Confused investors are asking why is Bitcoin down today after the price slipped below the $88K support. But it’s not just today that the BTC price has plunged; it has been declining since the Fed rate cut announcements on December 10, losing nearly 10% over the past week.

The Bitcoin price underwent a similar downward move after the last rate cut announcement in October. Market experts say the reason is that both times, most investors were already expecting an interest cut. That is why a bullish surge was already priced in before the announcement, and Bitcoin continues to decline under bearish market sentiment.

Another reason why is Bitcoin down today is that some experts are signaling further downside risk. Peter Brandt, a prominent commodities and foreign exchange trader, recently posted on X, warning investors that BTC could fall to as low as $25,240.

Bitcoin investors, do you know:

1. Bull cycles have experienced exponential decay

2. BTC's bull cycles have undergone parabolic advances

3. The violation of previous parabolas have all declined<80%

4. The current parabolic advance has been violated20% of ATH = $25,240 pic.twitter.com/0hWAaEd6Dy

— Peter Brandt (@PeterLBrandt) December 14, 2025

In an earlier post, Brandt shared a chart, highlighting $81K and $59K as his targets for the ongoing decline. These remarks by the professional investor have been fueling fear and selling among investors.

Many are now shifting capital from BTC to better-performing altcoins in search of a profit amid the broader market dip. In the list of high-reward opportunities, Bitcoin Hyper leads with its $29.5 million presale milestone. Instead of watching their funds slowly fade away in BTC, investors are starting to capitalize on HYPER for the year-end.

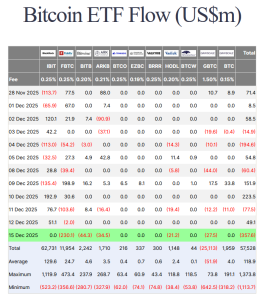

Bitcoin Down Today as ETFs Face Largest Withdrawal Since November

Last week was exciting for Bitcoin ETFs as inflows returned after months of consistent net withdrawals. However, over $351.7 million exited BTC ETFs on December 15, completely nullifying the inflows of the past few weeks.

It marked the largest single-day outflow since November. Since ETF flows are the primary drivers of Bitcoin’s price direction, yesterday’s outflow is the most direct cause linked to the question why is Bitcoin down today.

As a result of the ETF outflows, the price dipped, and over 189,001 traders were liquidated in the past 24 hours. According to CoinGlass data, the total liquidations are $655.48 million, of which $576.67 million were long liquidations.

Bitcoin Price Forecast: Technical Indicators Point to Continued Weakness

The Bitcoin price remains in a downtrend, struggling to break out of a descending channel since early October. Last week, BTC failed to break out from the upper trendline of the downtrend pattern and continued its dip.

The $94K level remains a significant supply region, pushing the price lower. Since its recent rejection, Bitcoin has fallen by over 9% and is now finding support near $85K. Over the past 24 hours, BTC has lost 3.4% and currently trades at $86,575.

The Bitcoin price is well below the 100-day and 200-day moving averages, which are also trending lower, further strengthening the bearish case. The RSI is at 37, indicating BTC is struggling to regain bullish pressure. If Bitcoin slips below the immediate support at $85K, it could face further correction to $81K and $59K, as Peter Brandt highlighted in his post.

At the same time, a broader market rebound could spark a trend reversal near the immediate demand zone, taking BTC back above the $100K psychological mark.

Bitcoin Hyper Captures Interest Amid BTC Weakness

As Bitcoin dips, retail capital is slowly rotating back into high-risk, high-reward opportunities, such as Bitcoin Hyper, the early-stage Bitcoin infrastructure project. As the first Bitcoin layer-2 solution, it is positioning itself as a next-generation altcoin that solves the speed and scalability issues in the oldest blockchain network.

Bitcoin Hyper isn’t just another layer-2 focused on solving minor security and payment issues. It is the only project opening the path to the execution of smart contracts and decentralized applications on Bitcoin. The real-world use cases that the project is bringing to the network have attracted long-term BTC holders who want something more than just value holding.

As Bitcoin continues to attract institutional interest through ETFs, demand for a scalable Bitcoin-centric ecosystem is growing. Bitcoin Hyper is capturing this next era by bringing Bitcoin’s dormant $2 trillion market into a modern application ecosystem.

Why it matters:

Massive $2 trillion market opportunity as Bitcoin expands beyond store-of-value

The first Bitcoin layer-2 network built for smart contracts and dApps

Strong early demand, with over $29.5 million raised and 650 million tokens sold

Up to 39% annual staking rewards, offering passive income to early ICO participants

Advanced SVM compatibility and zk-rollup support for faster, low-cost transactions

Low presale entry price of just $0.013435

What sets Bitcoin Hyper apart is its impeccable timing. The project is set to list its native token, HYPER, on major exchanges by Q1 2026, just around the time market rebound is expected.

While established altcoins may offer significant returns, Bitcoin Hyper’s presale demand among investors amid the market downturn suggests it can provide asymmetric returns during the upcoming bull cycle.