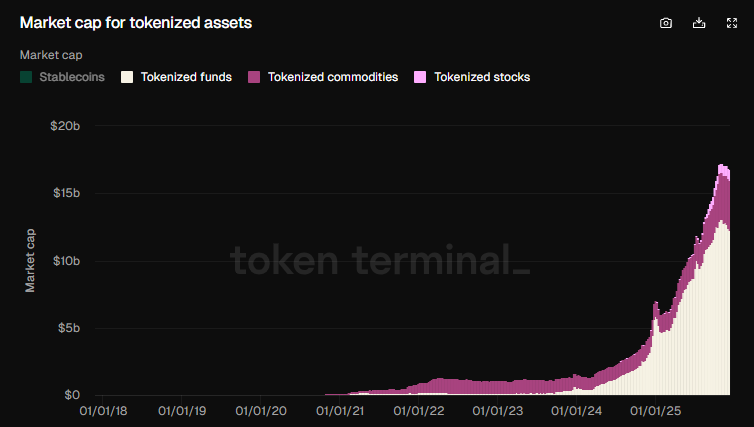

Tokenized stocks and commodities reached peak valuations, on a mix of increasing token supply and growing market prices. Stocks and commodities are still the smallest class in tokenized RWAs, but have been growing actively in the past months.

Tokenized stocks and commodities reached peak valuations, based on Token Terminal data. Asset tokenization remains one of the growth narratives in 2025, with more platforms seeking to add their own standard of stocks.

Tokenized commodities reached $3.7B in December, mostly based on the performance of gold. Tokenized stocks hover around $808M. Tokenized commodities mostly rely on Tether’s gold-backed tokens for their growth. Tether also set the industry standard for gold reserves.

Despite the recent rapid expansion of silver, there is hardly any representation of the precious metal among tokenized assets.

Tokenized stocks are harder to account for in full, due to several standards and platforms. Ondo reports around $368M in tokenized stocks. XStocks reports around $300M in tokens, excluding the market cap of Chainlink (LINK).

Other markets also exist, with various approaches to tokenization. However, in 2025, Ondo and XStocks tokenized shares turned into industry leaders.

Tokenized stocks reach a wider circle of investors

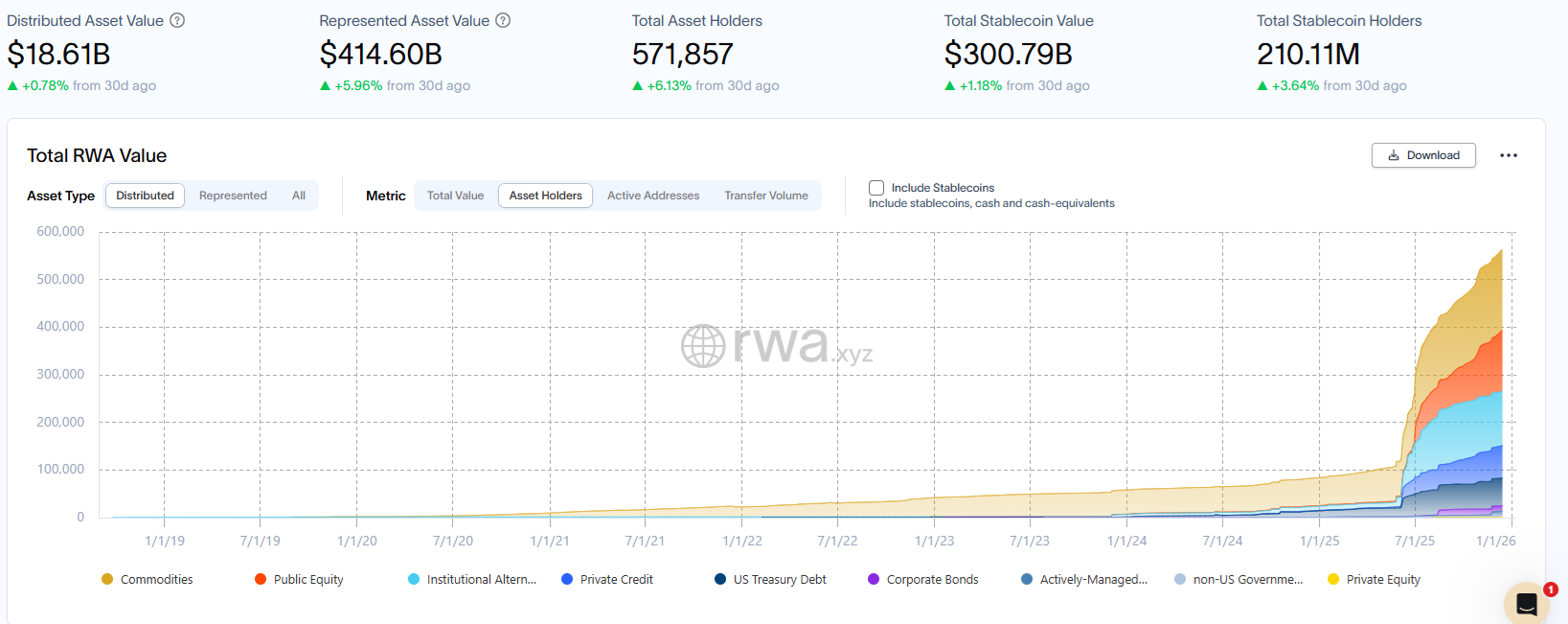

Tokenized stocks are showing record adoption, based on the addition of new wallets. While stablecoins make the bulk of tokenized RWAs, more wallets are moving into commodities, stocks, funds, and private credit.

The whole of 2025 showed rapidly expanding ownership of various tokenized asset classes. Wallet owners expanded to over 571K, still a fraction of legacy stablecoin holders. However, tokenization is proving to be a lasting trend with growing infrastructure.

XStocks solves bridging

One of the problems with stock tokenization is how corporate events such as splits and dividends are reflected on-chain.

Recently, XStocks introduced XBridge, which can shift stocks between Solana and Ethereum. While simple tokens are bridged daily, tokenized stock bridging may pose challenges due to the different ways of reflecting corporate events.

The bridge is the first step to launching XStocks on multiple chains, while preserving the exact value and features of each tokenized share.

Tokenized stocks are one of the drivers of Solana adoption. Recently, stock tokenization became the fastest-growing asset on Solana, displacing previous stars like meme tokens.

Competition is coming from other platforms, as with Robinhood’s stock tokenization on Arbitrum. Overall, tokenized stocks are growing their appeal, after a prolonged season of betting on tokens with no intrinsic backing.

Stock tokenization also allows international traders much easier access to US equities. In 2025, international investors aimed to tap the growth of US companies, creating tensions on the legal status of tokenized assets.

Some of the available tokenized stocks are permissionless, while others are tied to fully vetted, KYC accounts on centralized exchanges.

Want your project in front of crypto’s top minds? Feature it in our next industry report, where data meets impact.