JPMorgan Asset Management has just made a big move by investing in Numerai’s hedge fund, locking in $500 million in capacity. For Numerai, this is their biggest milestone so far—especially since JPMorgan is one of the largest players in quantitative investing, including funds that use machine learning for trading.

To meet the new demand, Numerai is expanding its team. Recent hires include an AI researcher from Meta, a trading engineer from Voleon, and several others with top-tier experience. On top of that, Numerai recently bought back $1M worth of its own cryptocurrency, NMR, which triggered a 40% price jump, pushing its market cap past $80 million.

Today, Numerai reached a major milestone: one of the largest allocators to quant strategies has secured $500m capacity in Numerai’s hedge fund.

Learn more: https://t.co/CZEQDmIY95

— Numerai (@numerai) August 26, 2025

Strategic Buybacks Fuel NMR: The Best Opportunity in the Market?

(CoinGecko)

Numerai just scored a huge validation from JPMorgan, one of Wall Street’s biggest names. Right after that, they kicked off a $1M NMR token buyback as part of their strategic campaign.

The fund already manages over $400M AUM, and with another $500M secured, people are looking at the $80M market cap (up 40% from under $50M) and seeing upside potential. But here’s the catch—Numerai is still a hedge fund. That means it mainly earns from management and performance fees, so you can’t really value it anywhere close to its AUM.

This rally looks like it’s running on the JPMorgan hype, so a correction wouldn’t be surprising.

What’s Next For NMR Coin?

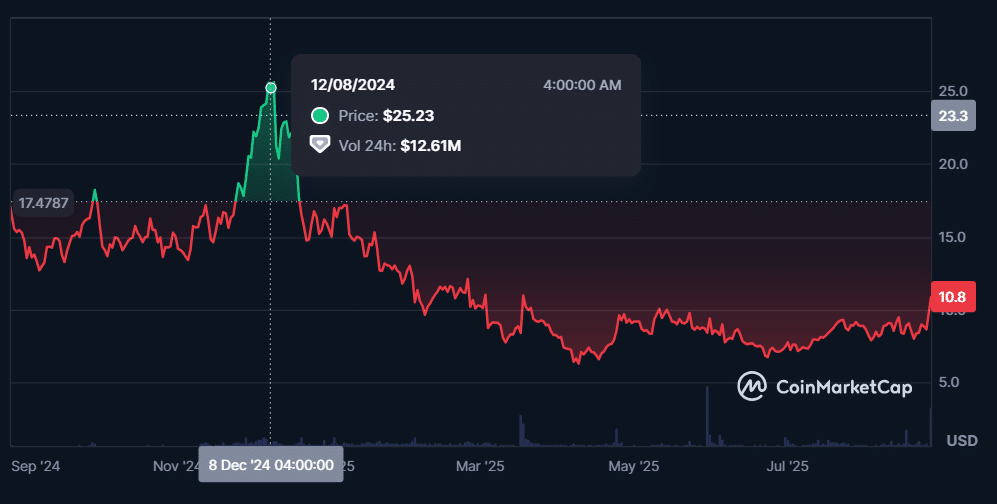

(CMC)

Over the past year, the coin’s been struggling. It peaked at around $180M market cap late last year but has been on a steady downtrend until this latest announcement. While the buyback mechanism can give the price a boost, it only happens occasionally, and in between those events, the coin tends to look weak.

Right now, it’s sitting at about $82M market cap with an average daily volume of $10M. It’s listed on major exchanges like Coinbase and Binance, and volume spiked 1,000% after the news—but that momentum faded quickly.

The coin is already dipping again, and seeing that kind of sell-off right after big news is definitely bearish. You know what’s not bearish, though? Snorter’s presale—a project aiming to become the leading trading bot on Solana.

Snorter Presale: Next Trading Bot?

Whales are always chasing the next big flip, and Snorter Bot is quickly becoming their favorite tool. Built right into Telegram, it’s fast, secure, and lets you mirror or flip wallets with zero hassle.

No gimmicks, no shady stuff—just clean, straightforward trading. For the degens, that means you can jump straight into plays like Trump, Pepe, or Fartcoin without wasting time.

On top of that, it only charges a tiny 0.85% fee, comes with MEV protection, honeypot checks, juicy 129% APY staking, and even free token rewards just for holding. Basically, everything you need is all in one spot—no more hopping between platforms.

SNORT is still in presale, but it’s already heating up. It has raised over $2 million and is holding strong at $0.099. Get in now before the price shoots up and the market goes wild.

Fast forward, and it’s already over $3.44 million in presale, with SNORT eyeing even more growth. It’s giving traders the edge in a game where speed’s everything.