STABLE continued its price drop in the first day after launching. The token started crashing almost immediately after Stable launched its main net.

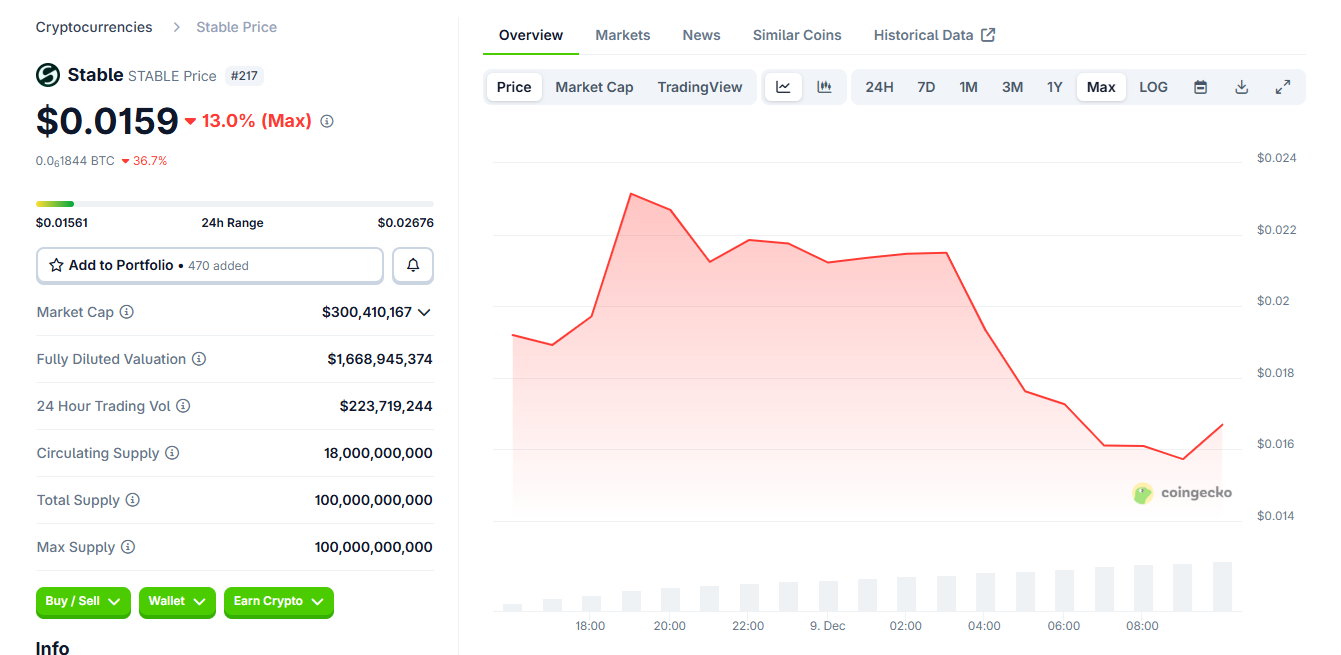

STABLE, the native token of the Stable network, started crashing right after its launch. The new asset took a downturn to an all-time low of $0.015, down over 50% in the past 24 hours.

The token is also down over 70% from its IDO price. Despite the success of the token sale, raising a total of $28M in eight funding rounds, the Stable project will now have to meet market forces and show its real post-IDO performance.

The newly launched token arrived with a circulating supply of 18B and a total supply of 100B, expecting more unlocks and inflows in the coming years. The team plus early investors and advisors hold 50% of the supply, with only 10% sold in a public distribution. STABLE thus launched as a low-FDV asset, sparking skepticism on its performance.

STABLE also caused worries that the 40% of community supply may be farmed by whales, who will be the first to claim the incentives. As of December 9, STABLE had around 1,200 holders on BNB Smart Chain, as well as multiple connected wallet clusters based on Bubblemaps data.

STABLE launched with minimal mindshare

The token is still in a period of price discovery, mostly relying on Bybit, Gate, MEXC, and KuCoin pairs. The community is just building the token’s mindshare, which is minimal compared to other recent launches.

Based on Messari data, STABLE talk on social media is up by 126%, but the total mindshare among influencers remains minimal. Community comments also point to potential risks, as newly launched tokens often underperform. Early analysis shows STABLE early buyers may be seeking to trade the token in the short term.

The STABLE token generation event invited comparison with other high-profile launches in 2025. While some assets, like TAO, tapped months of bull market, others launched at a moment of low enthusiasm.

Decentralized trading for STABLE also shows signs of early selling. The token only built up $720K in liquidity on PancakeSwap. Early whales are trying to sell and buy back lower, with high-velocity orders. However, due to low liquidity, even the leading whale only extracted around $127K from the market.

STABLE launched with a market cap of $300M and fully diluted valuation of just $1.6B. The launch, despite its high profile and connection to Bitfinex and USDT, achieved a market cap and liquidity similar to earlier meme token launches. The asset remains subdued despite the ambitious plans of turning Stable into the settlement layer for stablecoins and especially USDT.

Stable is still in pre-market phase

Despite the token launch as a BNB Chain asset, Stable is still in the pre-launch stage. The company has opened a registration for early settlement access.

The delayed launch of the product is unusual in a highly competitive crypto space. Stable will also have to really demonstrate the need for another chain to carry stablecoins, as some of the stablecoin liquidity already has preferred networks like Ethereum and TRON.

The project is viewed with skepticism in trying to prove its viability to handle stablecoin traffic and fulfill its launch goals.

Want your project in front of crypto’s top minds? Feature it in our next industry report, where data meets impact.