The way NVIDIA Corporation NVDA benefited from the artificial intelligence (AI) boom to become a $4 trillion behemoth, a smaller company, IonQ, Inc. IONQ, is aiming to do the same by taking advantage of the next major tech wave – quantum computing. Can IonQ do it, and is the stock a buy now? Let’s find out –

Why Quantum Computing is Growing and Why IonQ Stands Out

Unlike traditional computing, quantum computing can inherently solve complex problems much faster, making it highly sought after for training AI models and revolutionizing drug discovery, to name a few. As a result, the global quantum computing market is projected to reach around $20.20 billion by 2030 from $3.52 billion in 2025 at a CAGR of 41.8%, according to marketsandmarkets.

However, quantum computing has its own problems as well. Qubits can’t provide an exact 0 or 1 as an answer, and this leads to errors in calculation. But here is where IonQ steps in. It’s easily interconnected qubits boost computational accuracy. IonQ’s use of trapped ions is less error-prone than the man-made qubits that many of its competitors are utilizing. This trapped-ion method for quantum computing operates at room temperature, unlike other methods that require absolute zero, which curtails costs.

More Reasons to Be Bullish About IonQ

IonQ’s quantum-as-a-service (QaaS) model helps seamlessly integrate its systems into main cloud infrastructures, including Amazon.com, Inc.’s AMZN AWS, Microsoft Corporation’s MSFT Azure and Alphabet Inc.’s GOOGL GCP. The company has also enhanced its presence in the quantum space by acquiring several companies, including Oxford Ionics, Lightsynq, Capella and partnering with Sweden’s Einride.

The Oxford Ionics acquisition was the recent one, as it got approved by the UK Investment Security Unit (“ISU”). This acquisition will help IonQ aim for 10,000 physical qubits with 99.99999% accuracy by 2027 and scale to 2 million qubits by 2030, citing investors.ionq.com. This means that the chances of errors in the future will be minuscule, which is vital for building comprehensive quantum computers.

IonQ, anyhow, is on a positive trajectory since its initial public offering. The company reported second-quarter revenues of $20.7 million, which is 15% above the top end of its earlier estimated range. For the third quarter, IonQ expects continued growth, with revenues between $25 million and $29 million. For the full year, revenues are projected to be between $82 million and $100 million. This revenue growth suggests that IonQ’s acquisition and partnership strategies are yielding fruitful results, and its business model is solid.

Can IonQ Be the Next NVIDIA, or is it a Hype?

The consistent revenue growth makes one believe that IonQ is the next NVIDIA of quantum computing. Similar to NVIDIA, IonQ is aiming to build an all-inclusive ecosystem around quantum computing. It’s developing high-speed networking, a satellite-based distribution system and advanced error-correction software that are much needed to get practical results from quantum computing.

However, IonQ isn’t profitable yet. Its expenses have exceeded revenues. In the second quarter, IonQ reported a net loss of $177.5 million and an adjusted EBITDA loss of $36.5 million. This financial hurdle may act as a hindrance to future growth and threaten IonQ’s goal to become the next NVIDIA. On the other hand, the Jensen Huang-led company has been a profitable enterprise, which helps NVIDIA address quantum computing challenges effectively. So, it is too early to conclude that IonQ is the NVIDIA of quantum computing.

Should You Buy, Hold, or Sell IonQ Stock Now?

Consistent revenue growth through a series of acquisitions and a sound business model may encourage stakeholders to stay invested in IonQ.

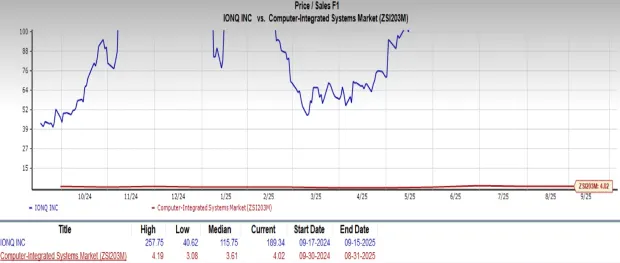

However, despite being a high-reward stock, IonQ remains a highly risky bet. IonQ isn’t profitable, and quantum computing in itself is in a nascent stage, with its practical usage in its early stages. Moreover, IonQ appears to be overvalued and may see a sharp drop in its share price if the broader market is subjected to a correction. For instance, IonQ’s forward price-to-sales (P/S) ratio is a staggering 189.34 compared with the Computer-Integrated System industry’s 4.02.

Image Source: Zacks Investment Research

Therefore, it’s judicious for risk-averse investors to stay away from IonQ for now. Currently, IonQ has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.