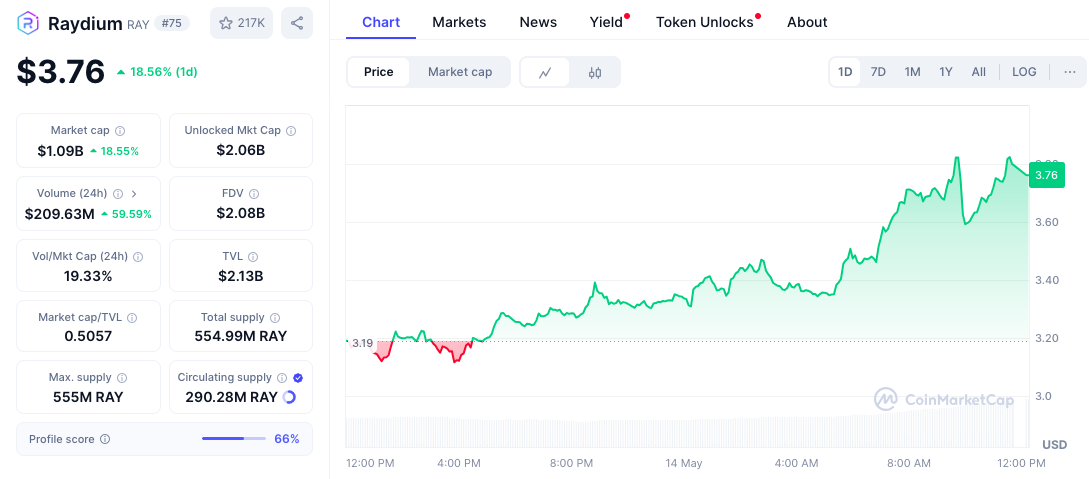

Raydium’s $RAY token has leaped 18.6% to $3.84 in the past 24 hours, propelling the Solana DEX into crypto’s top 75 and stretching its 2025 rally to 139%. Now at $2.1 billion in TVL, bulls are eyeing a breakout toward the $5 Gartley target despite overbought indicators.

Now trading near $3.76, the asset has staged an impressive 53.11% rebound since May 8, when it bottomed at $2.42.

This latest upswing brings Raydium’s year-to-date (YTD) gains to an impressive 138.78%, showing consistent performance across all timeframes.

However, it remains 77.6% below its all-time high of $16.93, reached during the 2021 bull cycle.

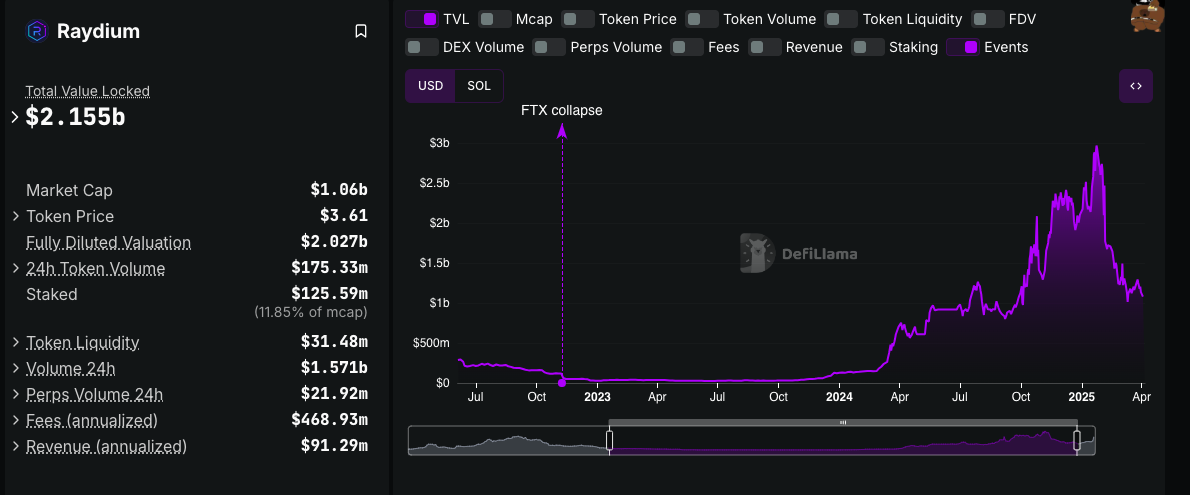

Raydium Dominates Solana with $2.1B TVL, Record Trading Surge

Launched in 2021, Raydium lets users swap tokens, provide liquidity, launch new assets, and trade perpetual futures.

Liquidity providers earn trading fees and may also receive $RAY tokens or other incentives, depending on the pool. Additionally, users can stake $RAY to earn more of the same token.

As Solana’s top DEX by volume, Raydium averaged daily trading volumes of $3.6 billion in Q1 2025.

This growth was largely driven by a record-breaking $195.8 billion monthly volume in January, which peaked at $16 billion on Jan. 19, fueled by the frenzy around Trump’s TRUMP memecoin ahead of his presidential return.

According to DeFiLlama, Raydium currently boasts over $2.15 billion in Total Value Locked (TVL), surpassing the TVL of other prominent chains like Sei, Aptos, and Polygon.

Raydium’s dominance is supported by its robust staking model and strong fee/revenue generation. Currently, over $125 million worth of $RAY, about 11.85% of its market cap, is staked.

On an annualized basis, Raydium generates over $460 million in fees and records $91.2 million in revenue, outperforming even some Layer-1 networks like Ethereum in this metric.

Nonetheless, competition in the Solana ecosystem has intensified. As Pump.fun enters the DEX trading ecosystem with PumpSwap, Raydium counters with LaunchLab, its token launch platform gaining rapid traction.

Telegram trading bot Maestro has integrated support for LaunchLab tokens, and Bonk launched its own launchpad, Letsbonk.fun, powered by Raydium’s infrastructure.

Bullish Gartley Pattern Points to Potential $RAY Rally Toward $5

The $RAY/USDT daily chart has formed a classic bullish Gartley pattern, identified by legs X-A-B-C-D, suggesting a potential rally toward the D-point around the $4.90–$5.00 range.

The pattern reflects ideal symmetry and aligns well with standard Fibonacci retracement levels.

The 9-day Simple Moving Average (SMA) has turned upward, currently sitting at $2.999, indicating a strengthening short-term trend.

Meanwhile, the RSI stands at 75.75, placing $RAY in overbought territory. This suggests the possibility of a short-term cooldown or consolidation before another leg upward.