Dymension (DYM) is a brand new Layer 1 blockchain born on Cosmos with the aim of becoming one of the reference modular ecosystems for the development of decentralised applications.

The RollApps that will populate it in the future, not to be confused with rollups (Layer 2 scalability solutions), are both dapp and real blockchains. Their main peculiarity? They are incredibly simple to develop. In this article, you will discover what Dymension is and how it works.

What is Dymension (DYM), and how did it come about?

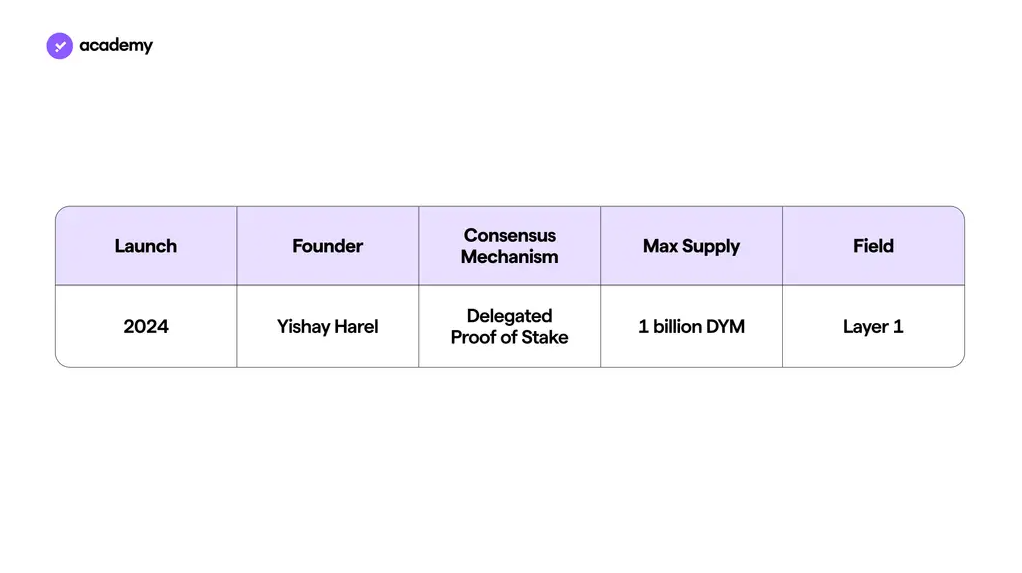

Dymension’s mainnet went public in February 2024, its launch coinciding with the airdrop of the DYM token. The project’s founder is Yishay Harel, who raised $6.7 million through a funding round in which two major Web3 funds participated: Big Brain Holdings and Stratos.

But what is Dymension (DYM) and how does it work in detail? To describe this network, it must first be specified that it operates in a modular ecosystem. Unlike monolithic ones, these types of virtual environments implement blockchains’ main functions on different levels. In other words, they are custom-built networks that can choose the components to meet their needs.

Some examples? They may decide to use the Ethereum Virtual Machine (EVM) as an execution layer or exploit the one Solana (SVM) developed. This also applies to the protocol for data availability; they can choose Celestia, Avail, or other solutions to achieve this.

To understand what Dymension (DYM) is and how it works, however, this is not enough. What does it allow you to do in practice? This blockchain operates on the settlement layer and allows anyone to easily launch their protocol. Dymension’s so-called RollApps are both decentralised applications and real blockchains, which are much easier to develop than traditional ones.

Suppose a group of developers wants to build their decentralised exchange or play-to-earn video game. In that case, they can focus exclusively on the front end without worrying about the underlying blockchain infrastructure, which is provided by this protocol. In other words, Dymension’s role is similar to that played by servers for traditional websites and applications.

How does Dymension work?

After having understood Dymension and how it works, let us analyse in more detail how this network fulfils three fundamental criteria of modern networks: security, interoperability, and sufficient liquidity.

Security: Dymension is a Layer 1 made secure by a Delegated Proof-of-Stake (DPoS) consensus mechanism. This means that DYM holders can staking their tokens by delegating transaction verification to validators and contributing to the security of the network. In this way, they secure the underlying infrastructure and build all RollApps on top of it.

Interoperability: Another key feature of this network is interoperability. All RollApps can easily interact with each other thanks to Inter-Blockchain Communication (IBC), the standard for Cosmos ecosystem bridges. Every blockchain built on Cosmos natively includes the IBC. Although they are all independent chains with different consensus mechanisms or assets, thanks to this standard, they can exchange information assets or interact.

Sufficient liquidity: finally, Dymension had to find a solution to the liquidity problem. For this reason, the team developed a decentralised exchange with an in-house automated market maker (DEX with AMM), designed to expose RollApps to efficient asset routing and, most importantly, to ensure that sufficient liquidity was available for the entire ecosystem.

So, what is Dymension in a nutshell? It is a Web3 server that allows developers to create applications easily. Moreover, thanks to its focus on security, interoperability, and liquidity, it enables users to interact with its RollApps simply, conveniently, and securely.

DYM, the beating heart of the ecosystem

As already mentioned in the section on what Dymension (DYM) is, this network uses a Delegated Proof-of-Stake consensus mechanism. This is why its native DYM token is crucial for the security of the entire ecosystem but also for the functioning of the RollApps built on it. Since it is needed to pay gas fees and thus process transactions.

Moreover, a few weeks before the launch, the development team announced that all tokens of decentralised applications that will be launched on Dymension can only be ‘paired’ with DYM, which is why it will be indispensable to purchase it to be able to use them. Dymension also exploits its token for governance purposes. It is, therefore, also necessary to own DYM to participate in voting on the future of the entire ecosystem.

The algorithmic output of DYM

The maximum availability (max supply) of Dymension is set at one billion units, which will be issued progressively over the next few years. This process, to which the team has attached the adjective ‘dynamic’, will be gradual as well as proportional to the number of tokens staked on the blockchain, as follows:

8% – circulating supply at launch (February 2024);

10% – maximum annual issuable availability;

1% – minimum annual issuable availability;

67% – target circulating availability locked in staking;

These parameters will be achieved by adjusting the issuance rate according to the ratio of staked tokens to those actually circulating. This mechanism is called Algorithmic Issuance and will be adjusted by the following:

If the percentage of DYMs blocked in staking is below 67%, the issuance rate will increase incrementally until it reaches 10% per year or until the target for blocked tokens is reached;

If the percentage of DYM in staking is equal to the target, the emissions remain unchanged;

If the percentage of DYMs in staking is greater than 67%, the issuance rate decreases to 1% per year or until the target for blocked tokens is reached;

Balance between supply and demand

Dymension aims at achieving a sustainable balance between supply and demand. From the perspective of the first variable in this equation, namely demand, DYM tokenomics is driven by three mechanisms:

Burn or destruction of tokens: A portion of DYMs is systematically burned (or destroyed) through the token exchange (swap) or transfer between Dymensione and RollApps. For example, if this type of commission is 0.1%, a user who withdraws USDC 1,000 from a RollApp will have to pay a commission of USDC 1. This amount is then converted to DYM using Dymension’s built-in AMM and burned.

Transaction fees: the fees required to process transactions are distributed between the DYM validators and the users who have delegated tokens to them for staking. Dymension charges an additional exchange fee on all decentralised applications in the ecosystem. This fee follows the same path as the bridge validation fees: it is converted to DYM and burnt.

RollApp Bonds: RollApp bonds reduce the circulating supply of DYM, increasing the security and stability of the network. The sequencers of the RollApps are obliged to staking DYM (or the RollApp/DYM LP token) as a guarantee for proposing network status updates.

Is the future modular?

Finally, answering the question of what is Dymension also means knowing how DYM was launched. The native token of this protocol was distributed to those holding a certain amount of staked Celestia (TIA), Ethereum (ETH), Cosmos (ATOM) or Solana (SOL) and also to NFT holders belonging to specific collections.

After Celestia and Cosmos, which share the ecosystem and bridging system, Dymension is one of the first projects designed to expand the universe of modular networks. These seek to go beyond the traditional blockchain concept introduced a few years ago by Ethereum and carried on by other monolithic networks. Many other protocols will likely emerge in the future that will expand this cosmos, either RollApps built precisely on Dymension or other Settlement Layers or projects that aim to improve other technological components, e.g., the Execution Layer.Why is it beneficial to anticipate this scenario? Because should the future repeat itself, owning and staking DYM could be one of the requirements for receiving the token airdrop of protocols aiming to expand the modular blockchain ecosystem.