Pi Network risks falling below $0.2200 as its decline continues below the 50-day EMA.

A surge in centralized exchanges' reserves amid increasing mainnet migration signals rising supply pressure.

The technical outlook for Pi Network remains bearish, targeting $0.1919.

Pi Network (PI) has been in a steady decline below the 50-day Exponential Moving Average (EMA), trading near $0.2200 at press time on Monday. The mobile mining cryptocurrency risks further losses as supply reserves on Centralized Exchanges (CEXs) surge amid a sharp increase in mainnet token migration. The technical outlook for the PI token highlights that the path of least resistance is to the downside.

Supply pressure on the rise

A steady rise in PI token deposits on exchanges indicates increased selling pressure. PiScan data shows that over the last 24 hours, CEXs' wallets recorded an inflow of 177,867 PI tokens, bringing the total balance to 437.88 million tokens.

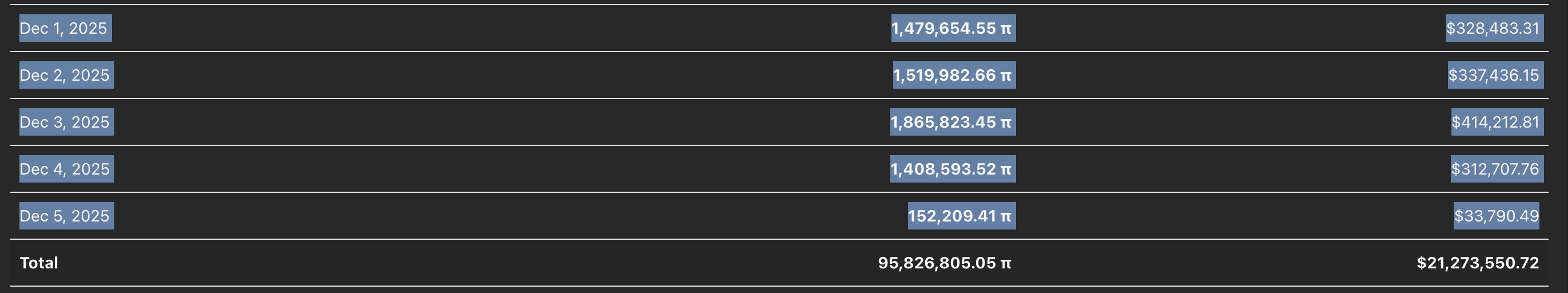

One of the key factors fueling the deposits is the token migration from Pi Network’s testnet to mainnet, as 17.5 million users complete Know Your Customer (KYC) verification. Furthermore, reports from Pi Network suggest that integrating AI into the KYC process has reduced the waiting period by 50%. According to PiScan, over 6.42 million PI tokens have been transferred to the mainnet so far in December.

If the network fails to drive demand for its token through real-world use cases, a decline in investor confidence could further fuel the current selling pressure.

Technical outlook: Looking at $0.1919

Pi Network holds broadly steady at press time on Monday, after a near 2% drop on Sunday. The path of least resistance for PI token targets $0.1919, marked by the October 11 low. If the token slips below this level, it could extend losses toward the record low of $0.1533 seen on October 10.

The technical indicators on the daily chart point to an increase in overhead pressure. The Relative Strength Index (RSI) at 43 is below the halfway line and slopes downward, suggesting bearish potential.

Meanwhile, the Moving Average Convergence Divergence (MACD) maintains a sell signal as the MACD and signal descend below the zero line.

To reinstate an uptrend, the PI token should exceed the 50-day EMA at $0.2394.