One figure represents decades of trading experience. The other is labeled “the individual with the highest IQ in the world” based on standardized tests. What are their predictions for Bitcoin’s price in the second week of December?

Interestingly, their views appear to clash. Their opposite perspectives highlight how even those with exceptional experience or intelligence can interpret the market in very different ways.

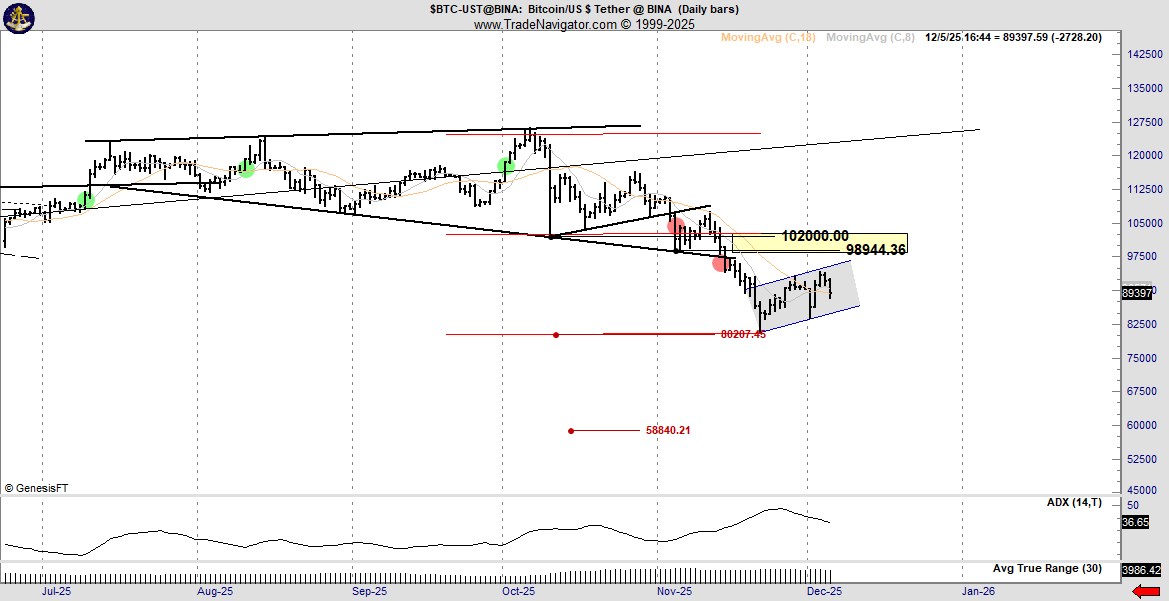

Peter Brandt – Bitcoin Is Retesting Before Returning to a Downtrend

Peter Brandt, a legendary trader with decades spent in commodity and equity markets, is warning about a bleak scenario for Bitcoin.

In his latest Bitcoin analysis, he argues that BTC is retesting a broadening top pattern. This formation shows rising highs and falling lows, often signaling a weakening uptrend.

Bitcoin Price Prediction. Source: Peter Brandt

“This week’s rally may be all the retesting of the broadening top we will see BTC. Of course, we will see.” – Peter Brandt predicted.

Brandt has repeatedly warned about a dead cat bounce scenario for Bitcoin. His chart markings suggest that BTC might push as high as $102,000 before possibly correcting toward $58,840 in the near term.

His perspective acts as a cold reminder from past cycles: the market does not reward naïveté, and classical technical models remain reliable guides amid relentless volatility.

YoungHoon Kim – Manipulation Has Passed, and BTC Is Ready for a New ATH

In contrast, YoungHoon Kim — whose verified IQ score is 276 — views the situation through the lens of game theory.

In his latest assessment, Kim argues that the current dip represents temporary manipulation by market whales. He believes it could fade within a week. After that, Bitcoin may move toward a new all-time high.

Bull Theory, an X account focused on crypto analysis, provides supporting evidence for Kim’s view.

Recent price action shows Bitcoin dropping to $87,700 before quickly rebounding to $91,200. This rapid dump-and-pump sequence, completed within four hours, reflects typical low-liquidity weekend manipulation aimed at wiping out both long and short leveraged positions.

Between the two perspectives—one shaped by decades of technical pattern mastery and the other based on reasoning about crypto market behavior—the answer may soon become clear during the second week of December.

These predictions emerge as the FOMC meeting approaches. Historical data shows a pattern during the last two rate cuts (September 17 and October 29):

Bitcoin tends to rise a few days before the announcement,

Bounce slightly right after the decision,

And then drop sharply afterward.

The market may soon reveal which outlook proves correct.