Ethereum’s long-term trajectory has become a focal point again after Arthur Hayes laid out a sweeping forecast for the asset’s institutional future, price potential, and competitive space.

His comments arrived as Ethereum trades near $3,200, fluctuating between $3,060 and $3,440 over the past week. Major players such as Tom Lee’s BitMine also increased their Ethereum holdings at an unprecedented pace.

Ethereum Becomes the Institutional Default

Hayes believes the market still misunderstands how deeply traditional institutions intend to integrate Ethereum. He argues that after years of failed experiments with private blockchains, banks now recognize the need for a public settlement layer.

“These organizations finally understand that you cannot have a private blockchain; you must use a public blockchain for security and real usage,” he said.

He links this shift to the stablecoin boom, which has forced banks to accept the value of on-chain settlement.

According to Hayes, Ethereum is positioned as the only platform with the security, liquidity, and developer depth institutions need.

He expects this shift to drive a significant price resurgence for Ethereum in the coming cycle, complementing aggressive treasury accumulation by firms such as BitMine.

BitMine bought 33,504 ETH ($112 million) this week and 138,452 ETH (~$435 million) earlier in December, bringing its total to roughly 3.86 million ETH. That scale of accumulation has strengthened the narrative that institutions are positioning for Ethereum’s next major cycle.

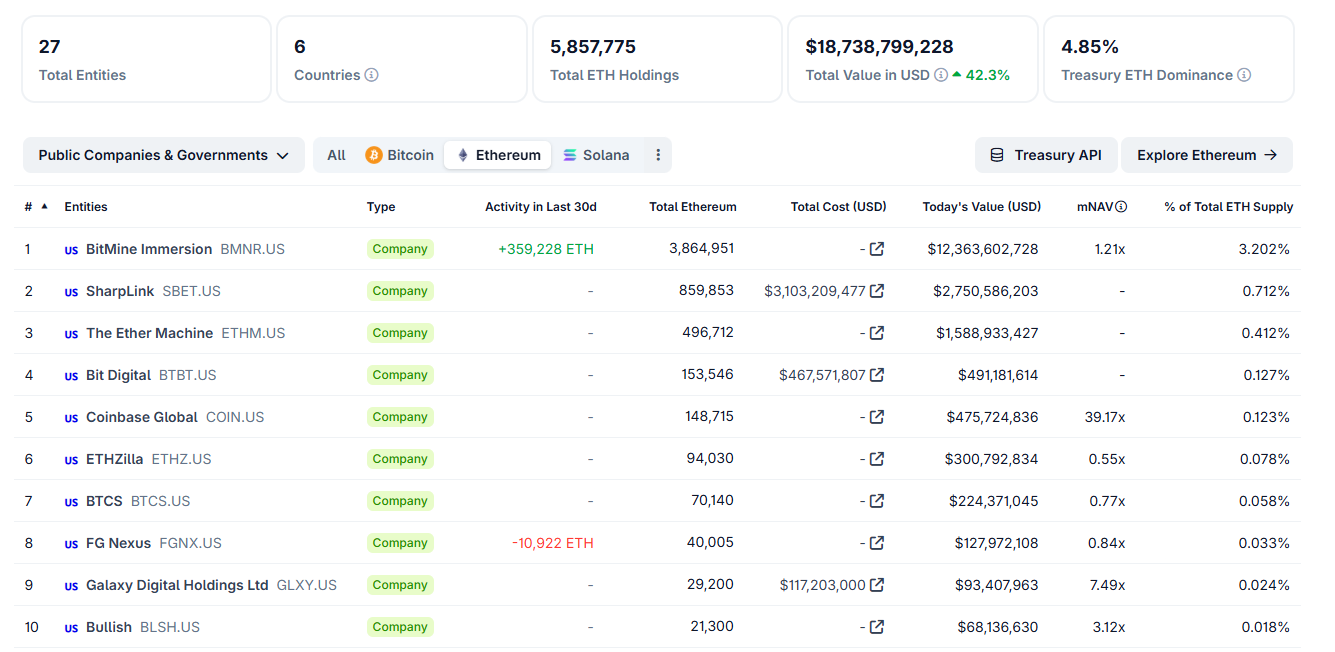

Ethereum Treasuries Hold Nearly 5% of ETH Supply. Source: CoinGecko

Privacy Remains Ethereum’s Biggest Weakness, But L2s Will Cover It

Hayes acknowledges Ethereum still lacks the privacy guarantees large institutions require. He notes that this is “the biggest thing Ethereum doesn’t have yet,” though he says Vitalik Buterin’s roadmap is actively addressing it.

Despite this gap, he argues institutional adoption will not be delayed. Instead, enterprises will deploy privacy-enabled Layer-2 networks while relying on Ethereum for settlement.

He believes Ethereum L1 remains the “security substrate” regardless of whether activity occurs on L2s like Arbitrum or Optimism.

“There may need to be a debate about how fees are distributed between L2s and Ethereum L1,” he said, but he stressed that this does not change the underlying reality: institutions will still secure their operations using Ethereum.

This aligns with current ecosystem trends. Exchange balances are at multi-year lows, and whales have accumulated over 900,000 ETH in recent weeks, according to Santiment data.

Institutional architecture continues to form around the Ethereum base layer, even as fees fall amid L2 migration.

A Narrow Field of Winners: Ethereum First, Solana Second

Hayes sees the future of public blockchains consolidating around a very small group. He places Ethereum as the clear long-term winner, with Solana in a distant but durable second place.

He credits Solana’s rise from $7 to $300 to intense meme coin activity in 2023 and 2024. However, he states Solana “needs a new trick” to outperform Ethereum again.

While he expects Solana to remain relevant, he does not expect it to match Ethereum’s institutional role or long-term price strength.

Hayes views nearly all other L1s as structurally weak. He dismissed high-FDV chains such as Monad as over-inflated projects likely to collapse after an initial pump.

50 ETH to Become a Millionaire by Next Election

Hayes offered his most explicit numerical prediction when asked how much ETH one would need to become a millionaire in the next cycle.

He stated that Ethereum could reach $20,000, implying that 50 ETH would be enough to reach a seven-figure portfolio.

The BitMex founder expects this price target to materialize by the next US presidential election. His outlook aligns with the current supply environment: exchange reserves are shrinking, institutions are accumulating, and treasury buyers like BitMine continue to deploy hundreds of millions into ETH.

If Ethereum fails to meet these expectations, Hayes says it will be due to narrative breakdown.

Also, if stablecoin usage slows or institutions retreat from on-chain trading, Bitcoin could outperform Ethereum for a prolonged period.

However, he argues that current market structure favors Ethereum’s long-term dominance—especially as banks prepare to execute Web3 strategies on public infrastructure.