Bitcoin mining firms are quietly becoming some of the largest corporate holders of BTC, accounting for a meaningful share of global Bitcoin treasuries as balance-sheet strategies continue to evolve across the sector.

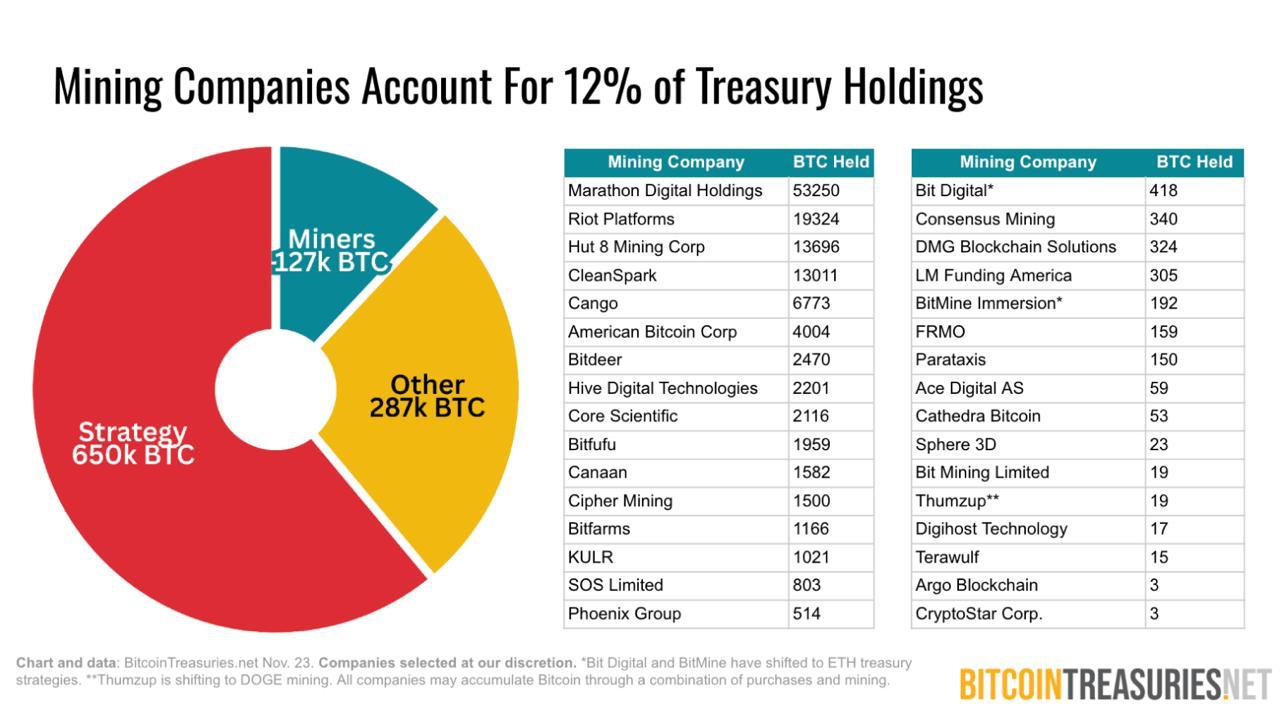

Recent data compiled by BitcoinTreasuries.net shows that publicly listed and private mining companies now collectively hold around 127,000 BTC, representing roughly 12 percent of all Bitcoin held by corporate treasuries worldwide.

Key takeaways:

Miners hold about 127,000 BTC, or 12 percent of corporate treasuries.

Marathon, Riot, and Hut 8 dominate miner Bitcoin holdings.

More miners are holding BTC instead of selling.

While this figure remains well below the massive stash controlled by Strategy, it highlights how miners are increasingly choosing to retain Bitcoin rather than immediately selling production to fund operations.

Miners emerge as long-term Bitcoin holders

The broader corporate treasury landscape remains heavily skewed toward a single player. Strategy alone controls around 650,000 BTC, dwarfing every other category. Outside of Strategy, other non-mining entities collectively hold about 287,000 BTC.

Within this context, miners have carved out a distinct role. Their combined holdings place them ahead of many traditional corporations that have added Bitcoin to their balance sheets through purchases rather than production. The data suggests that miners are increasingly treating Bitcoin as a strategic reserve asset, not just a byproduct of operations.

This approach reflects a shift in how mining companies manage capital. Instead of selling mined BTC immediately to cover costs, many firms are opting to hold at least part of their output, betting on long-term price appreciation and using Bitcoin as a form of treasury collateral.

Marathon, Riot, and Hut 8 lead miner treasuries

Among mining companies, Marathon Digital Holdings stands out as the largest Bitcoin holder by a wide margin, with approximately 53,250 BTC on its balance sheet. Riot Platforms follows with around 19,324 BTC, while Hut 8 Mining Corp holds close to 13,700 BTC.

CleanSpark and Cango round out the next tier, each holding more than 6,000 BTC. Other notable names with significant reserves include American Bitcoin Corp, Bitdeer, Hive Digital Technologies, Core Scientific, and Bitfarms.

Taken together, the top ten mining firms control the majority of Bitcoin held by miners, underscoring a growing concentration among large, well-capitalized operators that can afford to retain BTC through market cycles.

Smaller miners still participate, but at scale differences

Beyond the largest players, dozens of smaller mining firms hold more modest Bitcoin reserves, often ranging from a few dozen to a few hundred BTC. Companies such as Bit Digital, DMG Blockchain Solutions, Consensus Mining, and LM Funding America fall into this category.

Some miners on the list have begun shifting treasury strategies toward other digital assets, including Ethereum, or are pivoting parts of their operations toward alternative mining activities. This highlights the diversity of approaches within the sector, as firms balance exposure to Bitcoin with operational and financial constraints.

What this means for the Bitcoin market

The growing role of miners as long-term holders could have important implications for Bitcoin’s supply dynamics. When miners hold rather than sell, fewer newly mined coins reach the open market, potentially reducing sell pressure during periods of strong demand.

At the same time, miner-held treasuries can introduce new risks. In periods of stress, large liquidations from mining firms could amplify volatility, especially if operational costs rise or access to financing tightens.

Still, the data underscores a broader trend: Bitcoin is increasingly being treated as a strategic balance-sheet asset, not just by corporate buyers, but by the very companies responsible for producing it. As mining firms continue to mature financially, their influence on Bitcoin’s market structure is likely to grow.