Solana continues to lead all other chains in DEX volume for sixteen weeks in a row. The network carries double the volume of Ethereum and is the home of some of the busiest protocols.

Solana DEX activity remains elevated, surpassing other L1 and L2 chains in weekly volumes for 16 weeks in a row. Solana’s DEXs also report the biggest daily and weekly volumes, with only occasional anomalies where Ethereum or BNB Chain come close.

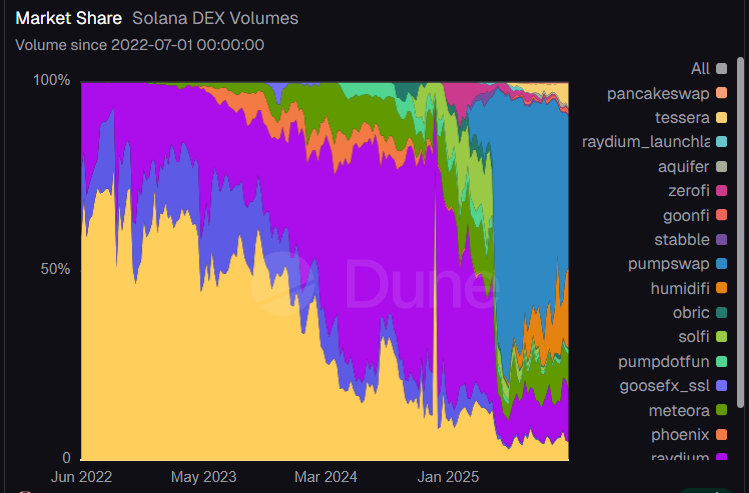

Trading on DEX across the board remains elevated, despite the slowdown of meme trading. On Solana, memes make up a shrinking share of overall token volumes. The other factor for Solana DEX activity is HumidiFi, a dark pool DEX that emerged in the past six months.

HumidiFi reported volumes are catching up with those of other top on-chain exchanges across all chains. HumidiFi recently launched a token presale, aiming to boost adoption with a native WET token.

DEX activity remains robust across the board, based on legacy tokens, stablecoin pairs, and wrapped tokens. DEX trading is part of the liquidity flow from DeFi. Solana activity also got a boost from the recent expansion of lending, with competition from Jupiter and Kamino.

Additional trading spikes come from high-profile launches like Monad’s MON token.

Solana remains the leader in cross-chain activity

Solana trading volumes on DEX have grown not only statistically. The ecosystem is more complex, including a new balance of platforms and cross-chain activity.

Despite the slowdown in meme creation, PumpSwap emerged as a leader for legacy tokens. The platform carries activity for PUMP tokens, USDC pairs, as well as hot trending legacy memes.

Other sources of volumes come from cross-chain activity. Solana remains the leader for transaction count, although BNB Chain was the leader for cross-chain volumes. Both networks benefit from the spike in activity on PancakeSwap, which is currently the most active protocol, passing even Uniswap.

DEX volumes remain significant despite the slower altcoin season. Trading remains active, with occasional whale activity and short-term rallies for selected tokens. DEXs are carrying some of the internal turnover of crypto whales and traders, tapping liquidity from lending and stablecoins.

Solana invites net inflows in the past three months

The Solana ecosystem is relatively balanced based on its current cross-chain trading. Solana saw $182M in net inflows for the past three months, according to Artemis data. Additionally, Solana gained internal liquidity from renewed USDC minting.

For the year to date, Solana has drawn in $634M in liquidity from other networks. Most of the bridged value comes from Ethereum, with a small part from Polygon. Solana is also used as an alternative chain for Polymarket predictions, causing some users to switch from Polygon.

Get up to $30,050 in trading rewards when you join Bybit today