Ethereum saw a flurry of big moves that traders say could matter for its next price swing. In just a few hours, major accounts pulled large sums off an exchange and big wallets opened sizable margin longs. Market watchers are parsing those moves for clues.

Institutions Shift Big Stakes

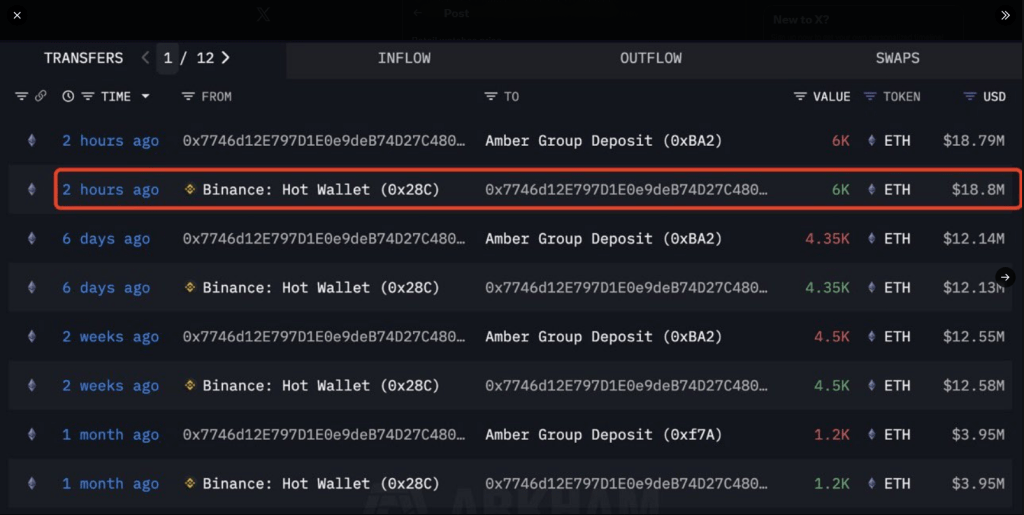

According to Arkham Intelligence, Amber Group and Metalapha pulled out 9,000 Ether from Binance in a short span, a haul worth more than $28 million at current prices.

Based on reports, institutional flows have been heavy for months — nearly 4 million ETH has been accumulated by institutions over five months. Those kinds of transfers are often linked to custody setups or long-term holdings rather than quick trades.

Whales Add Margin Bets

Several large wallets added roughly $426 million in margin long exposure. Wallets named 1011short and Anti-CZ are among the accounts that expanded long bets.

That kind of activity raises the chance of sharper moves in either direction: if prices rise, longs can feed a rapid upswing; if a pullback hits, forced selling could amplify losses. Market structure is tighter now than it was several months ago.

On-chain data shows only 8.7% of ETH is currently held on exchanges. More than 28 million ETH is locked up in staking, custody, and what reports call long-term storage.

Staking inflows remain high, with over 40,000 ETH added per day on average. Less supply on exchanges can lower immediate selling pressure, making price swings more dependent on fresh buy orders.

Price Range And Key Levels

Ethereum has gained 2.5% in the last 24 hours and is trading near $3,050. According to an analyst’s chart, ETH has been moving inside a tight range between $3,050 and $3,200, with $3,100 acting as a support line.

Traders say a clear break above the $3,300–$3,400 band could open the way toward $3,700 to $3,800. Failure at that resistance would likely push prices back toward $3,000, where buyers may step in again.

In a related development, the US Commodity Futures Trading Commission has launched a pilot that allows Ethereum, USDC and Bitcoin to be used as collateral in regulated derivatives venues.

Acting Chair Caroline Pham unveiled the plan in Washington and said the move will let regulators observe how tokenized collateral behaves in stressed conditions.

The program sets rules for custody, segregation, and valuation tests inside a controlled environment.

Featured image from Unsplash, chart from TradingView