IonQ has been a hot stock this year, but it is cooling off.

The quantum computing industry saw a lot of investment interest over the past few months, but that confidence has been shaken as of late. Many quantum computing stocks are well off their all-time highs established just a few days ago, and investors are likely wondering if this is a buying opportunity. One of the most popular quantum computing pure plays is IonQ (IONQ+0.15%), which was the first quantum computing company to go public.

Its stock is down around 30% from its all-time high at the time of this writing, but with how volatile these stocks are, it wouldn't surprise me if that figure drastically moves over the next few days. However, investing in quantum computing isn't about what the stocks do today or tomorrow or even a year from now; it's about what the market will look like decades from now. We're still several years away from commercially viable quantum computing, so investors must identify the best stocks and stay patient.

If investors can wait out the long buildup and IonQ captures a large chunk of the quantum computing market, it could result in incredible returns.

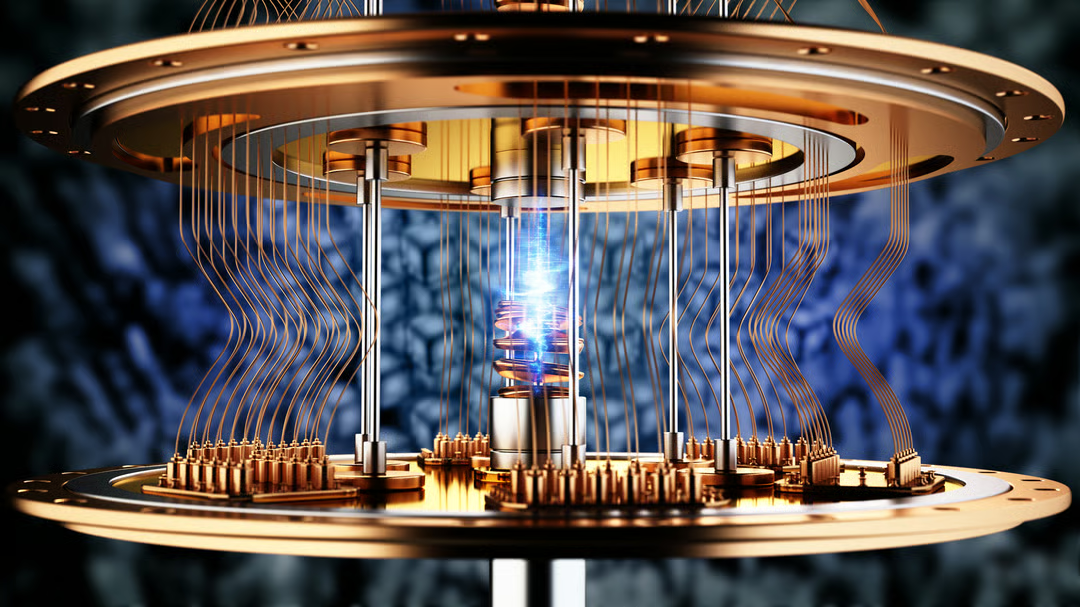

Image source: Getty Images.

IonQ is taking an alternate approach to quantum computing

There are a few ways that a company can approach quantum computing, with the most common being superconducting. This requires cooling a particle down to nearly absolute zero so that its movements are slow enough to harness the quantum mechanics to perform calculations. However, IonQ has chosen a different path.

IonQ uses a trapped ion approach, which doesn't require cooling the particle down to near absolute zero. This has huge cost benefits and could help IonQ easily scale to become the quantum computing hardware provider of choice. Additionally, the trapped ion approach is inherently more accurate than the superconducting approach. IonQ holds world records in one-qubit and two-qubit gate fidelity tests, which showcase its superior accuracy over the competition.

Accuracy is the biggest problem in the quantum computing field, as there are quite a few errors that appear during a quantum calculation. The company that solves this issue first and can provide accurate enough hardware to deploy at a commercial level will be able to capture significant market share. With IonQ already leading the pack, it's a smart horse to back in the quantum computing race.

Still, we're a few years out from when most quantum computing companies think this will be viable technology. Most point toward 2030 as the turning point for the industry, with full maturation coming a few years after that.

That's a long time to wait, but will it be worth it?

IonQ could be a monster winner over the next decade

While the estimates for the quantum computing market size vary widely, one of IonQ's competitors, Rigetti Computing (RGTI0.11%), offers a reasonable $15 billion to $30 billion annual market value that will arise between 2030 and 2040. That's a fraction of what artificial intelligence hyperscalers are spending on traditional computing units today, so it's not unreasonable to think that these quantum computing businesses could carve out a small slice of the accelerated computing pie.

Should IonQ emerge as one of the top options in this space and capture a 50% market share, that could be worth $15 billion in annual revenue if the market reaches the high end of revenue expectations by 2035. If IonQ can generate a 30% profit margin, that would lead to $4.5 billion in annual profits. At a 30 times earnings multiple, that would yield a $135 billion company. At the time of this writing, IonQ is currently a $60 stock with a $17.6 billion valuation. If IonQ's share count stays the same, that would translate into a stock that's worth $460 a decade from now.

That would be a massive gain, making IonQ a genius buy now if it wins the quantum computing arms race. There's also the possibility that its approach doesn't pan out and it is beaten out by one of its many competitors. This is a real concern, and there's also a chance that IonQ's stock price is $0 a decade from now. This makes IonQ a high-risk, high-reward investment, and investors need to keep their position sizes appropriate for the amount of risk that the stock represents.

Time will tell where IonQ ends up, but its future could have a wide range of outcomes.

Should you buy stock in IonQ right now?

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 5 best stocks for investors to buy now… and IonQ wasn’t one of them. The 5 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $521,982!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,137,459!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 5 stocks, available with Stock Advisor, and join an investing community built by individual investors for individual investors.