The Telcoin price prediction topic has gained a lot of attention lately, especially among beginners who want to understand where this project might be heading. Telcoin aims to make mobile money transfers fast, cheap, and accessible for anyone with a phone. Because of this simple mission, many new users are curious about the token and its long-term potential. This article will guide you through everything you need to know.

Right now, TEL trades around $0.0065. Earlier this month, on November 5, it dropped to its monthly low near $0.0025. Just two weeks later, on November 17, it reached a monthly high of $0.0068. These strong moves show a mix of renewed interest and typical crypto volatility. For beginners, this can feel confusing, so this guide will break things down step by step.

In the next sections, you will learn what Telcoin is, how it works, why it was created, and what drives its price. You will also see detailed TEL price predictions for the coming years, including long-term predictions up to 2050. We will also cover expert opinions, a technical chart review, and the most important features of the project.

The goal is simple: help you understand TEL in a clear and human way, without jargon, and give you the information you need to form your own view about its future.

| Current TEL Price | TEL Price Prediction 2025 | TEL Price Prediction 2030 |

| $0.0065 | $0.025 | $0.5 |

Telcoin (TEL) Overview

Telcoin is a blockchain project that aims to reshape the way people move money around the world. It focuses on mobile users and tries to make financial services simple, fast, and affordable. Instead of acting like a traditional bank or building a new financial network from scratch, Telcoin connects directly with telecom operators and mobile money platforms. This approach gives the project access to billions of users who already rely on their phones for essential daily transactions. Because of this, Telcoin positions itself as a bridge between global telecom infrastructure and modern blockchain technology.

TEL is an ERC-20 token built by Telcoin Pte. Ltd., a company based in Singapore and registered as a GSMA Associate Member. This status allows Telcoin to work closely with mobile network operators and follow strict security and compliance standards. The project was built to target the huge remittance market, which handles between 700 and 800 billion dollars each year. Many people who send money across borders face high fees, slow transfers, or limited banking access. Telcoin tries to solve these issues by using decentralized finance tools and leveraging mobile connectivity.

The project was founded in 2017 by Paul Neuner and Claude Eguienta. Neuner has over 20 years of experience in the telecom industry. He founded Mobius Wireless Solutions, which developed global fraud detection systems for mobile operators. His deep knowledge of mobile security and revenue protection strongly shaped Telcoin’s strategy and technology choices. He also helped build Ernst & Young’s internet application development department and later co-founded Sedona, a company focused on securing mobile financial services. Telcoin’s background shows a strong mix of telecom, cybersecurity, and fintech expertise. Over time, the company raised 35 million dollars in funding, including a significant 25-million-dollar round in October 2025.

Telcoin’s mission centers on improving access to financial services for people who struggle with traditional banking. The project wants to reduce the cost of sending money, give users more control, and remove unnecessary intermediaries. Its long-term goal is to bring decentralized finance to mobile users across Africa, Asia, Latin America, and other emerging markets. The team describes its vision not as replacing banks, but as upgrading the technology behind money, payments, and financial systems through secure, regulated solutions.

TEL Price Statistics

| Current Price | $0.0065 |

| Market Cap | $589,082,660 |

| Volume (24h) | $7,988,149 |

| Market Rank | #93 |

| Circulating Supply | 95,077,236,366 TEL |

| Total Supply | 100,000,000,000 TEL |

| 1 Month High / Low | $0.0068 / $0.0025 |

| All-Time High | $0.06448 May 11, 2021 |

TEL Price Chart

CoinGecko, November 18, 2025

Telcoin (TEL) Price History Highlights

2017 – ICO Launch and First Market Appearance

Telcoin entered the crypto market at the end of 2017 through its Initial Coin Offering. The ICO ran from December 2017 to February 11, 2018, and marked the first major milestone for the project. The initial recorded price was $0.00563, and Telcoin created a total supply of 100 billion tokens, with 25% allocated to ICO investors. The fundraising goal ranged between $10 million and $25 million. This period set the foundation for the project’s long-term vision of integrating telecom infrastructure with blockchain technology.

2018 – A Harsh Collapse

The first full year of trading was extremely difficult. TEL opened 2018 at $0.00468 but collapsed to $0.00042, a dramatic drop of -91%. It reached a high of $0.01178, but the general market crash that followed the ICO boom pulled almost every altcoin down. Telcoin was no exception. Trading activity also weakened, with an average daily volume of around 711,580 tokens. The year reflected the painful shift from hype to reality across the industry.

2019 – Continued Decline

In 2019, Telcoin extended its downward trend. It opened the year at $0.00042 and closed at $0.00035, showing a further decline of -16.39%. The price remained low, with a modest high of $0.00136 and a low of $0.00022. Investor interest stayed limited, and the average daily volume fell to just 193,167 tokens. These quiet years tested the project’s resilience and long-term commitment.

2020 – The Market Bottom

The price dropped even further in 2020. TEL slipped from $0.00035 to $0.00018, marking a -49.72% decline. In March, the token hit its all-time bottom of $0.0000789, reflecting extreme uncertainty across global markets. Although the yearly high touched $0.00055, overall trading remained weak. For many holders, this was the lowest point in the history of the project.

2021 – Explosive Bull Run

2021 changed everything for Telcoin. The token surged from $0.00018 to $0.01179, delivering an astonishing +6,600% yearly increase. A key moment came on April 10, when the price hit $0.05987, followed by a record all-time high of $0.06448 on May 11. This rally was driven by new product launches like TELxchange and the Send Money Smarter network, as well as a strong bull market for altcoins and rising interest in DeFi. Daily trading volume jumped above 23 million tokens, proving that Telcoin had captured renewed attention.

2022 – Heavy Crash and Bear Market

The momentum from 2021 faded sharply in 2022. TEL opened at $0.01179 and dropped to $0.00190, a major -83.89% collapse. The price hit a high of only $0.01217 and a low of $0.00117. The broader crypto market suffered several disasters, including the collapse of Terra/Luna, aggressive rate hikes from the Federal Reserve, and the bankruptcy of FTX. These events pushed investors away from risk assets, especially smaller altcoins. Average volume fell to 3.4 million tokens daily.

2023 – Slow Bleed

The decline continued in 2023, although at a slower pace. TEL opened at $0.0019 and ended the year at $0.00129, a drop of -31.96%. The price peaked at $0.0031 and fell as low as $0.00079, revisiting deep lows from previous years. Despite this, the project stayed operational, and the community remained active. Volume averaged just under one million tokens per day.

2024 – Strong Recovery

Market conditions improved in 2024. Telcoin climbed from $0.00129 to $0.00499, an impressive +285% recovery. It reached a yearly high of $0.00847 in March, showing that investors were returning. Trading volume increased to 1.8 million tokens daily, signaling renewed engagement with the project after a long bear market.

2025 (Year to Date – November 18)

Telcoin entered 2025 at $0.00499 and has risen to around $0.00642, delivering a +28.82% gain so far. The yearly high reached $0.01280, close to 2024 peak levels. Over the last week the price increased by more than 100%, and trading volume reached over 4.2 million tokens per day. In November, TEL moved between $0.006 and $0.007, forming a stable short-term range.

Telcoin Price Prediction: 2025, 2026, 2030-2050

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $0.005 | $0.052 | $0.025 | +285% |

| 2026 | $0.007 | $0.089 | $0.05 | +670% |

| 2030 | $0.031 | $1.09 | $0.5 | +7,600% |

| 2040 | $2 | $18.7 | $10 | +153,500% |

| 2050 | $3.3 | $50.4 | $25 | +384,500% |

Telcoin Price Prediction 2025

DigitalCoinPrice estimates that in 2025 Telcoin may climb to $0.0141 (+120%), while its minimum could fall to $0.00578 (-10%).

PricePrediction analysts expect TEL to trade between $0.0050 (-20%) at its lowest and $0.0055 (-15%) at its highest.

Telegaon presents far more bullish numbers, projecting a minimum of $0.016 (+150%) and a maximum of $0.052 (+700%) by the end of 2025.

Telcoin Price Prediction 2026

DigitalCoinPrice forecasts show a potential high of $0.0166 (+160%) in 2026, while the lowest expected price is $0.0138 (+115%).

PricePrediction predicts moderate growth, placing TEL at a minimum of $0.0072 (+10%) and a maximum of $0.0087 (+35%).

Telegaon again provides the highest numbers, suggesting the 2026 low at $0.053 (+730%) and the top around $0.089 (+1,300%).

Telcoin Price Prediction 2030

According to DigitalCoinPrice, TEL may reach a maximum of $0.0353 (+450%) in 2030, while the minimum sits around $0.0305 (+370%).

PricePrediction expects a 2030 high of $0.0355 (+450%) and a low near $0.0305 (+370%).

Telegaon is extremely bullish on long-term growth, projecting $0.78 (+12,000%) at the lowest and $1.09 (+16,900%) at the highest point in 2030.

Telcoin Price Prediction 2040

PricePrediction sees Telcoin reaching much higher levels in 2040, with a minimum of $2.19 (+34,000%) and a maximum of $2.54 (+39,500%).

Telegaon expects even stronger long-term gains, putting the 2040 low at $14.51 (+226,700%) and the high at $18.74 (+292,000%).

Telcoin Price Prediction 2050

PricePrediction analysts forecast a 2050 minimum of $3.29 (+51,000%) and a maximum of $3.80 (+59,000%).

Telegaon, known for ultra-bullish long-range estimates, expects the 2050 low near $41.23 (+644,000%) and a peak around $50.42 (+787,500%).

Telcoin (TEL) Price Prediction: What Do Experts Say?

Telcoin attracted strong market attention in November 2025 after receiving historic regulatory approval in the United States. The token climbed more than 100% in mid-November, which pushed analysts to re-evaluate its short-term outlook. Many experts now see cautious optimism, driven mainly by this regulatory breakthrough rather than pure market speculation.

The approval granted by Nebraska regulators on November 12 became the key catalyst behind the latest bullish sentiment. Telcoin secured permission to operate the first regulated Digital Asset Depository Institution in the U.S., placing the project between traditional banking and decentralized finance. This step increases confidence in Telcoin’s long-term utility, especially in the global remittance sector worth around $700 billion each year. It also allows the launch of eUSD, a bank-pegged stablecoin designed to support faster and cheaper international payments.

Analysts at AInvest pointed to $0.0067 as an important technical level during November. They described it as a psychological barrier that repeatedly rejected upward moves. The regulatory approval helped TEL jump from $0.0028 to $0.0067 in only a few weeks. Still, the price struggled to hold above that range, showing that resistance remains strong even with positive news.

Technical research presents a mixed picture. Changelly’s market outlook suggests Telcoin may trade between $0.00679 and $0.00756 during November 2025, with an average near $0.00718. This scenario offers moderate upside potential but acknowledges high volatility, which became a defining feature of TEL’s recent market activity.

TEL USDT Price Technical Analysis

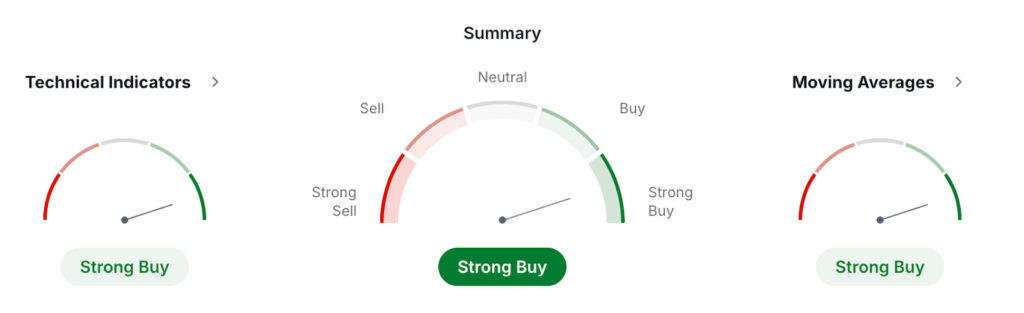

Telcoin’s monthly technical outlook shows strong bullish momentum based on fresh data from Investing.com. The overall rating for the monthly timeframe stands at Strong Buy, supported by both technical indicators and moving averages. This suggests that the broader trend remains positive, even if short-term volatility continues to influence daily movements.

Investing, November 18, 2025

Technical indicators lean heavily toward buying pressure. Out of the full set, six signals point to a Buy, three remain neutral, and only two show Sell conditions. The RSI sits at 56.96, which places TEL in a healthy zone that still allows room for further growth. The Stochastic value at 21.44 shows a brief oversold condition, but the StochRSI at 67.64 confirms upward momentum. MACD flashes a clear Buy, indicating growing bullish energy. Indicators like ADX at 21.64 support a strengthening trend, while the Rate of Change reading at 240.22 highlights the strong performance seen throughout November. Neutral readings from CCI and Williams %R reflect a balanced market rather than an overheated one.

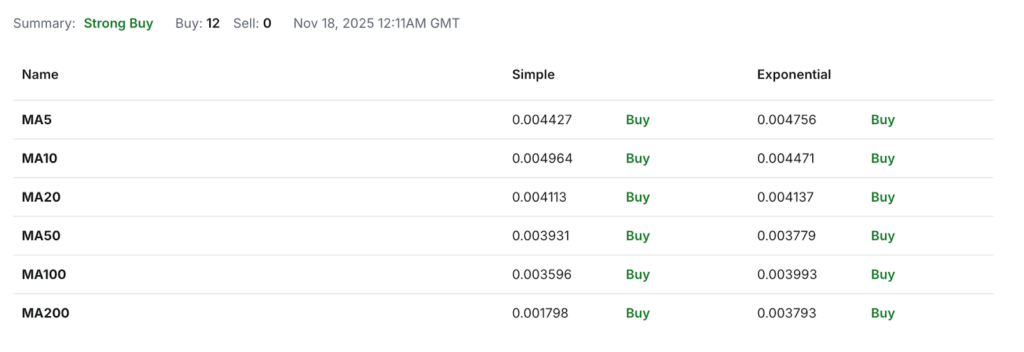

Moving averages show an even stronger picture. All 12 tracked averages—both simple and exponential—signal Buy, with zero sell readings. Short-term averages such as MA5 and MA10 trade above recent price ranges, confirming the continuation of the upward move. Long-term averages, including MA100 and MA200, also point higher. This alignment indicates that Telcoin remains in a clear long-term uptrend on the monthly chart, which is often more reliable than shorter timeframes.

Pivot point data offers insight into potential reversal and breakout zones. The classic pivot sits at $0.003804, with resistance levels building at $0.004537, $0.005784, and $0.006517. These zones mark areas where Telcoin could face temporary pauses before continuing its trend. Support levels around $0.002557 and $0.001824 provide a cushion for downside movement, though current momentum keeps the price well above them.

Overall, the monthly technical structure suggests sustained bullish strength. While traders should remain aware of volatility, the long-term indicators reflect a market leaning strongly in favor of higher TEL prices.

What Does the TEL Price Depend On?

The price of Telcoin depends on several key factors that shape demand, utility, and overall market confidence. Because the project sits at the intersection of telecom infrastructure and decentralized finance, its value reacts to both crypto-specific forces and external economic conditions. Understanding these elements helps new investors see why Telcoin sometimes moves quickly and why its long-term potential remains tied to real adoption rather than speculation alone.

Telcoin’s regulatory progress has become one of the biggest drivers of price action. The approval to operate as a regulated digital asset bank in the United States dramatically increased investor confidence. Any new licenses, banking partnerships, or government-level integrations can strengthen this trend. On the other hand, delays, investigations, or unclear regulatory updates could weaken momentum around the token.

Adoption within the telecom and remittance sectors also impacts the price. Telcoin grows when more mobile operators integrate with its platform or when remittance corridors expand. Because the project aims to enter the $700-billion remittance market, every new corridor or telecom partnership serves as proof of real-world utility. Higher usage of the Send Money Smarter (SMS) Network or TELx products often correlates with stronger market sentiment.

Market conditions within the broader crypto world play a major role as well. In bullish environments, investors seek high-potential altcoins, which increases demand for tokens like TEL. In bearish seasons, low-cap assets usually suffer stronger corrections, as seen in 2018, 2022, and early 2023. Liquidity, Bitcoin trends, and exchange listings all influence Telcoin’s ability to maintain upward movements.

Some additional factors include:

Trading volume across centralized and decentralized platforms;

User growth within the Telcoin app;

Stablecoin activity, especially demand for the eUSD digital dollar;

Updates to Telcoin’s DeFi tools and ecosystem launches.

Investor psychology also shapes price behavior. Positive news often sparks rapid momentum, while long consolidation periods can slow enthusiasm. Since Telcoin operates in a highly competitive industry, its ability to keep expanding real utility will remain the most crucial factor for long-term growth.

Telcoin Features

Telcoin offers a wide set of technical features designed to support fast, secure, and affordable financial services. The project combines blockchain efficiency with telecom-grade infrastructure, creating a hybrid system that works well for both decentralized finance and mobile remittances. Its architecture, security model, and multi-network deployment make the ecosystem flexible and scalable for real-world use.

At its core, Telcoin functions as an ERC-20 token built on the Ethereum blockchain. Over time, the project expanded to multiple networks, including Polygon and Base, to reduce fees and improve transaction speeds. The Telcoin Network itself is EVM-compatible, meaning developers can deploy Ethereum-based smart contracts without modification. It relies on a Proof-of-Stake consensus model with GSMA-certified mobile network operators serving as validators, ensuring security standards aligned with telecom regulations.

The project uses a three-layer design to organize its ecosystem. The Telcoin Network acts as the execution layer, TELx provides decentralized exchange functionality, and the Telcoin Application Network supports mobile-based financial services. This layered structure helps separate technical tasks and improves overall performance.

Security is a major focus for Telcoin. The platform uses multi-signature protection, where three keys exist—one for the user, one for Telcoin, and one for the operator. Any transaction requires at least two keys, creating a strong protective layer. The system also supports assisted self-custody, allowing users to maintain full asset ownership while benefiting from additional security. Fast transactions are another key feature. SwiftTX enables rapid processing through decentralized masternodes, offering near-instant settlement compared with traditional banking systems.

Verification and compliance tools strengthen the network further. Telcoin integrates AI-based identity checks through Jumio, allowing users to verify accounts using government-issued identification. The project also supports bridging between Ethereum and Polygon through an official Polygon bridge, helping users move assets efficiently. A Proof-of-Concept model ensures that transactions meet real-world conditions before validation, while API access allows mobile money platforms and telecom operators to integrate Telcoin services directly.

TEL Price Prediction: Questions And Answers

Is Telcoin a Good Investment?

Telcoin can be a good investment for users who believe in mobile-based financial services and long-term adoption of decentralized tools. The project focuses on real utility rather than speculation, which strengthens its long-term outlook. However, TEL remains a volatile altcoin, so beginners should only invest money they can afford to lose.

What Are the Risks of Investing in Telcoin?

The main risks include high volatility, competition within the remittance market, and uncertainty about long-term adoption. Regulatory changes can also affect Telcoin’s operations, especially since it now functions as a regulated digital asset institution. Like most low-cap tokens, sharp price swings may occur during both bullish and bearish phases.

What Is Telcoin All Time High?

Telcoin reached its all-time high of $0.06448 on May 11, 2021. This peak happened during a strong bull market in the altcoin sector, supported by new Telcoin product launches and rising interest in decentralized finance. Since then, the price has seen major corrections but continues to show periodic recovery phases.

How High Could Telcoin Go?

Future highs will depend on user adoption, regulatory progress, and overall crypto market cycles. Expert forecasts show wide ranges. Conservative models place future highs below $0.10, while long-term bullish forecasts—from sources like Telegaon—suggest that Telcoin could reach multi-dollar levels by 2040 or 2050. These estimates remain speculative.

Will Telcoin Recover?

Many analysts believe Telcoin has the potential to recover as long as the project keeps expanding mobile remittance services and building a regulated financial infrastructure. The strong rally in 2024–2025 shows growing interest after several bearish years. Still, recovery depends on market conditions and continued user adoption.

What Price Can Telcoin Reach?

Short-term projections suggest that Telcoin may range between $0.006 and $0.01, depending on market momentum. Mid-term forecasts for 2025–2026 show possible movement toward $0.01–$0.05. Long-term predictions vary widely, with some expert models projecting values above $1 by 2030 and even higher by 2040.

Will Telcoin Reach $1?

Reaching $1 is unlikely in the short term but possible over the long term if Telcoin secures major remittance corridors and expands its regulated financial services. Some long-range forecasts, especially from very bullish sources, see Telcoin crossing the $1 mark between 2030 and 2040. This scenario requires strong real-world adoption.

Can Telcoin Reach $10?

A $10 price target is extremely ambitious and considered highly speculative. Only the most bullish models project values near this range, and such predictions assume massive global adoption of Telcoin’s products. While not impossible, reaching $10 would require Telcoin to become a major player in global payments.

What Is Telcoin Prediction 2025?

Predictions for 2025 vary by source. Estimates range from conservative highs around $0.0055 to more optimistic predictions above $0.014. Ultra-bullish models suggest values above $0.05. The final outcome will depend on regulatory progress, user growth, and overall market conditions.

What Will Telcoin Crypto Be Worth in 2026?

Price forecasts for 2026 show potential highs between $0.009 and $0.016. Bullish long-term models place possible peaks above $0.08.

Does Telcoin Have a Future?

Many analysts believe Telcoin has a future because it targets a real problem: expensive and slow international money transfers. Its telecom-focused model, recent regulatory approval, and growing ecosystem add credibility. However, long-term success depends on continued adoption, strong partnerships, and stable market conditions.

What Factors Influence Telcoin’s Price?

Several factors shape Telcoin’s price movement.

Regulatory announcements and licenses;

Adoption by telecom operators and remittance users;

Overall crypto market sentiment;

Trading volume and liquidity;

Updates to Telcoin’s products, including eUSD and TELx.

Positive developments in these areas can boost demand, while setbacks may slow growth.

What Is Going On With Telcoin?

Telcoin recently gained major attention after securing approval to operate the first regulated digital asset bank in the United States. This milestone sparked a strong price rally and increased trading volume. The project is also expanding its DeFi tools, strengthening the Telcoin app, and improving its remittance infrastructure.

Where to Buy Telcoin?

You can buy Telcoin on several exchanges that list the TEL token. TEL is available on decentralized exchanges across the Ethereum and Polygon networks. One of the easiest options for beginners is StealthEX, a non-custodial platform that allows quick swaps without creating an account.

StealthEX is here to help you buy TEL crypto if you’re looking for a way to invest in this cryptocurrency. You can buy Telcoin privately and without the need to sign up for the service. StealthEX crypto collection has more than 2,000 coins and you can do wallet-to-wallet transfers instantly and problem-free.