in November, while US equities held much closer to their norm.

Long‑term holders also showed a rare period of coin distribution, and digital asset products traded below net asset value for the first time this year. These factors point to a recovery in December.

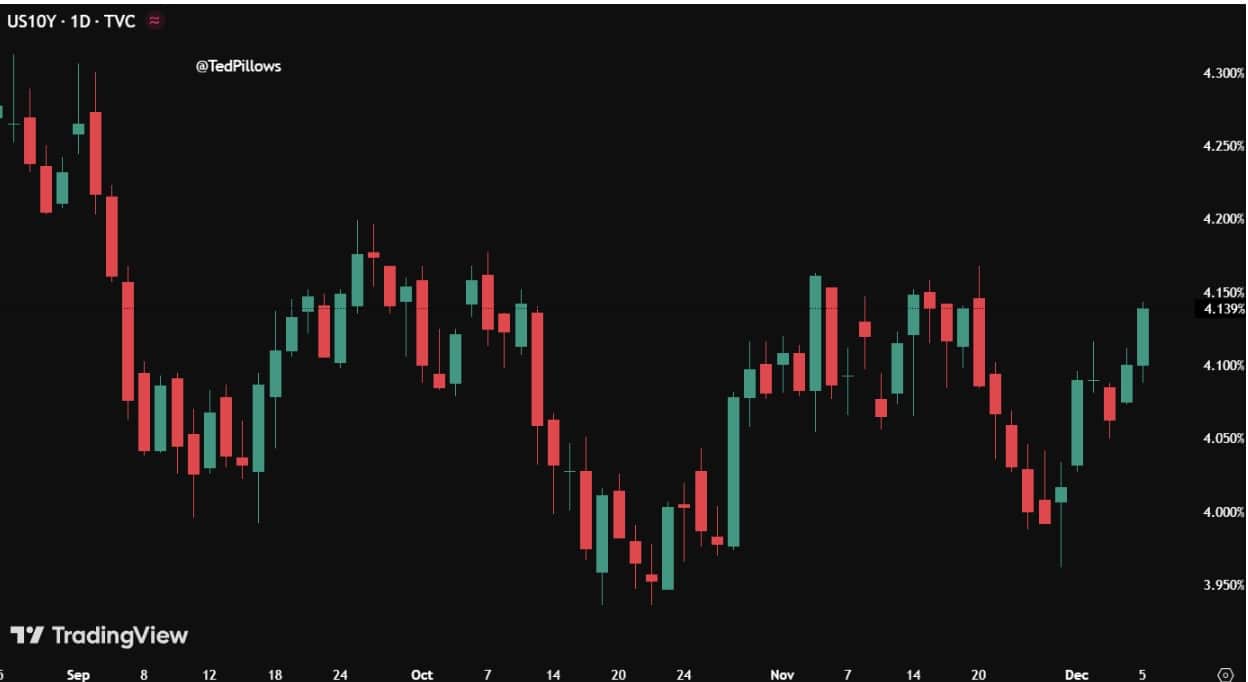

On the other hand, according to analyst Ted Pillows, the US 10-year bond yield is set for its biggest weekly gain since June 2025. “Despite Fed cutting rates, 10-year bond yield is above 4%,” he added, claiming that this is “not a good sign for risk-on assets.

Source: Ted Pillows

Shifts in Altcoin and Stablecoin Signals

Data shared by Altcoin Vector claims a divergence between stablecoin dominance and altcoin relative performance. Periods when USDT dominance peaked often came just before capital rotated back toward higher‑risk assets.

The divergence between Stablecoins dominance and Alts is a clean risk-on/risk-off signal:

?Risk-off: USDT dominance rises while alts fall, classic capital-preservation.

?Risk-on: alt dominance rises while USDT drops, liquidity shifts toward risk.Every time stablecoin… pic.twitter.com/UjmTs2qXjV

— Altcoin Vector (@altcoinvector) December 4, 2025

In recent weeks, stablecoin strength showed signs of fatigue while altcoins held firm, an early clue that participants may shift back into the market once Bitcoin stabilizes.

If that rotation continues, altcoins may follow a familiar pattern of fast acceleration as liquidity turns toward risk.