A recent report from BitcoinTreasuries.Net highlights significant challenges faced by Bitcoin-focused treasury companies since November. The findings revealed that the vast majority of these firms are now grappling with substantial unrealized losses, prompting many to sell off considerable amounts of their Bitcoin holdings.

Market Struggles Continue

In a sample analysis of 100 companies with reliable cost basis measurements, approximately 65% purchased Bitcoin at prices that now exceed the current market value, leaving a considerable number of these treasuries with substantial unrealized losses.

Bitcoin’s market downturn in late November pushed spot prices down towards $90,000, leaving many buyers from 2025 at a financial disadvantage.

Now, the market’s leading crypto has retraced below this key level on Thursday, even despite the Federal Reserve (Fed) rate cut announcement. Among the companies surveyed, about two-thirds are found to be sitting on unrealized losses based on current market values.

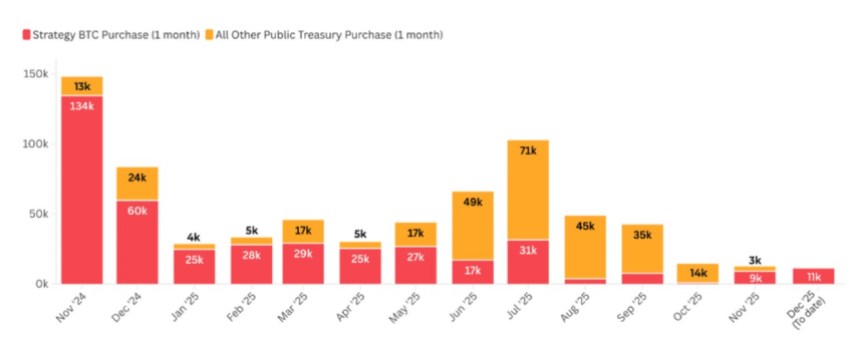

But despite the volatility in pricing, some of the largest balance sheets continued to acquire Bitcoin. Notably, firms like Strategy (previously MicroStrategy) and Strive significantly contributed to net additions in November, with Strategy accounting for approximately 75% of all monthly purchases following their sell-offs.

Mining companies remain steadfast as a cornerstone of public market Bitcoin holdings. In November, they represented about 5% of new additions to the market and around 12% of the total balances held by public companies.

Bitcoin Demand Remains Strong

Even as Bitcoin treasury stocks have shown softness compared to Bitcoin itself and broader equity benchmarks, many companies still pursued strategies to add BTC to their balance sheets while refining their capital-market approaches.

BitcoinTreasury.Net’s analysis indicates that nearly 50 firms have managed to achieve gains of at least 10% over the last 6 to 12 months.

Over time, losses have begun to soften for some. Currently, around 140 companies have experienced declines of at least 10% over a 1 to 3 month period, while about 105 companies have seen similar declines year-to-date.

However, not all corporate holders opted to weather the storm of price fluctuations. In November alone, at least five companies decided to sell Bitcoin, with Sequans leading the charge by offloading roughly one-third of its holdings.

Looking forward, the fourth quarter of 2025 is expected to close with about 40,000 BTC added to public company balance sheets. This figure is notably below the totals from each of the prior four quarters and aligns closely with the additions seen in the third quarter of 2024.

The report concluded that despite a clear easing in the “summer buying frenzy,” demand for Bitcoin has not entirely diminished as public corporations are adapting to a more cautious and selective approach as they reassess their recent purchases.

At the time of writing, BTC traded at $89,920, down over 2% in the previous 24 hours. This places the cryptocurrency 27% behind its all-time high of $126,000 set in October of this year.

Featured image from DALL-E, chart from TradingView.com