KEY TAKEAWAYS

OpenLedger debuted with a 200% price surge as early adopters received 10 million tokens.

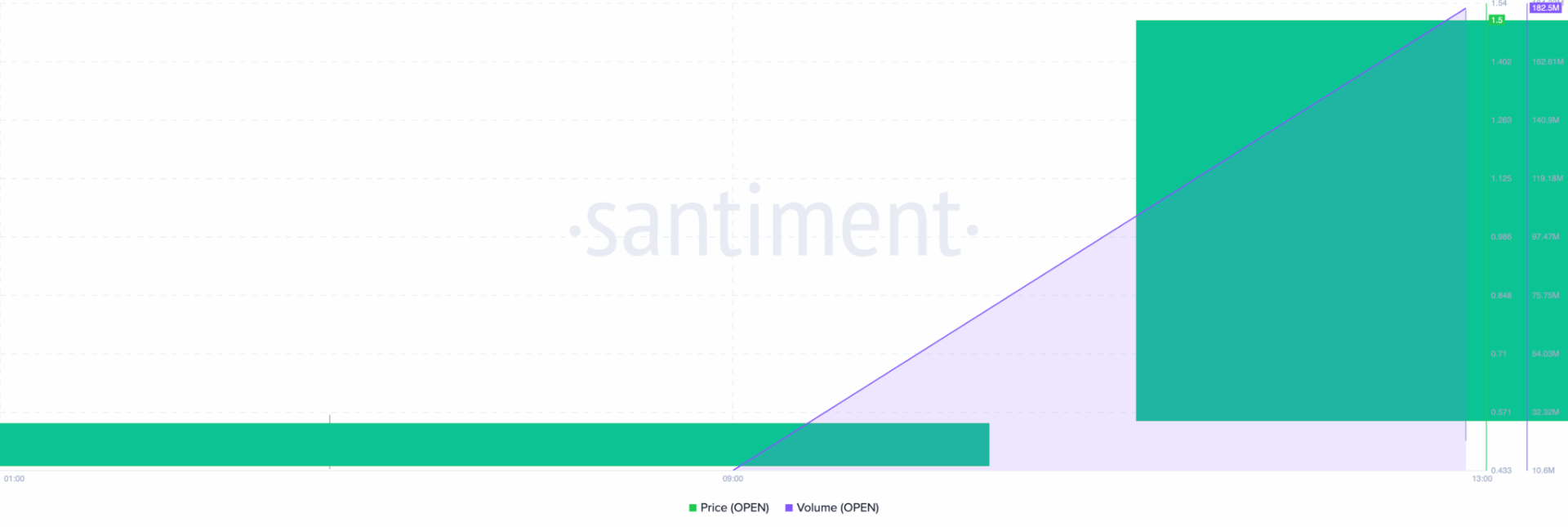

The trading volume soared past $18 million, validating the rally with genuine demand.

If momentum holds, OPEN could test $2, but heavy selling from airdrop recipients could cap gains.

The decentralized AI project OpenLedger (OPEN) launched on the mainnet and made its native token available for trading. Following this development, the OpenLedger price spiked by 200% after Binance listed it.

At press time, OPEN trades at $1.52.

Here is a breakdown of the project and its price outlook.

OpenLedger Launches

OpenLedger positions itself as the next-generation blockchain network for AI, designed to unlock liquidity and monetize data, models, apps, and agents.

The platform enables seamless training, deployment, and on-chain tracking of specialized AI models and datasets, tackling the AI ecosystem’s critical challenges of transparency, attribution, and verifiability.

Today the OPEN token officially launched for trading, accompanied by an airdrop to early adopters through the Binance HODLer distribution program.

“This listing is a milestone in bringing OpenLedger’s vision of a transparent, accountable AI economy to a global audience,” said Ram, core contributor at OpenLedger.

“Through Binance’s HODLer Airdrops, we’re rewarding long-term BNB participants while laying the foundation for OPEN’s role in the future of data-driven AI,” The project revealed in exclusive conversation with CCN.

Tokenomics Revealed, Volume Spikes

According to CCN’s findings, OpenLedger’s total supply is 1 billion OPEN tokens. At listing, the circulating supply is 215.50 million OPEN, accounting for 21.55% of the total supply.

For the HODLer Airdrops Rewards, the project allocated an initial 10 million OPEN at launch, with an additional 15 million OPEN scheduled for distribution six months later.

This phased release incentivizes early adopters and helps manage token liquidity and long-term community engagement.

Amid the recent OpenLedger price surge, trading activity has also accelerated. At press time, OPEN’s trading volume has surpassed $182 million.

High trading volume acts as fuel for price momentum. When surging volume accompanies an upward price move, it typically validates the trend, reducing the likelihood of a false breakout.

In OpenLedger’s case, the $182 million volume surge suggests that the rally is supported by high demand rather than thin trading. Should this trend remain the same, OPEN’s price might rally toward $2.

OPEN Price Prediction: Still Early

As of now, predicting OPEN’s price remains challenging. Having just launched, the token is still in its price discovery phase.

During this stage, volatility tends to run high as early adopters, speculative traders, and long-term holders all shape liquidity and sentiment.

If demand for OpenLedger rises, the value might break $2. However, that will only happen if airdrop recipients refrain from selling.

On the other hand, if this trend changes, the price might fail to sustain its uptrend. In that case, OPEN’s price might decline.