Cryptocurrencies may be universal in concept, but their uptake varies dramatically by geography — and the newest international ranking shows a surprising leader at the top.

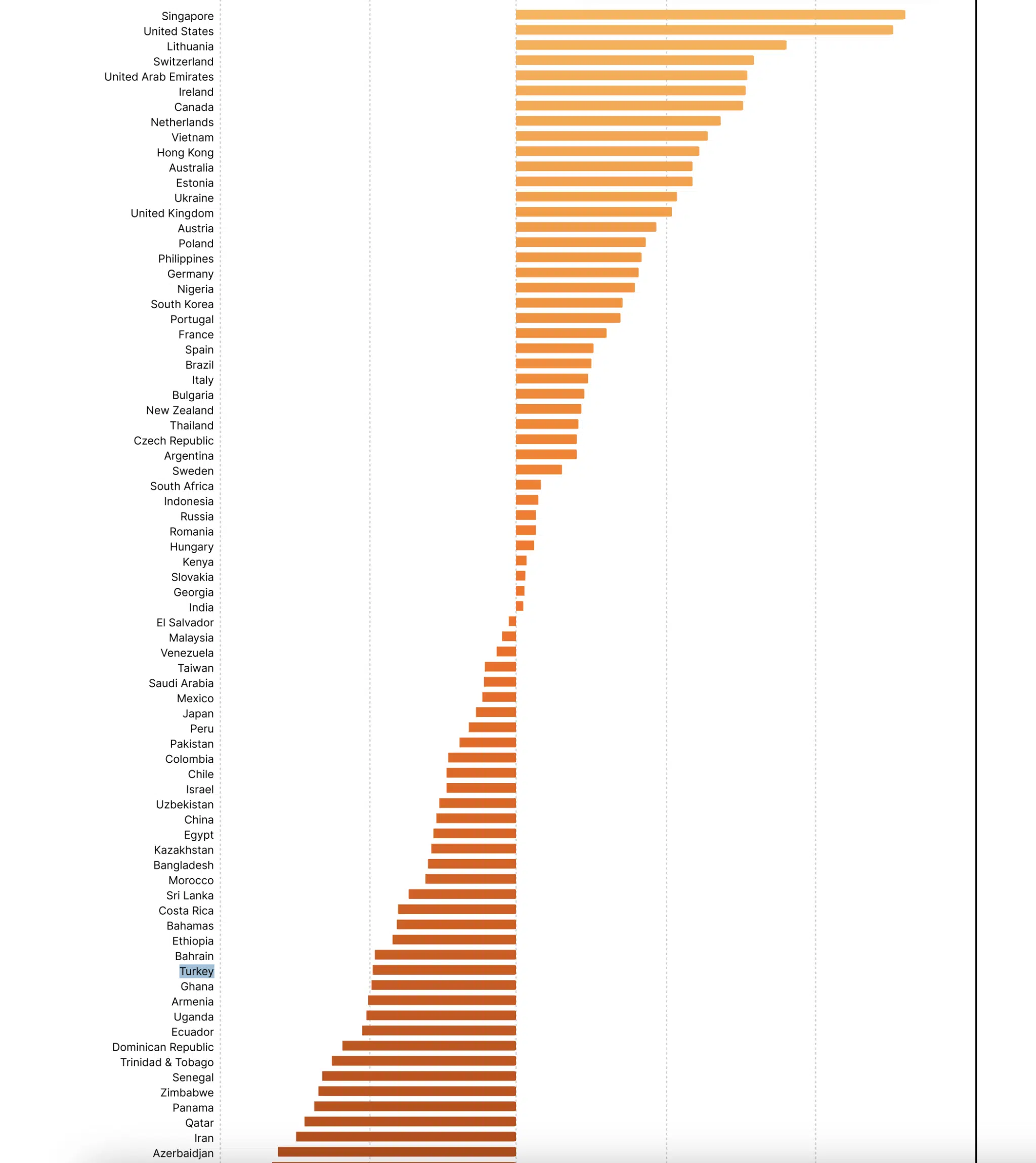

The “World Crypto Ranking 2025” study by Bybit and DL Research lists Singapore as the most advanced market for digital asset adoption among 79 countries surveyed. Analysts say the city-state’s regulatory clarity, fintech culture, and institutional engagement have pushed it ahead of far larger economies.

Key Takeaways

Singapore ranked first globally for crypto adoption in a new 2025 report.

Stablecoins now dominate on-chain payroll activity and business payments.

Turkey shows high retail usage but weak institutional infrastructure.

The United States, Lithuania, Switzerland and the UAE completed the top tier — illustrating that strong crypto ecosystems are emerging within both traditional finance hubs and innovation-driven micro-states.

Stablecoins Quietly Become the Workhorse of Payments

While headlines often focus on Bitcoin or speculative trading, the report argues that stablecoins have quietly become the real engine of crypto usage. Enterprises are increasingly accepting them for payments, and non-USD stablecoins are gaining ground.

One standout statistic: nearly one in ten payroll payments worldwide now executes on-chain, and over 90% of those rely on stablecoins — hinting at a future where digital settlement replaces legacy banking rails for salaries and services.

Another theme is the growth of real-world asset (RWA) tokenization. According to researchers, the sector’s market value climbed by roughly 63% to more than $2.5 billion, signalling rising institutional appetite for blockchain-based capital markets.

Turkey Highlights the Divide Between Adoption and Infrastructure

Turkey receives a much lower overall placement, ranking 64th globally. Yet the country’s profile is paradoxical: retail participation is high, ranking seventh globally in DeFi web traffic and 23rd in crypto ownership. The issue, the report notes, is structure — licensing remains sparse, fiat support inconsistent, and regulatory clarity limited.

Without institutional backing or mature frameworks, Turkey’s adoption skews heavily toward informal or consumer-driven engagement, placing it 54th in institutional readiness.

A Global Market, But Not a Uniform One

The broader message from the research is that crypto expansion is real but uneven. Some jurisdictions are building institutional-grade markets, while others rely on grassroots enthusiasm without structural support.

Singapore’s rise — and Turkey’s gap — illustrates how regulatory design, market access, and investment infrastructure now matter as much as raw user demand in shaping national crypto outcomes.