Strategy chair Michael Saylor signaled that his firm may add to its Bitcoin holdings just as the market slid again on Sunday, a move that kept traders on edge and fed fresh debate over what is driving the declines.

Back To More Orange Dots

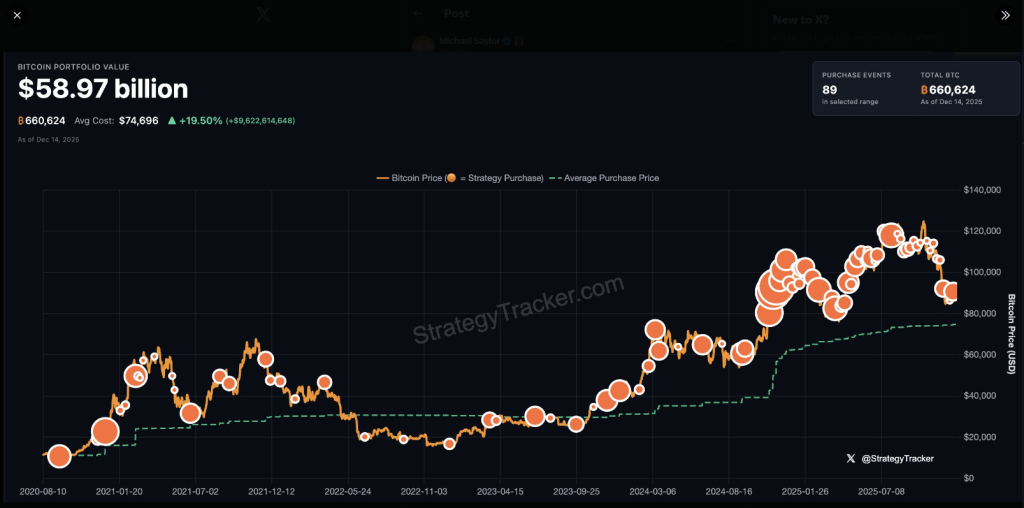

According to a post on X, Saylor shared a chart with the phrase “Back to More Orange Dots,” a shorthand that investors interpret as fresh buying.

Based on reports tracked by SaylorTracker, Strategy bought 10,624 BTC on Dec. 12 — its biggest single purchase since late July.

The firm now holds about 660,624 BTC, which at current prices is worth roughly $58.5 billion, and its average cost per coin stands at $74,696.

Sunday Wick, Low Liquidity

Bitcoin briefly dipped to a two-week low near $87,750 in late trading on Sunday, before climbing back above $89,000 by the time of writing.

Traders pointed to a familiar pattern: quick wick-downs on weekends when liquidity is thin. Ether showed relative strength while major altcoins lagged, and market participants were seen positioning ahead of a packed calendar of US data and central bank decisions this week.

Analysts Eye Bank Of Japan

According to analyst commentary, some market participants blame the selling on expectations around the Bank Of Japan.

People are seriously underestimating what the bank is about to do to crypto, said one analyst using the handle NoLimit.

Justin d’Anethan, head of research at Arctic Digital, said the slide toward $88,000 “feels like a defeat,” and linked the move to fear of a carry trade unwind tied to Japanese rate expectations.

Markets May Have Priced It In

Sykodelic, another market watcher, argued that Japan’s actions are largely priced in. “Markets are forward-thinking, forward-moving. They move in anticipation of events, not when those events happen,” they wrote.

Based on that view, the recent drop is less about a fresh shock and more about ordinary back-and-forth: macro funds trimming exposure, short-term traders taking profit, and buyers stepping in at lower levels.

That push-and-pull helps explain why Bitcoin keeps snapping lower on thin pockets of liquidity but does not break decisively below key support.

Meanwhile, the tension between long-term holders — represented by companies like Strategy — and short-term macro flows is shaping price action.

There is no sign yet of widespread liquidations or a funding crisis, which suggests the declines are measured rather than chaotic.

Featured image from Australian Farmers, chart from TradingView