The best crypto to buy now may not be Bitcoin, as investors brace for a possible plunge below $70,000 following a widely expected interest rate hike by the Bank of Japan.

With the broader crypto market under pressure, many are turning to early-stage alternatives like Bitcoin Hyper, a rising presale token that remains insulated from short-term volatility and macro shocks.

Bitcoin is already trading near $89,800, roughly 29% below its all-time high. Past BOJ decisions have caused severe pullbacks, and with another hike expected on December 19, analysts are warning of a repeat – one that could break key support levels and send prices tumbling.

Japan’s Rate Hike Could Push Bitcoin Below $70K

Every major BOJ decision over the last year has delivered a painful correction in crypto. In March 2024, Bitcoin fell 23% after the announcement. In July, it dropped 26%.

And in January 2025, the decline hit 31%. The pattern is clear, and traders like Merlijn The Trader are warning that a repeat could send Bitcoin below $70,000.

BITCOIN LOVES EXTREME FEAR

Every time the crowd panicked Bitcoin exploded

Look at the track record:Extreme fear: +233%

Extreme fear: +70%

Extreme fear: +42%

Extreme fear: loading…Fear isn’t the signal to sell.

It’s the signal to watch closely. pic.twitter.com/Kr0NvxB4Ud— Merlijn The Trader (@MerlijnTrader) December 15, 2025

Japan’s influence isn’t just regional. As the largest foreign holder of U.S. debt, Japan’s monetary shifts affect global liquidity. A BOJ hike forces capital to leave risky assets like crypto and flow into bonds or stable currencies.

Traders who once borrowed yen to buy crypto are now closing out those positions due to rising Japanese yields, which just hit 2.94%, the highest since 1998.

Bitcoin Struggles as Market Liquidity Shrinks

The Bitcoin network remains fundamentally strong, but price action tells another story. With a market cap of $1.79 trillion and volume down over 40%, demand has softened considerably. Technical analysts are highlighting resistance near $92,000 and major support only below $70,000, leaving room for a sharp drop if sentiment shifts.

Macroeconomic stress is building. Japan’s policy move could drive out as much as $500 billion in global capital, putting more pressure on crypto valuations. At the same time, altcoins like Solana, XRP, and Cardano have already lost 40% to 70% since October, showing widespread weakness in the space.

Bitcoin’s dominance can’t shield it forever. When market liquidity dries up, even the strongest assets bleed. Investors looking to enter now are reconsidering whether BTC offers the best upside – or whether there’s a smarter entry elsewhere.

Bitcoin Hyper Attracts Buyers Seeking Presale Safety

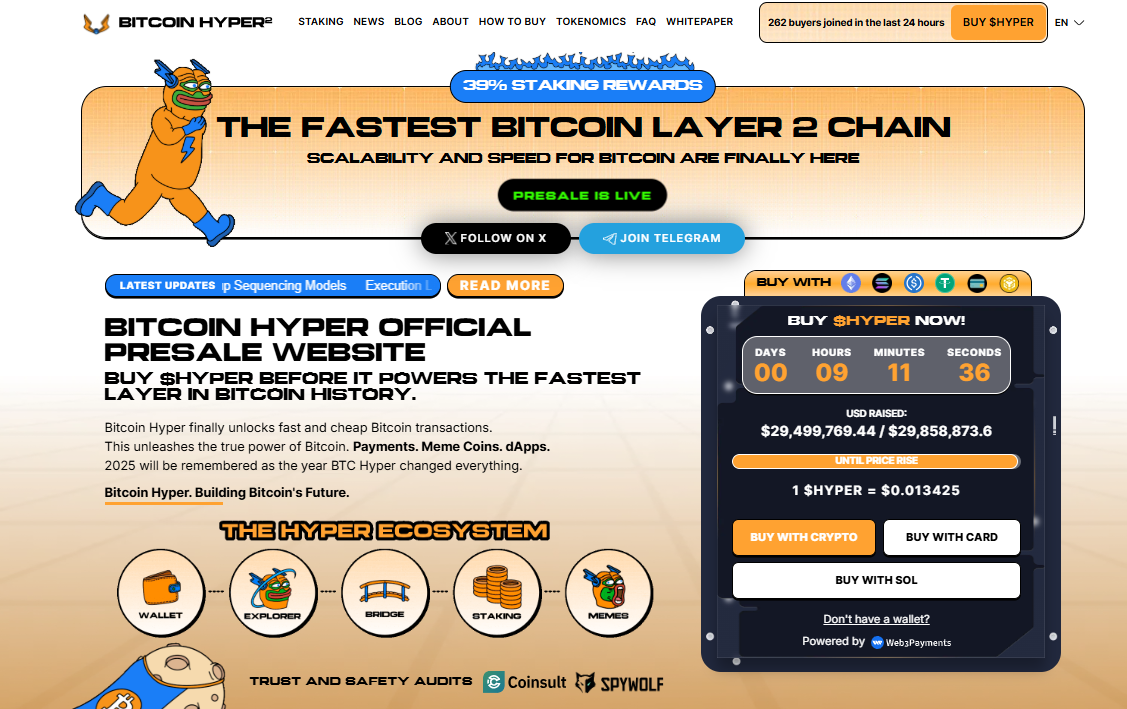

While Bitcoin battles macro risk, some traders are turning their attention to presale tokens like Bitcoin Hyper. The project has already raised over $29.4 million, with Stage 6 about to close. At just $0.0134 per token, Bitcoin Hyper offers fixed presale pricing that protects early holders from volatility in the broader market.

Bitcoin Hyper’s appeal lies in its timing. It’s not yet exposed to exchange listings, meaning it avoids the price pressure that comes with market corrections. Investors get in early, ahead of listings and market sentiment swings.

This separation from Bitcoin’s price makes it attractive in periods of high macro stress, like the one building now.

Presales give retail traders the ability to act before the crowd. Bitcoin Hyper is being positioned as a next-gen store of value, built with modern tokenomics, lower entry points, and a deflationary model that contrasts sharply with Bitcoin’s saturated cycle.

Why Bitcoin Hyper May Be the Best Crypto to Buy Now

Bitcoin Hyper’s rise reflects a broader trend: retail investors looking for growth outside the Bitcoin cycle. Its low cost, rising demand, and fixed presale pricing make it an increasingly popular option for those trying to stay ahead of the next wave.

As Bitcoin teeters on the edge of a possible $70K breakdown, investors are asking where they can enter safely.

For many, the answer is shifting. Instead of chasing BTC into resistance, they’re turning toward presales like Bitcoin Hyper, which offer upside without current exposure to central bank risks.

The best crypto to buy now may not be the oldest or most established – it might be the one positioned just before the next rotation.

With Bitcoin Hyper’s next price stage looming, entry opportunities are limited. If Japan’s rate hike hits the market hard, buyers may flood into alternatives like Hyper as a protective move.