A solo bitcoin miner has achieved a remarkable feat, defying 1-in-82-year odds to mine block 927,474 and capture the entire block reward and transaction fees—totaling $284,633—late Thursday.

Miner claims full block reward

The winning miner, operating through the CKpool solo mining pool, earned 3.125 BTC in subsidy ($283,944) and an additional 0.008 BTC ($689) in transaction fees.

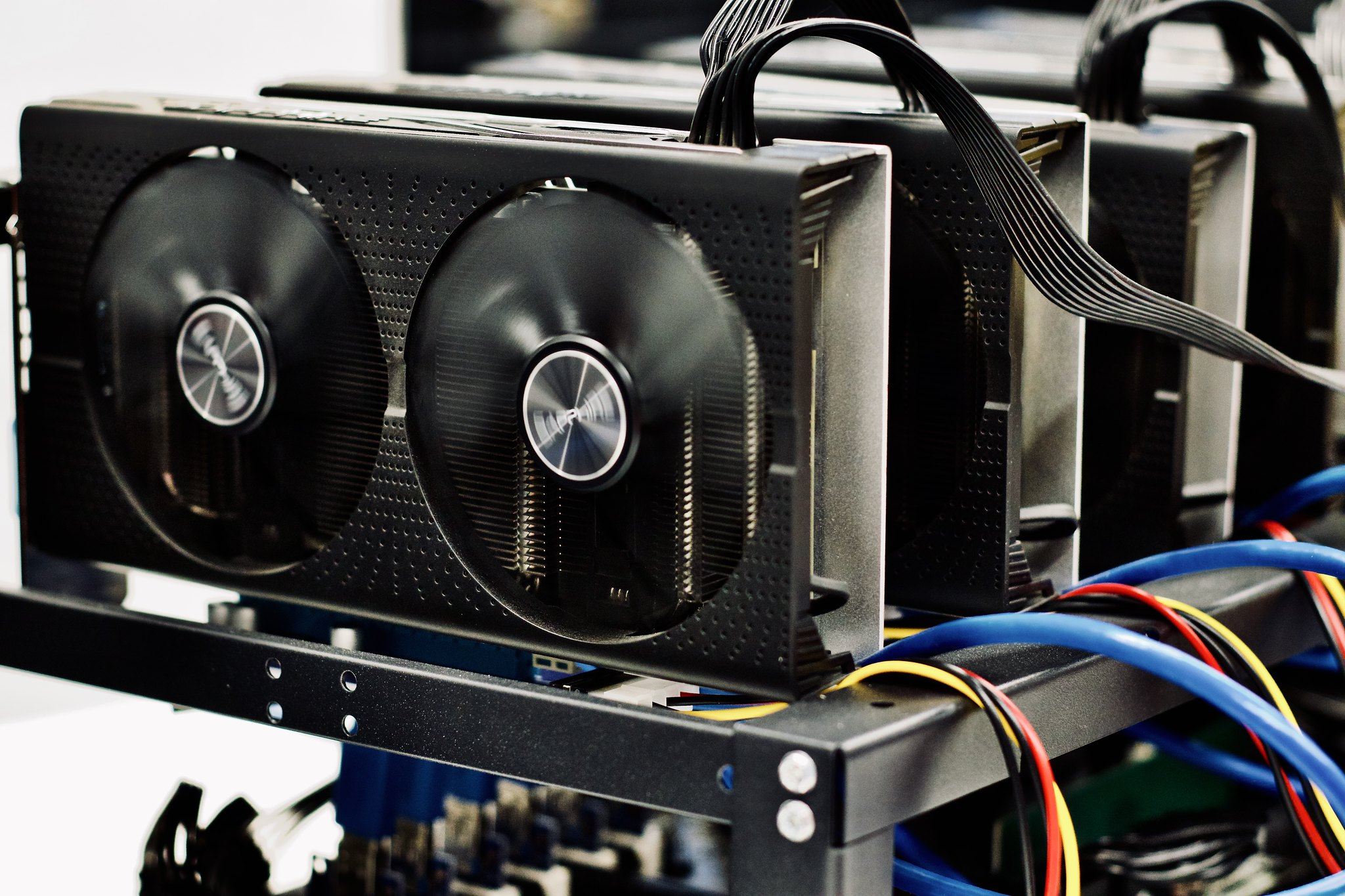

According to CKpool developer Con Kolivas, the miner used three machines totaling 270 terahashes per second (TH/s), comparable to three Bitmain Antminer S19 ASICs. Kolivas posted on X:

“A miner of this size has a 1 in 30,000 chance of solving a block per day.”

This rare event equates to a once-in-82-years probability for a miner with this hashpower, which represents just 0.00002% of Bitcoin’s estimated total network hashrate of 1.15 zettahashes per second (ZH/s) as of December 11.

In comparison, leading public bitcoin miners like Marathon Digital and IREN operate at 59.4 exahashes per second (EH/s) and 50 EH/s, respectively.

For broader network trends, see the bitcoin historical hashrate chart.

Why solo miners take the risk

Most small bitcoin miners typically join shared mining pools to secure more frequent, proportional payouts, since solo mining offers an extremely low chance of success.

However, some choose solo pools like CKpool for a chance at the entire block reward, treating it as a high-stakes lottery.

Notably, this is not the first instance of a solo miner striking it big. Last month, another miner with only 6 TH/s—an even smaller setup—beat 1-in-180-million odds to mine a block, earning around $265,000 in rewards.

Solo miners with larger or rented hashrates have also managed to find multiple blocks in recent months.

Bitcoin price and network context

Bitcoin was trading around $92,264 on Friday, marking a 2.2% increase over the past 24 hours.

The ongoing stories of solo mining wins underscore the decentralized and probabilistic nature of bitcoin mining and highlight the vast scale of the bitcoin network relative to individual miners.