Strategy slows Bitcoin accumulation as liquidity concerns rise, while Mono Protocol gains momentum as a leading crypto presale for 2025.

A major shift is underway as Strategy’s aggressive Bitcoin accumulation model slows sharply. On-chain data shows a steep decline in monthly purchases throughout 2025, marking the company’s most conservative positioning in years.

As institutions reassess risk exposure, activity in the crypto presale market continues to intensify, with Mono Protocol emerging as one of the best crypto presale entries of the current cycle.

Strategy’s Bitcoin Accumulation Collapses

Strategy’s Bitcoin purchases have dropped dramatically, according to fresh analysis from CryptoQuant. Monthly buys fell from 134,000 BTC at their 2024 peak to 9,100 BTC in November 2025, with only 135 BTC purchased so far this month. Analysts note this is the clearest sign yet that the firm is preparing for a deeper contraction phase.

A 24-month trendline shows a steady decline in accumulation that now aligns with broader bearish market conditions. The report states plainly: “They’re bracing for the bear market.”

The shift occurs as Bitcoin faces its largest drawdown of 2025. Nearly every major technical and on-chain indicator now points toward a bearish phase, adding weight to Strategy’s sudden move toward treasury protection instead of expansion.

Strategy currently holds 650,000 BTC, valued near $61B, still up roughly 26% from its average entry at $74,436. But a prolonged downturn could erase that cushion, putting the company’s reserves under pressure.

Liquidity Becomes the Priority

The report highlights sweeping adjustments across Strategy’s treasury operations. The firm raised $1.44B through common equity issuance to build a dedicated U.S. dollar reserve. This reserve is designed to cover preferred stock dividends — approximately $700M annually — and service bond interest for up to two years.

Crucially, Strategy disclosed that it may sell Bitcoin or Bitcoin derivatives as part of ongoing risk-management decisions. This marks a significant departure from the company’s earlier doctrine of relentlessly converting balance-sheet capital into BTC.

Key changes include a dual-reserve model, separating short-term liquidity from long-term Bitcoin holdings. Declining accumulation, new flexibility to sell BTC, and a stronger USD buffer collectively show a strategic shift toward capital preservation.

Mono Protocol Stands Out as Infrastructure Demand Rises in Presale Crypto Markets

While large institutions like Strategy reduce risk exposure, interest in early-stage infrastructure continues to rise. Mono Protocol has emerged as one of the top crypto presale candidates for 2025 due to its focus on solving long-standing fragmentation across blockchain networks.

Mono Protocol enables unified balances across all chains, eliminating failed routes, bridging delays, or network switching. Its architecture introduces Liquidity Locks, MEV-resilient routing, universal gas abstraction, staking-secured governance, and execution bonds for instant settlement.

This utility-forward approach has pushed Mono Protocol to the center of discussions surrounding cryptocurrency presales 2025, where investors increasingly prioritize real infrastructure over speculative memecoin-driven models.

The project continues to attract users seeking structured, problem-solving presale cryptocurrency exposure as the sector trends toward practical utility rather than hype cycles.

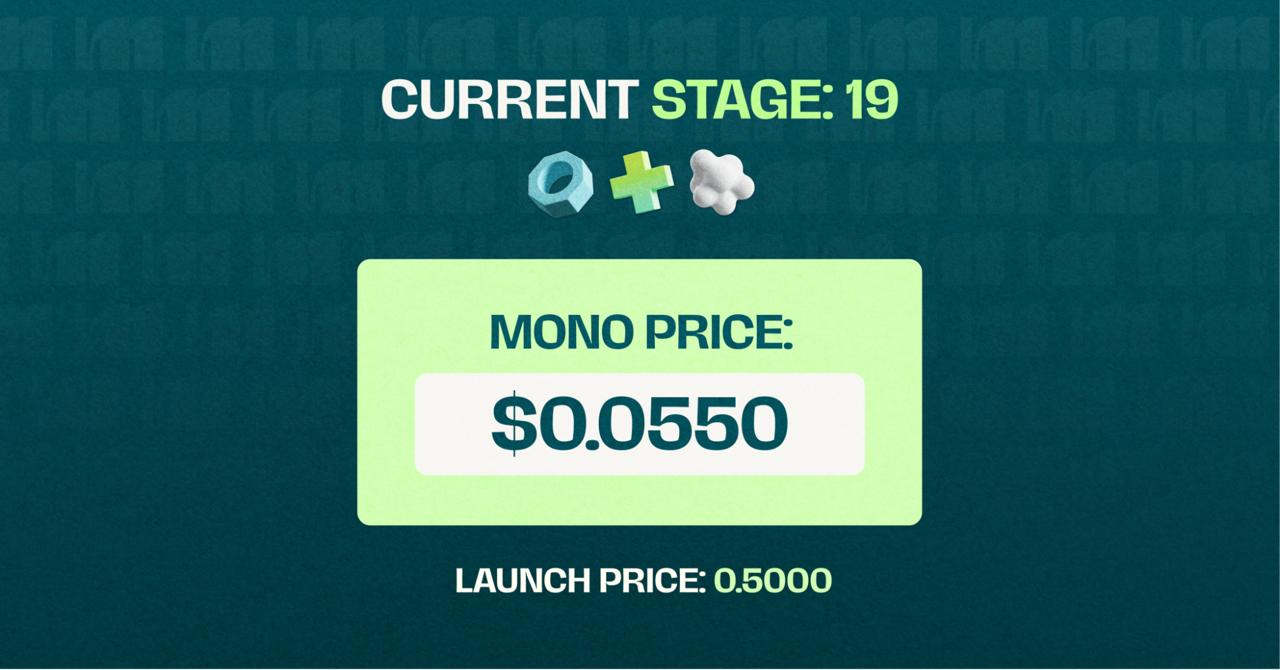

Mono Protocol is currently in Stage 19, priced at $0.0550, with $3.76M raised. The upcoming December 8 beta launch will demonstrate key features such as unified balances and universal gas execution. With an estimated 809% listing margin, the project remains one of the most closely watched opportunities in the best crypto presale discussions.

Conclusion

Strategy’s dramatic slowdown in Bitcoin accumulation reflects a clear pivot toward liquidity protection as bearish conditions deepen. The firm’s shift toward a dual-reserve model marks the most conservative posture it has taken in years.

Meanwhile, investors exploring early-stage opportunities continue looking toward Mono Protocol, where a strong utility foundation and steady presale progress have positioned it as one of the leading entries in crypto presales 2025. As macro conditions evolve, both institutional treasury strategies and infrastructure-driven presales are set to remain central narratives in the months ahead.