In late September 2025, SoundHound AI was recognized as a Leader in IDC MarketScape’s 2025 assessment for Worldwide General-Purpose Conversational AI Platforms, with its Amelia 7 platform highlighted for advanced conversational capabilities. This acknowledgement coincided with heightened optimism in the broader artificial intelligence sector after OpenAI’s US$500 billion share sale fueled investor interest in AI companies.

Industry analysts note that SoundHound AI’s recent industry validation underscores its differentiated technology and growing market presence, reinforcing its suite of agentic capabilities in a rapidly evolving landscape.

We’ll examine how this leadership recognition for Amelia 7 may influence SoundHound AI’s long-term competitive outlook and investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

SoundHound AI Investment Narrative Recap

To own shares in SoundHound AI today, investors need to believe that the company’s advancements in conversational AI, underscored by recent industry recognition for the Amelia 7 platform, will translate into sustained market share gains and improved financial outcomes despite continued losses. However, while the IDC MarketScape Leadership designation highlights SoundHound’s technology, it does not materially change that the biggest near-term catalyst remains the path to profitability, with the principal risk still being ongoing large net losses and pressure on margins as growth investments persist.

Among several recent collaborations, the automation partnership with AVANT Communications through the Amelia 7.0 platform best reflects how SoundHound intends to convert its technical strengths into real-world deployments. This kind of enterprise integration is vital for driving more predictable revenue streams, potentially critical to validating the bullish sentiment driven by the company’s technological validation and meeting the expectations that come with sector momentum.

But even with all the excitement, investors should also be mindful that ongoing net losses could limit the company’s flexibility if...

Read the full narrative on SoundHound AI (it's free!)

SoundHound AI's narrative projects $308.5 million revenue and $40.4 million earnings by 2028. This requires 32.9% yearly revenue growth and a $265.8 million increase in earnings from the current level of -$225.4 million.

Exploring Other Perspectives

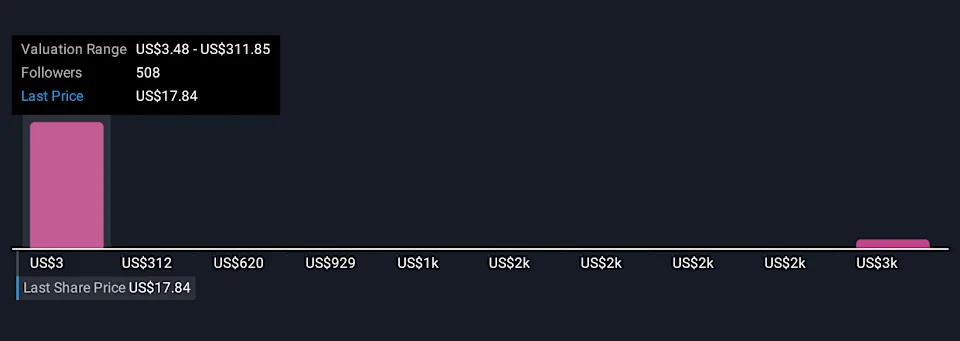

Fifteen individual fair value estimates from the Simply Wall St Community range widely from just US$3.48 up to US$3,087.14 per share. Many see potential in the company’s rapid revenue growth, but persistent net losses remain a key financial consideration shaping the outlook for SoundHound AI’s future performance.

Explore 15 other fair value estimates on SoundHound AI - why the stock might be worth less than half the current price!

Build Your Own SoundHound AI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

A great starting point for your SoundHound AI research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Our free SoundHound AI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SoundHound AI's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.