Ethereum price prediction now trades above $3,300, recovering sharply after weeks of volatility. The altcoin surged over 6% on Tuesday, reaching a new monthly high of $3,396.

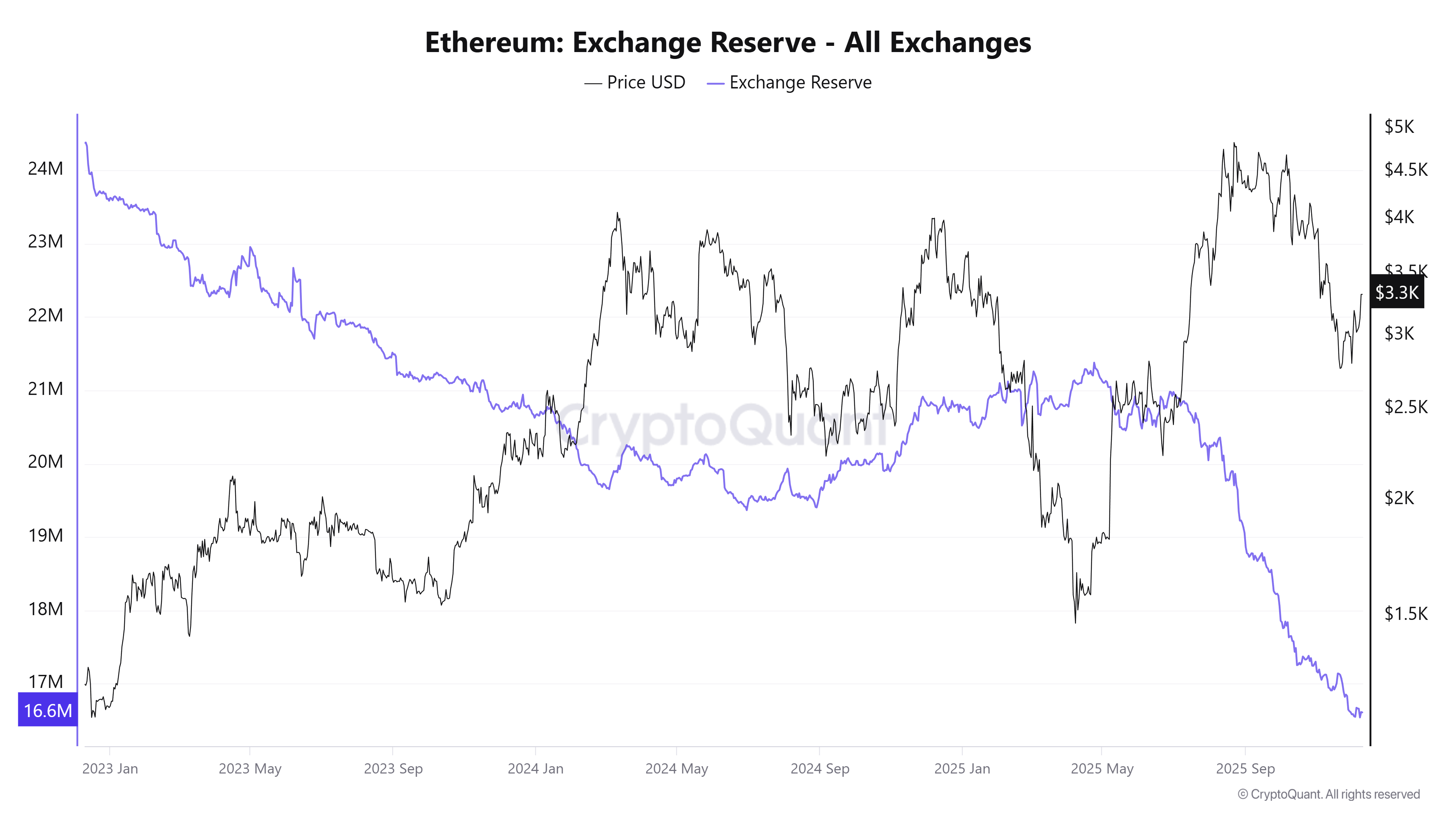

Investors’ momentum has renewed after major institutions and investors intensified accumulation. Currently, Ethereum reserves on CEXs have dropped to just 8.7% of the total circulating supply. Meaning only 10.5 million ETH out of 120.7 million in circulation is in reserves.

$ETH is quietly entering its tightest supply environment ever.

Exchange balances just fell to 8.84% of total supply, a level we’ve never seen before.

For context, $BTC is still sitting near 14.8%.

ETH keeps getting pulled into places that don’t sell, staking, restaking, L2… pic.twitter.com/T7MW3D2bG1

— Milk Road (@MilkRoad) December 5, 2025

On the network, this is happening for the first time after Ethereum’s launch in 2015. Analysts believe this could set the stage for a supply-demand imbalance that could, in turn, skyrocket prices. The reserve drop came after major acquisitions, such as Bitmine’s $435 million Ethereum purchase, which now puts the firm at 3.2% of the total ETH supply.

Amid strong demand in established tokens, infrastructure projects are the need of the hour. Bitcoin Hyper, a layer-2 infrastructure project on Bitcoin, is gaining serious traction, raising more than $29.2 million in its ongoing presale. Currently, HYPER tokens are available at a discounted price. However, the low-price opportunity window is closing in less than 24 hours.

Ethereum’s Exchange Reserves Plunge to Historic Low

Ethereum is quietly shifting toward a scarcity-driven market. Only 8.7% of all ETH, around 16.6 million coins, is still sitting on centralized exchanges, showing that most holders continue to move their assets off trading platforms. Even though many Ethereum price predictions still highlight bearish pressure, the supply trend paints a very different picture.

Source: Cryptoquant

This steady decline accelerated after July 2025, with exchange balances dropping by nearly 20%. Much of this outflow aligns with the growing accumulation by institutions such as Bitmine, which have been accumulating large amounts of ETH.

Momentum increased again after the Fusaka upgrade went live on December 3, 2025. Exchange reserves initially slipped to roughly 16.8 million ETH. Still, real-time data now points to lower levels, suggesting a rapid shift as developers and users migrate to faster, cheaper network operations.

Analysts say that if buyers return at this pace, Ethereum could enter a strong rally, driven by a shrinking supply and rising network activity.

Ethereum Price Prediction Soars, Breaks $3,100 Resistance

Ethereum, the world’s second-largest crypto, has defied the bearish pressure, breaking out of the $3,100 resistance after weeks of holding it. Currently, it is trading at $3,325 with a market cap of around $401 billion, representing a strong recovery from its Q3.

Ethereum Price Chart. Image Courtesy: TradingView

Despite resistance near $3,100, Ethereum has regained traction upward, confirming support above $3,000. Technically, the 50DMA has been established as a short-term resistance level, aligning with the $3,400 level. However, volume support is still missing. A break above $3,400 would open the way toward $3,670 and next to $4,000.

Failure to maintain the current $3,100 immediate support would expose Ethereum to lower levels around $2,900, with deeper support levels at $2,750–$2,500.

Bitcoin Hyper Nears $30 Million Amid Roaring Demand

As the Ethereum price prediction improves, the focus is shifting to high-ROI projects that could deliver outsized returns during this market revival. Bitcoin Hyper is topping this list. The project has already attracted over $29.2 million in presale funding, selling over 637 million tokens. That makes it one of the best crypto presale projects of 2025 so far.

Bitcoin has existed longer than most blockchains, but its network still struggles with slow transactions and limited on-chain features. As Solana and Ethereum push ahead with faster speeds and richer ecosystems, Bitcoin often ends up used mainly as a store of value. Bitcoin Hyper steps in to change that narrative.

Instead of working within Bitcoin’s constraints, Bitcoin Hyper introduces an SVM-based execution layer that delivers fast confirmations, low fees, and full innovative contract capabilities. This setup unlocks new possibilities, letting Bitcoin power instant payments, DeFi platforms, gaming experiences, and even meme-coin markets.

Why it matters:

Massive $2 trillion market opportunity in Bitcoin layer-2

40% annual staking reward for ICO adopters

Supported by advanced SVM and zk-roll-ups

Massive investor interest with $29.2 million raised and 637 million tokens sold

Undervalued tokens price of just $0.013405 in presale

The strong fundamental factors make Bitcoin Hyper a unique layer-2 DeFi project with real-world functionality. These offerings set it apart in early-stage crypto investments. Many industry experts believe that Bitcoin Hyper might be the next big altcoin to watch, and it’s more than theory.