What is OPEN Crypto? Open Ledger Price Just Erupted +200% – Here’s Why

OpenLedger’s token soared by +200% in its first 24 hours. But can this rally hold, or is it only a launch-day pump? Here’s a closer look.

The project aims to build what it calls a “Payable AI” economy, where datasets, AI models, and agents can be exchanged with verifiable attribution and fair compensation.

Its system uses tools such as Datanets, ModelFactory, and OpenLoRA to support collaborative AI development. The architecture relies on a dual-layer setup of off-chain inference combined with on-chain settlement, intended to keep rewards transparent and traceable.

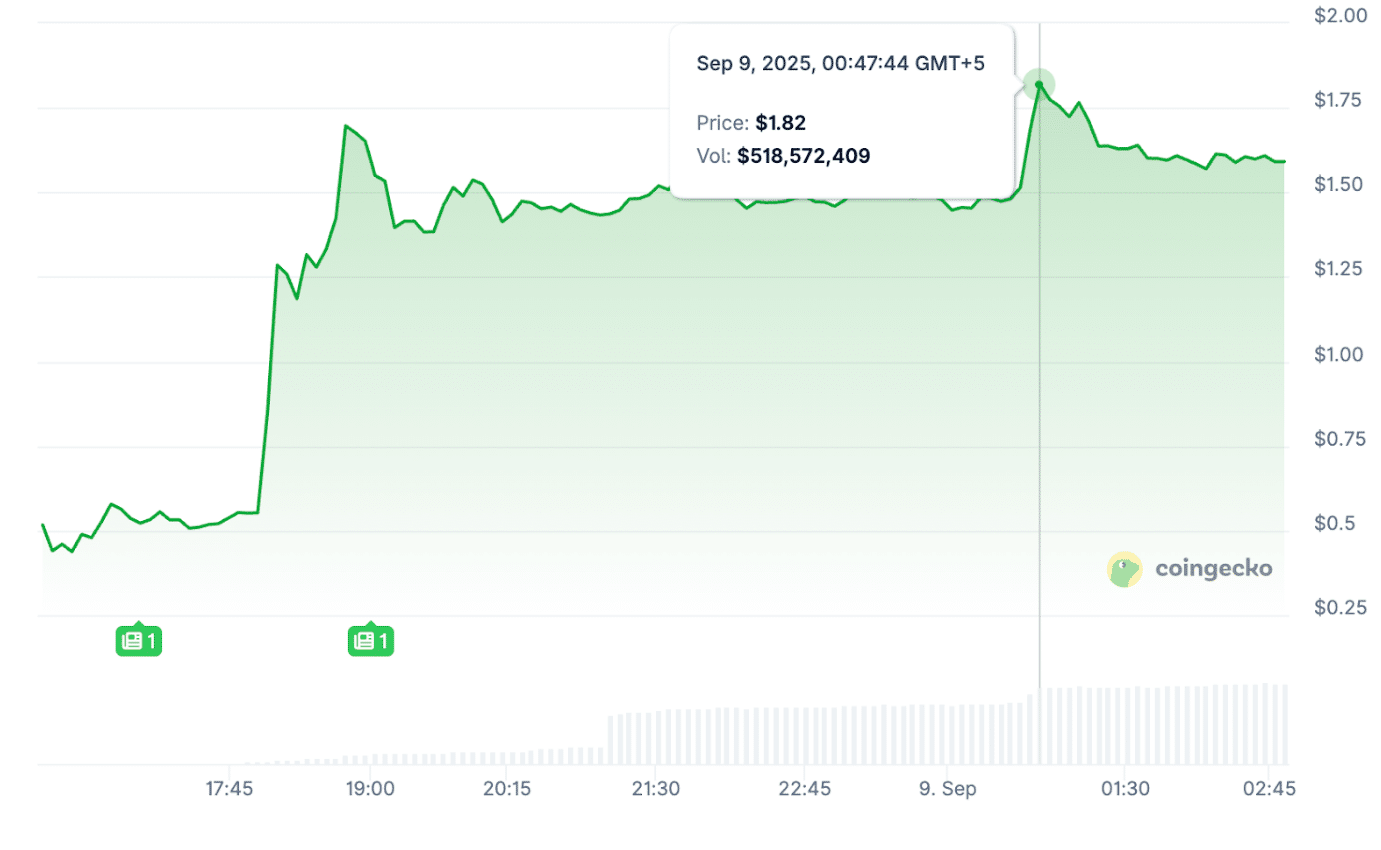

The token’s first trading session was marked by extreme volatility.

According to CoinGecko, OPEN soared nearly +200% in 24 hours, hitting an all-time high of $1.82 on September 9. It later settled near $1.67, with trading volumes around $66.5M.

(Source – Coingecko)

The token briefly dipped as low as $0.4375 earlier in the day. With a circulating supply of about 220M tokens, CoinGecko valued the project at roughly 2,753 BTC, ranking it #256 among global cryptocurrencies.

The platform also estimated circulating supply at 215.5M tokens, giving the project a market capitalization of $311.5M.

Despite the discrepancies, both sources highlight an explosive launch that has quickly put OpenLedger on traders’ radar.

DISCOVER: 20+ Next Crypto to Explode in 2025

OPEN Price Prediction: Can Holding the $1.50 Zone Set Up Another Rally?

OPEN’s hourly chart on Kraken shows a sharp pullback after a run toward $1.95, with the token hovering near $1.58 as profit-taking cooled earlier buying.

(Source – OPEN USDT, TradingView)

The hour opened at $1.6145, briefly ticked $1.6163, then slid to $1.5705. Long upper wicks mark firm rejection on rallies, especially above the mid-$1.80s.

The wide range and quick spike-then-reversal point to speculative trading. Reported volume near 7.82K on the move suggests fast, short-lived positioning rather than steady accumulation.

This looks like a failed breakout attempt. Sellers knocked the price back below the $1.60 area soon after the push toward $1.95. Around $1.58 now acts as a pivot. Near-term resistance sits at $1.70-$1.75. Initial support is around $1.50, with $1.45 next if pressure builds.

A clear hourly close above $1.75 would be needed to put bulls back in charge.

The broader bias is still up after today’s surge, but momentum is tiring. Traders are locking gains, and the tape has shifted into a choppy consolidation with big swings.

Long red candles after the peak show heavier selling into strength. Even so, the structure can stay constructive if supports hold and pullbacks remain shallow.

For now, OPEN is digesting a rapid advance inside a wide range. Holding the $1.50 zone could steady the price and set up another push at resistance. Losing it would risk a deeper reset toward $1.45.

With sentiment jumpy and liquidity patchy, the next few hourly closes should tell whether this was a brief overreach or the pause before another leg higher.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Why Did Major Exchange Listings Drive OPEN’s Rally?

The rally came as OPEN secured listings on several major exchanges. On September 8, Bitget added OPEN/USDT to its “Innovation and AI Zone” at 13:00 UTC, with withdrawals scheduled for September 9.

KuCoin also launched OPEN/USDT the same day, following a one-hour call auction that began at 12:00 UTC. Kraken confirmed its own listing soon after, opening deposits and trading once liquidity requirements were met.

These simultaneous listings boosted access and fueled demand. At the same time, exchanges like MEXC rolled out airdrops and trading fee discounts to pull in more users.

Token design also played a part. Early unlocks, airdrops for holders, staking rewards, and contributor incentives kept community engagement high.

Beyond exchange activity, OPEN benefited from broader market appetite for AI-linked crypto projects. Its model, built around transparent and monetized AI contribution, fits neatly into the growing narrative of blockchain and artificial intelligence converging, adding further momentum to its rise.