XRP is currently showing technical patterns that may indicate a buying opportunity, as a new TD Sequential signal coincides with strong ETF inflows and institutional interest around critical support levels.

Recent on-chain data and trading activity suggest that XRP’s market structure is at a key juncture. While some analysts see potential for a move toward mid-channel resistance, others caution that volatility and regulatory uncertainty may influence near-term price action.

TD Sequential Signals Appear Near Key Support

On the weekly XRP/USD chart, TD Sequential, a trend exhaustion and reversal indicator developed by Tom DeMark, has printed a “9” buy signal near $2.09. This setup follows a 9.5% pullback from $2.20 and indicates potential short-term trend exhaustion.

A weekly Coinbase chart shows a TD Sequential “9” buy signal at $2.09, indicating a potential XRP reversal near $2.10 amid $700M ETF inflows and mixed market pressures. Source: Ali Martinez via X

Ali Martinez, a cryptocurrency market analyst and charting specialist, noted via X.com that TD Sequential has been historically reliable for XRP in 2025, citing previous signals that preceded an 18% rebound in early December and a 24% decline following an August sell signal.

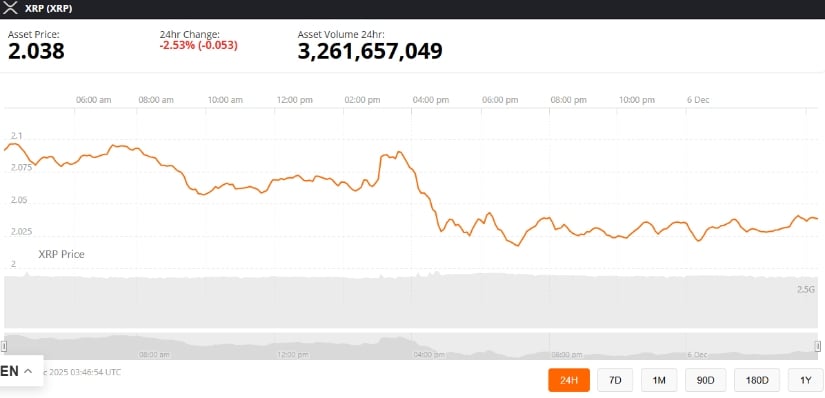

As of December 6, the XRP price today ranged between $2.05 and $2.15. Analysts emphasize that while the TD Sequential signal highlights a potential rebound zone, confirmation via price action and volume is necessary before concluding.

“TD Sequential signals provide structural clues, but they are not standalone predictors. Traders should consider support zones, volume, and broader market context,” said Martinez.

Institutional Demand and ETF Inflows

Institutional activity is increasingly shaping XRP’s short-term dynamics. WhaleInsider reported that XRP spot ETFs recorded $12.84 million in net inflows on December 5, extending a streak of 13 consecutive days of positive inflows. Total ETF assets under management now stand at approximately $881 million.

On December 5, 2025, XRP spot ETFs saw $12.84 million in inflows, bringing AUM to $881.25 million during a 13-day streak, highlighting rising institutional interest amid regulatory scrutiny. Source: Whale Insider via X

This inflow pace has outstripped early adoption trajectories seen in Bitcoin and Ethereum ETFs. Analysts from Coinomedia suggest that these inflows reinforce support around the $2.00 level, which may help maintain XRP’s consolidation within its current channel.

“ETF inflows are creating liquidity and helping defend key support zones, but broader adoption hinges on regulatory clarity,” said James Norton, a digital asset strategist at Valhil Capital.

Whale Accumulation Supports Key Price Zones

On-chain data from CryptoQuant show significant accumulation from large XRP holders, especially within the $1.80–$2.00 range. Highlights include:

160 million XRP accumulated in December 2024

590 million XRP added over seven days

Over $2.17 billion acquired between December 25 and 28

These clusters indicate institutional positioning rather than retail-driven speculation. Traders often view such accumulation as a stabilizing factor for short-term market movements.

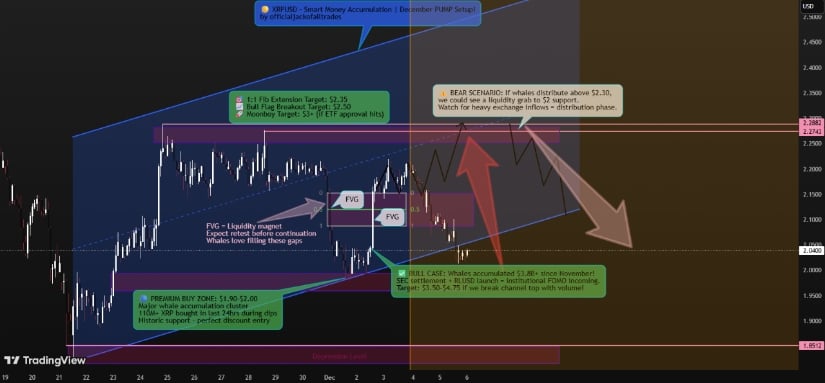

XRP consolidates near $1.90–$2.00, backed by whale accumulation, regulatory clarity, and RLUSD adoption, signaling a potential high-probability buy zone. Source: officialjackofalltra on TradingView

“Whale clusters typically defend support levels and can signal areas where price may stabilize before the next trend leg,” said Laura Chen, senior blockchain analyst at Santiment.

Outlook: Potential Mid-Channel Retest at $2.30–$2.40

Short-term, XRP is consolidating between $1.98 and $2.10. Analysts suggest that a decisive close above $2.10 on the hourly or four-hour chart may increase the probability of a test of $2.30–$2.40, the midpoint of the rising channel.

XRP $2.03 tests 38.2% retracement, bearish momentum persists, key support $1.64, trend reversal $2.05–$2.26. Source: GURULifeline on TradingView

Final Thoughts

XRP is positioned at a technically and fundamentally significant juncture. While the TD Sequential buy signal, ETF inflows, and whale accumulation suggest potential stabilization and upward movement, conditions are sensitive to regulatory, macroeconomic, and liquidity factors.

XRP was trading at around 2.038, down 2.53% in the last 24 hours at press time. Source: XRP price via Brave New Coin

A sustained hold above $2.00, coupled with confirmation above $2.10, would strengthen the case for testing $2.30–$2.40. Investors are advised to monitor market structure, whale activity, and institutional flows while acknowledging that cryptocurrency markets remain inherently volatile.