Bitcoin price prediction is showing bullish momentum, regaining $91,000 after tumbling to $87,000 on Sunday. The market is eagerly waiting for the Fed’s interest-rate decision coming this week.

BTC is trading up 2% over the past 24 hours, as the market expects another rate cut at this meeting. The FedWatch tool is already showing an 87.2% probability of a 25 BPS interest rate cut at the December 10 meeting.

Source: Fedwatchtool

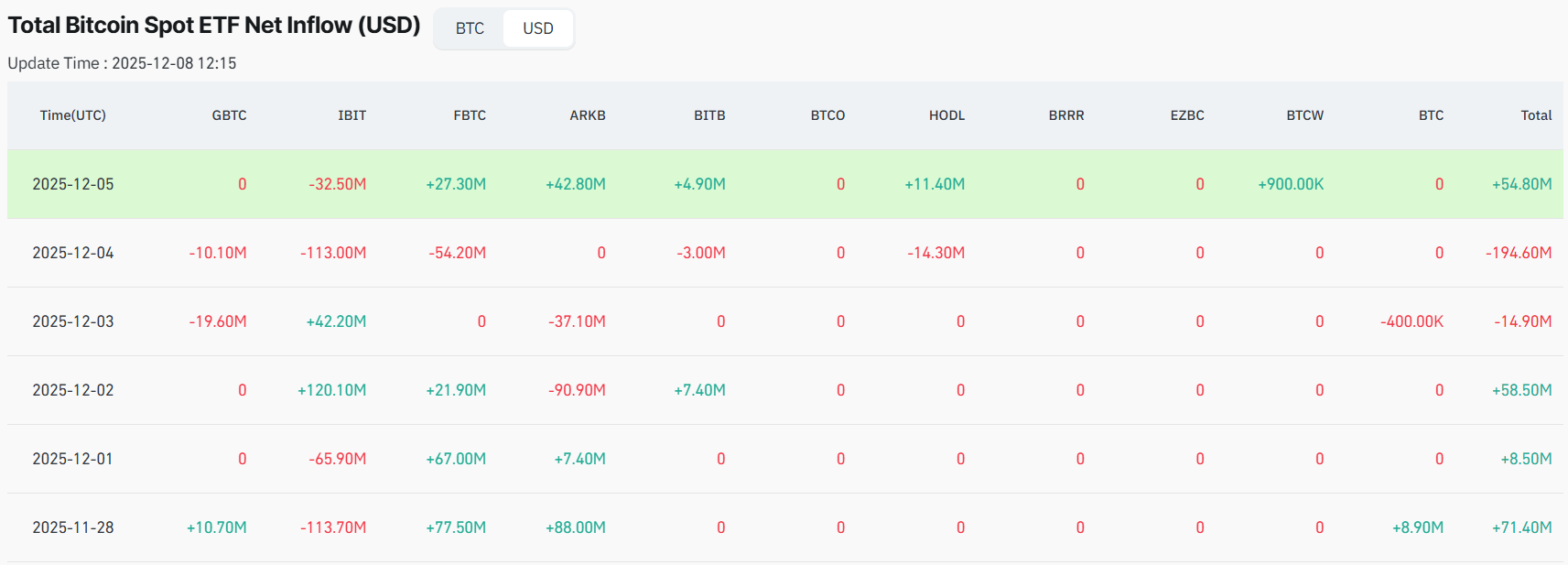

Fueling the bullish momentum, Bitcoin exchange-traded funds (ETFs) snapped back into positive territory, recording a $54.8 million inflow on Friday. This renewed momentum suggests investor appetite is shifting broadly across the crypto market as Bitcoin and other established tokens recovered.

Crypto experts believe that in the upcoming bull cycle, projects building Bitcoin infrastructure could lead to most of the gains. One Bitcoin layer-2 infrastructure platform, Bitcoin Hyper, is already attracting significant attention, having raised $29.1 million in its presale. As the Bitcoin price prediction recovers, the platform is transforming BTC utility and emerging as the best utility crypto for 2025.

Firm Fed Cut Expectations And ETF Inflows Recovery

Optimism returned to the market as traders grew more confident that the Federal Reserve might finally cut rates this week. Fresh U.S. jobless claims data added to that belief. The latest report showed a sharp drop in weekly filings, bringing them to their lowest level in over three years.

Michael Wu, CEO of Amber Group, said, “Shifting rate expectations ripple through crypto funding markets in Asia far more quickly than traditional asset classes.” This could trigger a strong rebound in the crypto market. A cut to the Fed’s funds rate attracts investors to high-risk assets like crypto, leading to a broader market rally.

Source: Coinglass

Spot Bitcoin ETFs also got back on track on Friday. Bitcoin’s ETF products closed the Friday session with $54.79 million inflow. The day before, it saw a significant outflow of $194 million; however, with the market rebounding, ETFs could see steady inflows.

Friday’s revival came mostly from Ark & 21Shares’ ARKB, which pulled in $42.79 million, while Fidelity’s FBTC followed with a solid $27.29 million, and IBIT closed in a loss of $32.5 million.

Bitcoin Price Prediction: Investors Eye $100,000 Amid Market Rebound

The week has opened on a positive note for Bitcoin, which recovered above $91,000 on Monday. At press time, it trades near $91,500, up 2% on the day, with $56.6 billion in 24-hour volume.

Technical analysis shows immediate resistance at $94,000 and another liquidity pocket around $96,500. Analysts believe that reclaiming and holding above the $95,000 psychological mark could unlock the upside target of $100,000.

This would be my bullish scenario.

Pre-FOMC and on Monday, correction to sweep the lows. Perhaps hitting $87K.

After that, bounce back up, swiftly, in which the uptrend is confirmed for #Bitcoin and it's ready to break $92K and therefore the run towards $100K in the coming 1-2… pic.twitter.com/lQezKkQM5W

— Michaël van de Poppe (@CryptoMichNL) December 7, 2025

Crypto analyst Michaël van de Poppe expects Bitcoin to dip before making a strong move higher. He believes the price could slide toward $87,000 ahead of the FOMC meeting, then rebound quickly and resume its uptrend, potentially clearing $92,000 and aiming for $100,000 within a couple of weeks as the Fed eases policy and boosts liquidity.

He noted, “ Breaking and holding $92K would be the ideal trigger for continuation to $100K, so failing to break $92K is the bearish case and second invalidation point.”

Bitcoin Backed – Bitcoin Hyper, Predicted to 100x as Presale Nears $30M

As Bitcoin price prediction improves following the market recovery, Bitcoin Hyper, a project built on Bitcoin’s base layer, is rising as the next star. The project has already raised over $29.1 million, selling 635 million+ tokens. The project is specifically designed to build a layer-2 that will open BTC’s $2 trillion capital to numerous sectors, including meme coin trading, NFTs, and other dApps.

Bitcoin is slowly blending into the world of traditional finance, but it still struggles with one major problem: it’s slow. This limitation holds back real-world adoption. Bitcoin Hyper tackles this issue by building a fast Bitcoin Layer 2 network powered by the Solana Virtual Machine (SVM).

Instead of relying on Bitcoin’s main chain at every step, Bitcoin Hyper processes transactions off-chain via SVM and then sends the final results back to Bitcoin via a trustless bridge, meaning no middleman controls the funds. As a result, users can move value with near-instant speed and extremely low fees, all without clogging the Bitcoin network.

What’s driving Bitcoin Hyper’s growing momentum:

Revolutionizing Bitcoin’s $2 trillion capital base

40% p.a. In staking rewards for ICO investors

Audited and ranked #1 by Coinsult and Spywolf

Over $29.1 million raised and 635 million tokens sold

Available at just $0.013395 in ongoing presale

Bitcoin’s institutional demand and Bitcoin Hyper’s innovation represent two sides of the same market story. On the one hand, Bitcoin remains the largest crypto in the market, with the highest security. On the other hand, Bitcoin Hyper is emerging as a low-cap crypto gem, building the infrastructure for Bitcoin’s real utility. This makes it one of the most promising upcoming altcoins to watch in 2026.