Bitcoin has retraced below the $91,000 level following the Federal Reserve’s decision to cut interest rates by 25 basis points, a move that initially generated volatility across risk assets. While the market’s reaction has leaned bearish in the short term, on-chain data tells a very different story beneath the surface.

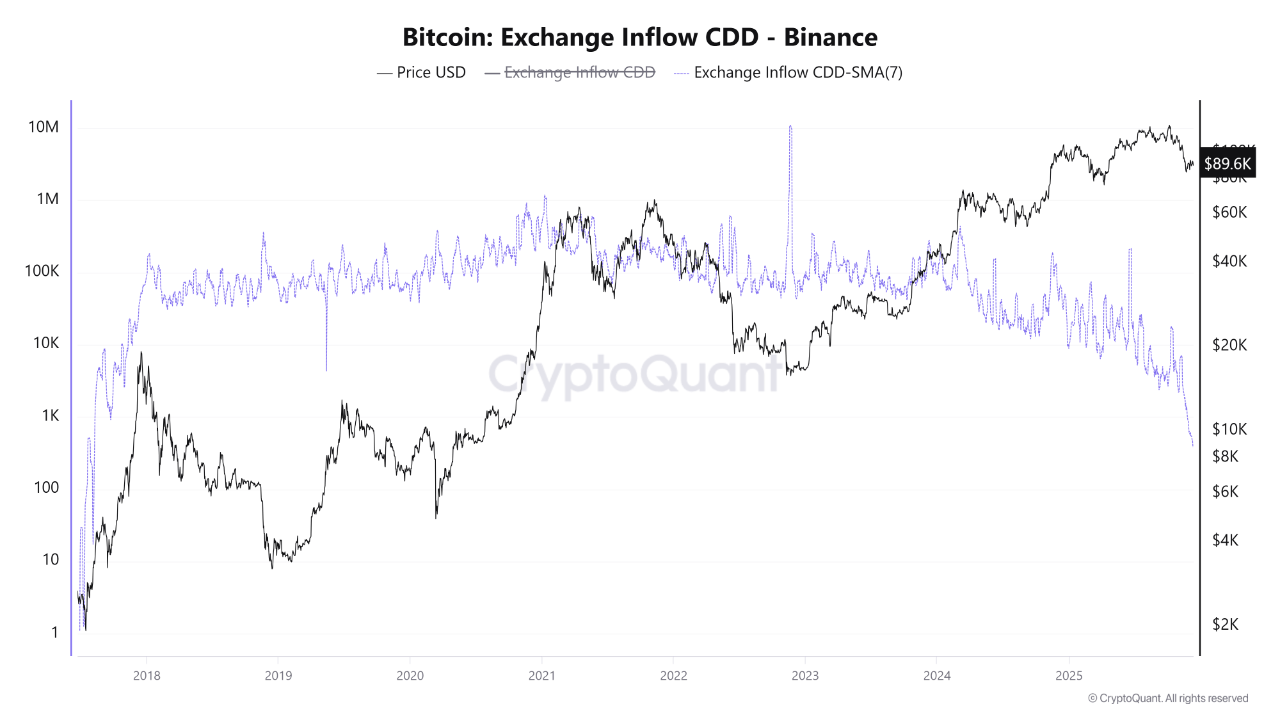

According to new insights from CryptoQuant, one of the most striking signals comes from the Exchange Inflow Coin Days Destroyed (CDD) metric on Binance, which has fallen sharply to 380, its lowest reading since September 2017.

CDD is one of the most important indicators for understanding long-term holder behavior because it assigns greater weight to older coins that have accumulated more “coin days.” Low values mean that the BTC moving onto exchanges is predominantly from short-term traders, not long-term holders.

In other words, veteran holders — the investors who historically move markets — are refusing to sell, even as Bitcoin trades near cycle highs.

Long-Term Holders Signal Strong Conviction

CryptoOnchain highlights that the significance of this CDD collapse becomes far clearer when viewed against Bitcoin’s current price context. With BTC trading near $89,600, the market is witnessing an unusually large divergence between price action and long-term holder behavior.

Historically, when Bitcoin approaches or surpasses all-time highs, long-held coins tend to move — triggering spikes in CDD as early investors and whales take profits. This pattern has repeated across past cycles, making elevated CDD a classic top-signal.

But this time, the exact opposite is happening. Instead of old coins entering exchanges, Exchange Inflow CDD is collapsing, indicating that almost none of the BTC being deposited onto Binance comes from long-term wallets. CryptoOnchain explains that this phenomenon strongly suggests that Smart Money and long-term whales have zero interest in selling at these levels, even after a multi-month correction.

This refusal to distribute supply removes a major source of overhead resistance and reflects a market dynamic driven increasingly by strong hands. The absence of long-term sell pressure reduces the available liquid supply, often preceding powerful bullish expansions. In simple terms, whales are signaling confidence — not caution — despite short-term volatility, reinforcing the narrative that Bitcoin may be preparing for its next major move.

Bitcoin Price Action: Testing Support Amid Weak Momentum

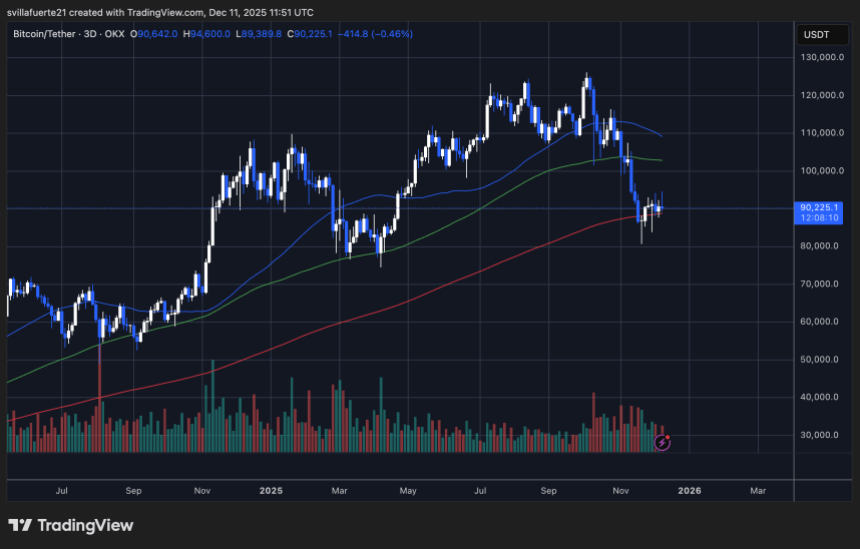

Bitcoin’s 3-day chart shows the market stabilizing just above the $90,000 level after last week’s sharp post-FED decline. Price remains compressed between the 200-day moving average (red line)—currently acting as primary support—and the 100-day moving average (green line) overhead, which continues to cap upward momentum. This creates a classic squeeze structure where BTC is holding its ground but struggling to reclaim lost trend levels.

The recent candle structure highlights a series of higher lows forming near the $89K–$90K region, suggesting buyers are defending this zone as a short-term floor. However, the rejection from the 100-day MA reinforces the broader bearish shift, as BTC remains below both key trend indicators and is yet to reclaim the breakdown level around $100K.

Volume also tells an important story: despite the bounce, buy-side conviction appears weak. The rebound has not been accompanied by a spike in demand, indicating that market participants are cautious following the rate cut and macro uncertainty.

If Bitcoin loses the 200-day MA, the next major support lies closer to $84K, which would open the door to a deeper retracement. Conversely, a decisive close above the 100-day MA near $98K would signal momentum returning to the bulls. For now, BTC remains in a fragile consolidation with limited directional strength.

Featured image from ChatGPT, chart from TradingView.com