XRP price prediction has flipped decisively bearish after the token failed to break above the $2.12 resistance level during a brief surge earlier this week. Despite a daily gain of +1.23% pushing XRP to $2.08, the broader price action confirms sellers remain in control.

The rejection at $2.12 and the quick reversal from $2.17 point to distribution, not continuation. Over 189 million XRP tokens changed hands during the breakout attempt, far above average volumes, yet buyers lacked the conviction to hold the gains.

The elevated volume spike – up 45.53% to $3.79 billion – initially suggested institutional involvement, but the failure to sustain momentum shows it was tactical, not directional.

While XRP is currently trading at $2.08, a modest 1.23% gain over 24 hours, the broader price action suggests a more fragile outlook ahead – especially as Bitcoin Hyper and other major tokens attract capital inflows.

Technical Compression Tightens Between $2.083 and $2.17

The current chart structure reflects a tight compression zone between $2.083 and $2.17, with XRP trapped in a sideways channel that continues to reject upside pressure. Price briefly dipped to $2.083 before recovering in two sharp stages toward $2.17.

However, the inability to close above $2.12 – now acting as entrenched resistance – flipped sentiment bearish. Momentum oscillators show mild bullish divergence from the $2.083 low, but the declining recovery volume and heavy sell-side presence make this signal unreliable.

XRP must reclaim $2.12 with strong confirmation volume to regain any upward bias. Until that happens, every approach toward that level is likely to be met with aggressive selling. If price breaks below $2.09, the next downside targets are $2.05 and $2.00, both identified as near-term support zones.

Short-Term Forecast: $2.05 in Focus

The XRP price prediction for the next several days reflects continued bearish pressure. Market models project a decline toward $2.05 by December 13, with only a slight rebound expected by December 15. Day-by-day projections show:

December 12: $2.06

December 13–14: $2.05

December 15: $2.08

This forecast represents a –1.73% dip from today’s rate and confirms that sellers are likely to remain dominant until the price can reclaim the $2.12–$2.17 zone.

From a market structure standpoint, the failure to build upside follow-through after piercing $2.12 invalidated the previous breakout thesis.

Instead of entering an expansion phase, XRP has entered a liquidity rebalancing zone where supply outpaces demand. That dynamic is consistent with prior controlled distribution phases observed during weak rallies in 2023.

Institutions Trading Volatility, Not Building Exposure

The surge in volume to 184% above the 24-hour moving average might typically signal the beginning of accumulation. However, order book analysis shows that large players are using volatility spikes to harvest liquidity, not build long-term positions.

Their footprint is visible, but their behavior leans toward profit extraction, not commitment. Until that dynamic shifts, every upward movement will struggle to find continuation. XRP’s inability to benefit from broader market strength adds to its short-term vulnerability.

With Bitcoin showing resilience near key resistance and Solana continuing to pull capital inflows, XRP remains a laggard – locked in a zone that lacks both narrative and momentum. That leaves it more exposed to rotation outflows as traders seek clearer upside opportunities.

Bitcoin Hyper Captures Trader Attention

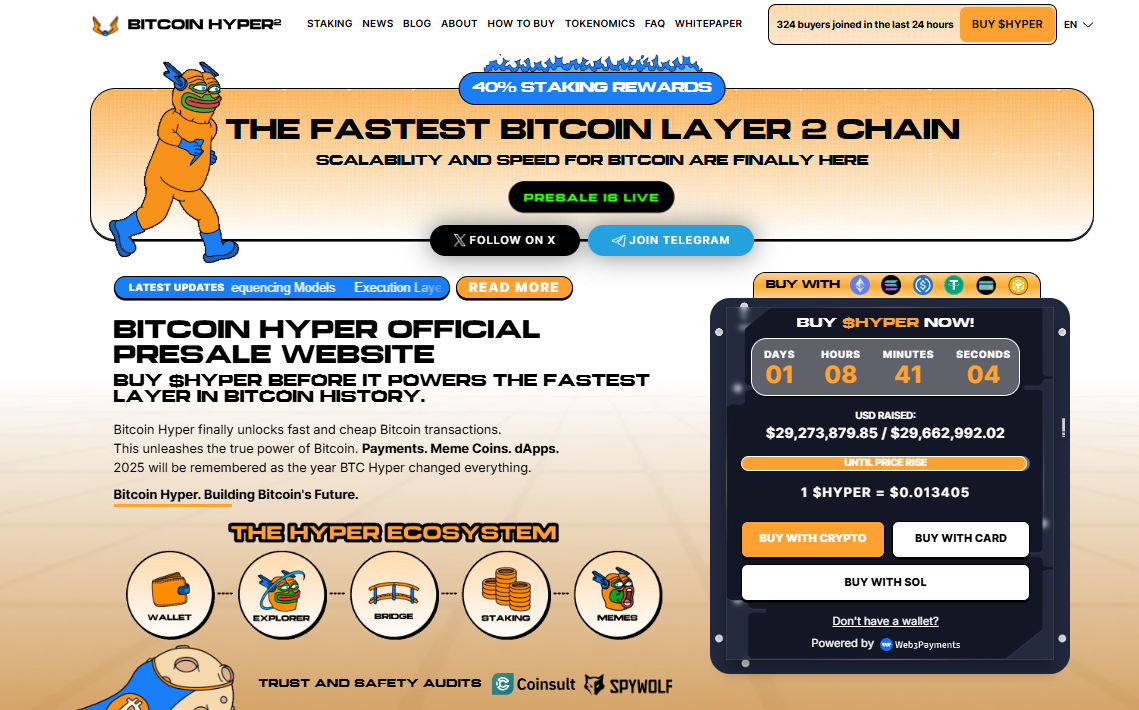

As XRP stalls, Bitcoin Hyper is emerging as a more attractive play for traders looking for momentum-driven setups. The presale has now raised over $29.27 million, with only $390,000 remaining until the next price rise.

At the current rate of $0.013405 per $HYPER, the token offers both pricing clarity and deflationary incentives, two things XRP lacks in its current setup.

Bitcoin Hyper’s model is structured around predefined price stages, with each raise triggering a permanent price increase. That architecture has fueled rapid growth, pulling in fresh capital from both retail and early institutional buyers.

The presale’s countdown and scarcity mechanics have created measurable urgency, drawing attention from altcoin traders frustrated by stagnant majors like XRP.