KEY TAKEAWAYS

Upbit listed Hyperlane (HYPER) on July 10, triggering a rally.

The HYPER price increased by 150% after the listing.

Can HYPER sustain its upward movement to new highs?

The Hyperlane token price had declined steadily since April, gradually losing over 70% of its value.

Promising signs were visible in July, when the HYPER price created several slightly higher lows.

Hyperlane then went parabolic on July 10, in a rally catalyzed by a listing from Upbit, South Korea’s largest exchange.

With that in mind, let’s analyze the HYPER price action and see where the rally will lead.

Hyperlane Breaks Out

The weekly analysis shows that Hyperlane’s price broke out from a descending resistance trend line before today’s rally, which was catalyzed by the Upbit listing.

Nevertheless, today’s breakout defines the Hyperlane analysis, which negated over three months of bearish price action.

While the price action is definitely bullish, the failure to close above the $0.270 horizontal resistance area is discouraging for the future trend.

Instead of doing that, HYPER created a long upper wick (red icon) and now trades below it.

Momentum indicators show overbought signals. The Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) are at multi-month highs.

However, neither has generated any bearish divergences, which is a positive sign for the future.

In any case, the most crucial part of HYPER’s price movement is contained within this daily candlestick.

Looking at the 2-hour analysis can provide more clarity for where Hyperlane will go next.

Correction Before New Highs

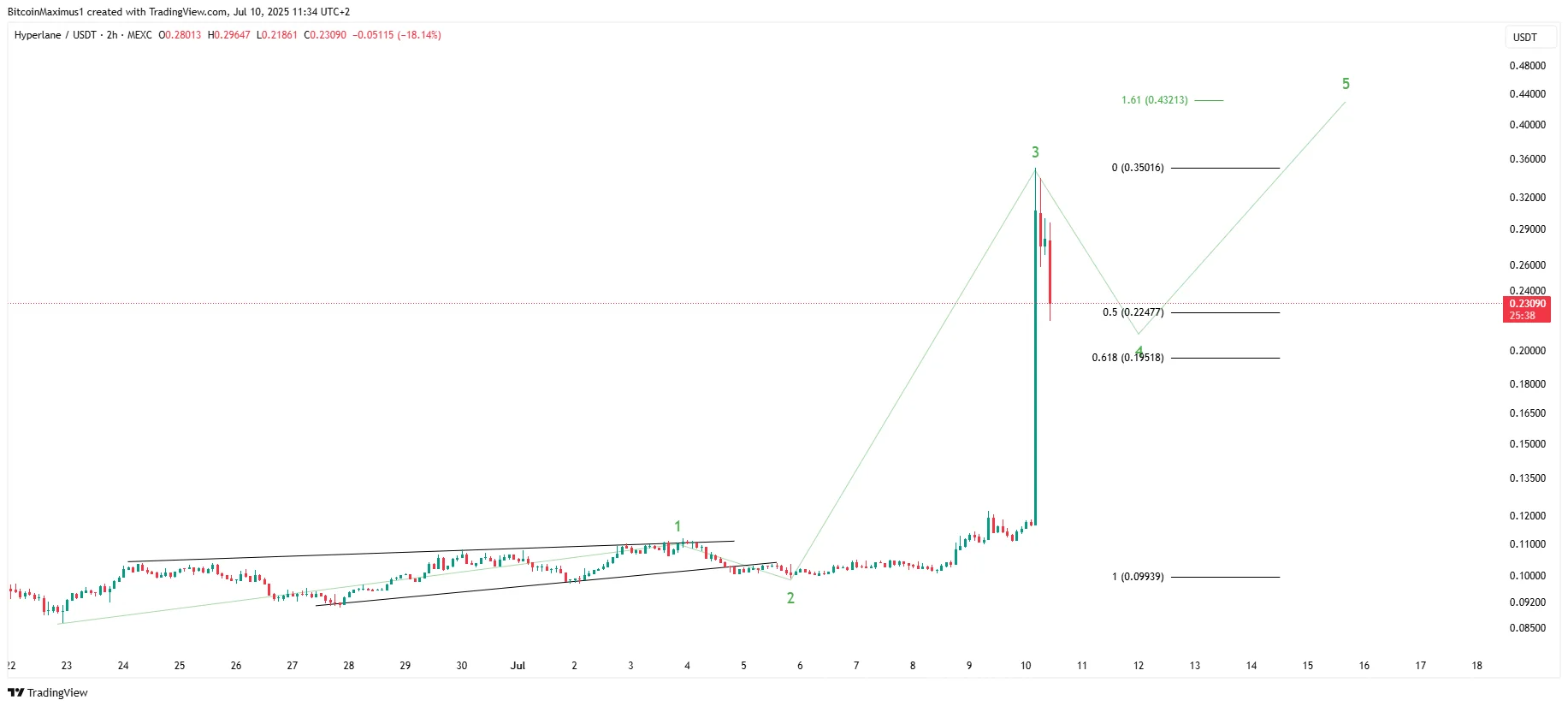

The two-hour chart shows HYPER’s rally started on June 22, when the price created a leading diagonal.

The trend gained momentum in July, setting the stage for the parabolic surge to new highs.

Hyperlane’s increase is wave three in a five-wave upward movement (green), and the price is now correcting in wave four.

Since the price of HYPER has already reached the 0.5 Fibonacci retracement support level, the correction might be over, though the price might tag the 0.618 Fibonacci level at $0.195.

Then, the main target for the top of the move will be at $0.432.

Even though the proposed count will not take HYPER to a new all-time high, its development will still be extremely positive, since HYPER would close above the $0.270 resistance area.

Bullish Hyperlane Prediction

The Hyperlane price surged by more than 150% after South Korean exchange Upbit listed it today.

While the listing catalyzed the sharpest portion of the rally, the HYPER trend was already bullish before the breakout.

The analysis suggests HYPER is correcting in the short term, but another increase awaits in the long term.