Bitcoin may still be trading below its previous highs, but institutional conviction remains firmly intact — and few names signal that louder than Michael Saylor’s Strategy.

The company revealed a fresh acquisition of 10,624 BTC, spending roughly $962.7 million at an average price of $90,615 per coin.

Key Takeaways

Strategy has bought 10,624 BTC, spending about $962.7M at ~$90,615 per coin.

The firm now owns 660,624 BTC, worth more than $60 billion at current prices.

Bitcoin price action remains mixed but shows improving structure with higher lows.

Investors view Strategy’s purchase as another institutional confidence signal.

The disclosure pushes Strategy’s total holdings to 660,624 BTC, accumulated at a blended cost basis near $74,696 per Bitcoin. With prices hovering around $91,800, Strategy’s long-term treasury approach continues to sit comfortably in profit despite recent market volatility.

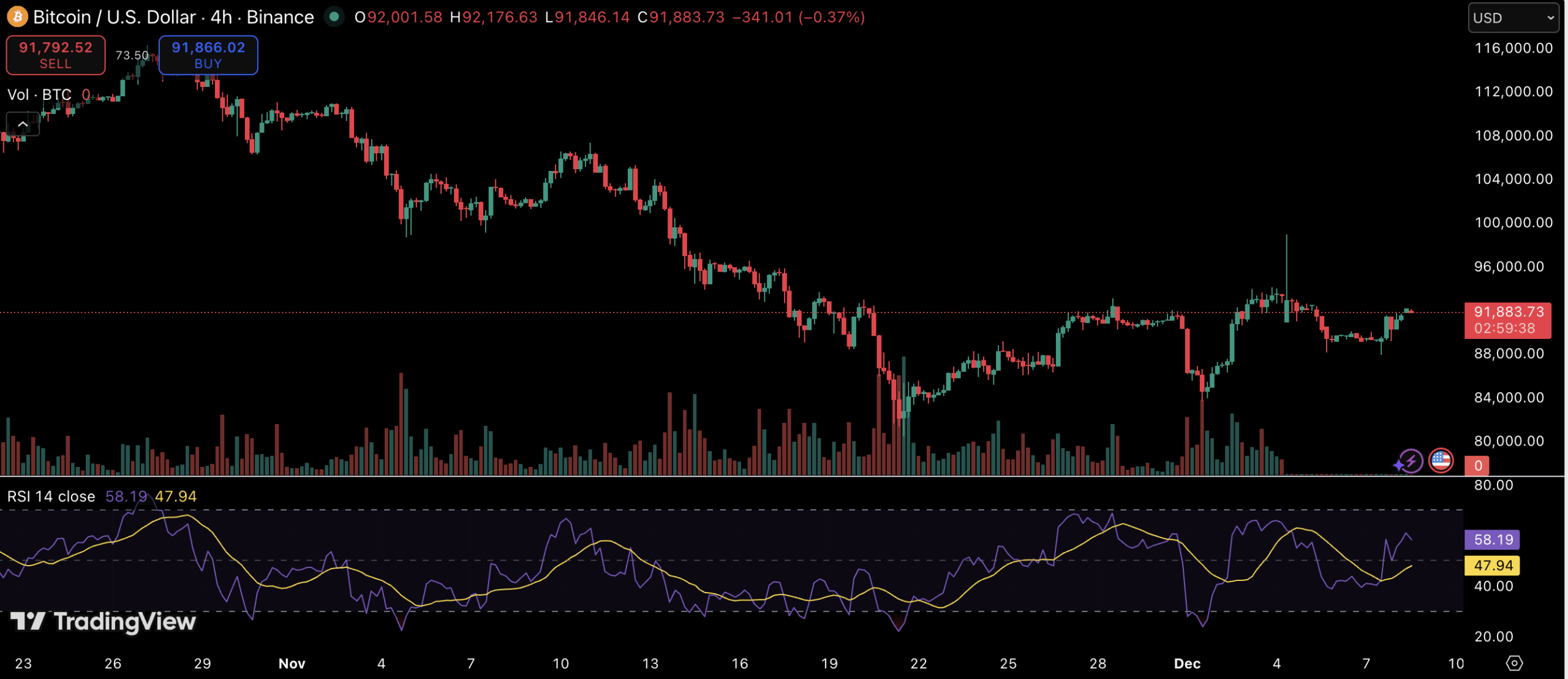

Bitcoin has been trading in a choppy range over the last few weeks, with multiple attempts to reclaim the $93,000–$94,000 band failing to hold. The broader market still leans bullish, though price action has shifted into a consolidation structure with higher lows forming since late November, suggesting the downtrend may be losing momentum.

Short-term traders have struggled to define direction, but RSI levels on the 4-hour charts indicate recovering buying momentum after briefly approaching oversold conditions last week. This backdrop makes Strategy’s purchase all the more notable — buying into weakness rather than chasing tops.

Saylor Frames the Buy as Yield Performance and Commitment

In his announcement post, Saylor noted Strategy’s Bitcoin portfolio has already delivered a 24.7 percent year-to-date yield for 2025. That performance metric reinforces the firm’s positioning narrative: Bitcoin is not simply a treasury reserve to them, but a productive asset expected to outperform traditional capital strategies.

The latest buy fits seamlessly with Strategy’s historic behavior — leaning aggressively into dips, publicly signalling confidence, and positioning the firm as the world’s largest corporate Bitcoin treasury operator.

Strategy has acquired 10,624 BTC for ~$962.7 million at ~$90,615 per bitcoin and has achieved BTC Yield of 24.7% YTD 2025. As of 12/7/2025, we hodl 660,624 $BTC acquired for ~$49.35 billion at ~$74,696 per bitcoin. $MSTR $STRC $STRK $STRF $STRD $STRE https://t.co/oyLwSuW7nW

— Michael Saylor (@saylor) December 8, 2025

Market Reads Saylor’s Buy as a Sentiment Signal

Institutional positioning increasingly affects sentiment, and Strategy’s actions often function as an indirect confidence cue. Traders on social platforms highlighted the timing, noting Bitcoin’s attempt to stabilize above the $90,000 zone could be significant if aggressive buyers align with that level as a structural support.

Whether the purchase ignites upside momentum remains to be seen — especially with liquidity thinning one week after heavy derivatives unwinds and leveraged flush-outs. But historically, Strategy’s accumulation phases have often coincided with the early stages of larger moves.

For now, the message is clear: while Bitcoin wrestles with direction, Saylor has once again leaned into conviction.