KEY TAKEAWAYS

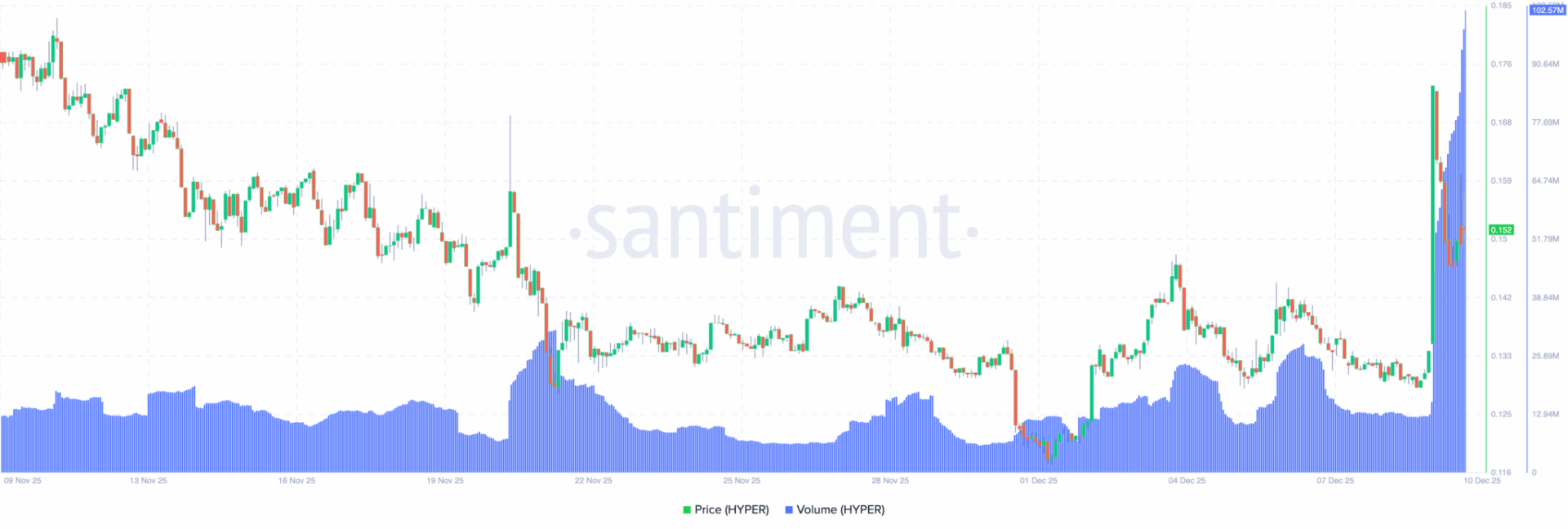

Hyperland’s trading volume has jumped 714% ahead of its listing on Coinbase today.

Indicators signal a breakout toward the $$0.23 zone if volume continues to rise.

Momentum remains strong, but HYPER risks a pullback if selling pressure increases.

A 714% explosion in trading volume has propelled Hyperlane (HYPER) into the market spotlight just before its official listing on Coinbase.

The surge signals aggressive accumulation from traders positioning for a liquidity-driven breakout, with many expecting HYPER’s uptrend to continue once trading begins on the major U.S. exchange.

Is HYPER’s price ready for its next leg up? Let’s check the charts.

Hyperlane Exits Bearish Trend

On the 4-hour chart, the Relative Strength Index (RSI) is flashing strong bullish momentum.

Sitting at 65.12 with room to enter the overbought zone, the indicator reflects accelerating buy pressure ahead of the listing catalyst.

The rebound from the previous dip indicates that buyers are stepping in aggressively to reclaim control.

Apart from the RSI, the Money Flow Index (MFI) reinforces this trend. In the reading observed below, the indicator indicates an accelerating capital inflow as traders increase their liquidity commitment.

With the HYPER token hovering around $0.15, the next key obstacle lies at the upper resistance near $0.19.

Should this trend continue, the altcoin could break above this level, triggering another leg higher.

Coinbase Listing Sparks Hike in Volume

In addition, a significant catalyst behind the HYPER token’s current surge is its upcoming listing on Coinbase.

On Dec. 9, the exchange announced that the HYPER/USD trading pair would go live on Dec. 10, 2025, stating:

“Spot trading for Hyperlane (HYPER) will begin on or after 9 AM PT, provided liquidity conditions are met, in regions where trading is supported.” The exchange noted.

The announcement drew sharp market attention, unleashing a wave of volatility as traders positioned ahead of the official listing.

Historically, some Coinbase listings have triggered significant pre-listing momentum. Other times, prices remain muted.

Thus, considering the volume has surged above $100 million, it appears that the HYPER token is following this pattern.

HYPER Price Outlook: Bullish

Assessing the daily chart, CCN observed a breakout from a falling wedge pattern, signaling a bullish trend reversal.

On the same chart, the Directional Movement Index (DMI) supports this shift.

The positive DMI at 33.19 has surged above the negative DMI at 13.89, indicating a substantial buying advantage. This gap highlights accelerating bullish pressure and a clear directional bias.

Furthermore, the Average Directional Index (ADX) sits at 23.73, confirming that the upward trend has real strength behind it.

Additionally, the Bull Bear Power (BBP) has flipped into positive territory, printing green histogram bars and marking the start of sustained bullish control.

The shift indicates that buyers are gaining the upper hand as momentum builds.

If this trend continues, HYPER’s price is likely to challenge the resistance at $0.19.

Examining the Fibonacci levels offers a deeper understanding of potential targets. As seen above, HYPER trades at $0.15, moving toward the next Fib zone at $0.23.

Meanwhile, a sustained move above this level could pave the way for the $0.23 to $0.32 range.

However, things could change if buying volume drops.

If that were to happen, the altcoin will likely test the first support at $0.13, with a deeper pullback targeting the Fib level at $0.08 if selling pressure intensifies.